DJIA Forecast DJIA rises after PPI sends mixed messages US Open 2024 4 11

US futures

Dow futures 0.06% at 38473

S&P futures 0.17% at 5167

Nasdaq futures 0.34% at 18072

In Europe

FTSE -0.06% at 7943

Dax -0.2% at 18057

- US PPI rises 2.4% YoY but eases to 0.2% MoM

- The market is licking its wounds after yesterday’s selloff

- Nvidia falls into correction territory

- Oil holds steady amid Middle East jitters and higher oil inventories

US PPI eases on MoM basis, rises on YoY basis

US stocks are pointing to a modestly higher open after yesterday's hotter CPPI data was tempered by PPI data.

The latest PPI report showed that wholesale inflation eased on a monthly basis in March to 0.2%, down from 0.6%. The cooling inflation is helping investor sentiment. However, the market is looking past the rise in annual PPI by 2.4%, up from 1.6% in February.

This report doesn’t dramatically change anything, and the rise in equities could be more of a relief that the numbers weren’t worse. The bottom line is that an early Fed rate cut is off the table.

Meanwhile, jobless claims were relatively stable at 211k, as recent data continues to highlight the underlying strength in the US economy, keeping inflation persistently sticky and dampening expectations that the Fed will be able to cut interest rates anytime soon.

Stocks slumped yesterday following CPI data showing that inflation rose for a third straight month, raising the likelihood of high rates for longer. The minutes from the March meeting also showed that policymakers needed more convincing that inflation was on track to cool to 2%.

The markets are projecting an 80% probability that rates will remain unchanged in June, up from just 40% a week ago.

Looking ahead, attention will now turn to earnings, which kicks off with the banks tomorrow. Investors will be keen to see whether fundamental support lofty valuation.

Corporate news

CarMax is set to open around 10% lower after missing both earnings and revenue forecasts. EPS was $0.32c vs. the $0.46 forecast, and revenue fell to $5.63 billion.

Nike is set to open 2% higher after Bank of America upwardly revised the stock to buy from neutral. Analysts see mid-single-digit revenue growth.

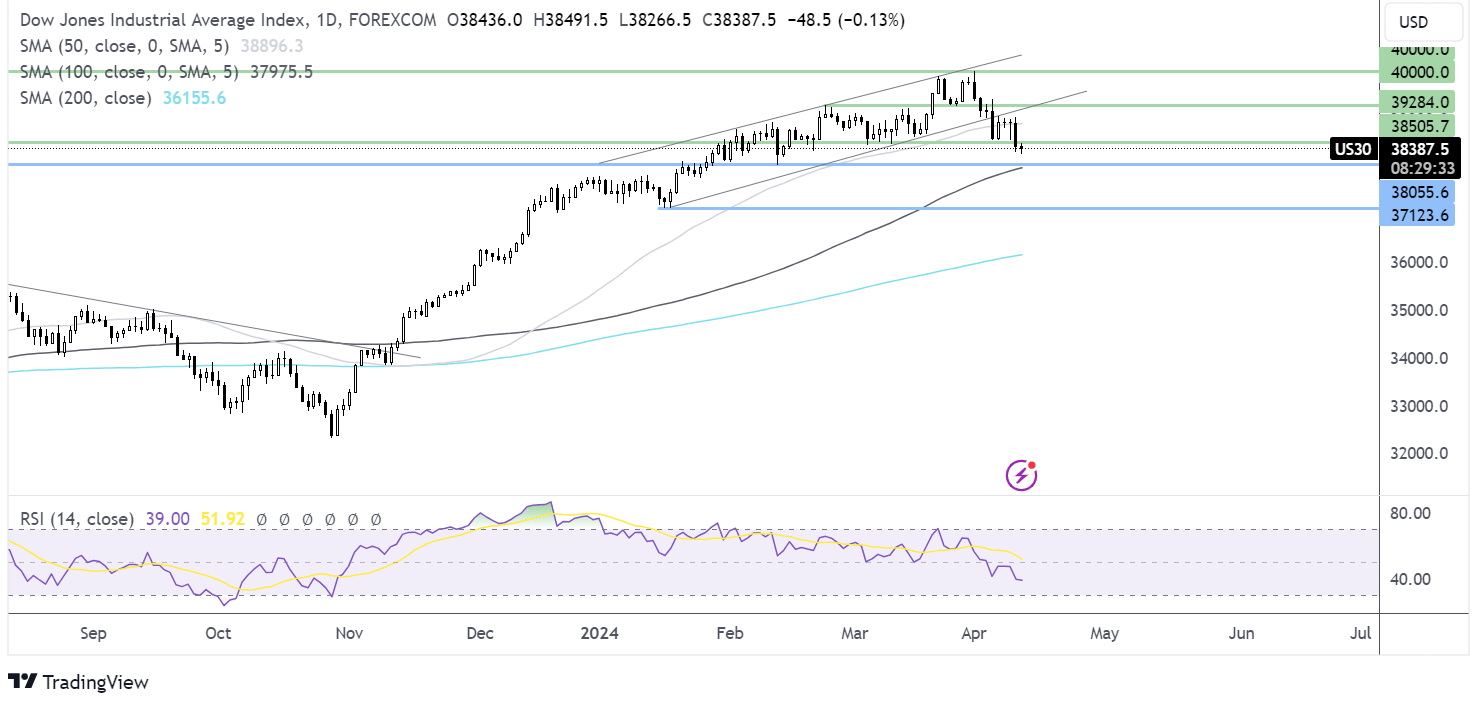

Dow Jones forecast – technical analysis.

After breaking below the 38450 March low, the Dow selloff has stabilised. Sellers supported by the RSI below 50 could look to push the price lower and test support at 38000, the February low. A break below here opens the door to 37150, the 2024 low. Any recovery must first retake 38450 to test the 50 SMA at 38950 and towards 39284, the February high.

FX markets – USD falls, EUR/USD rises

The USD is giving back some of yesterday’s gains following PPI data, which appears to have taken the edge off the CPI blow.

EUR/USD is rising amid a weaker USD after the ECB left interest rates on hold at 4%, which is in line with expectations. Attention will now turn to the press conference with ECB president Christine Lagarde for further clues on the timing of the first rate cut.

USD/JPY remains an intervention watch after rising to a 34-year high of 153.24 in the previous session. The yen has weakened 8% against the USD, despite the BoJ hiking interest rates for the first time in 17 years last month.

Oil falls as the demand outlook darkens

Oil prices are edging lower as concerns over higher interest rates for longer, hurting the demand outlook, offsetting worries over Middle East tensions hitting supplies.

Concerns over persistently sticky US inflation and the Fed keeping interest rates high for longer dampening economic growth and suppress oil demand, is weighing on the price.

These worries are overshadowing concerns of escalating tensions in the Middle East. US Secretary of State Anthony Blinken has told the Israeli defense minister that the US will stand with Israel against any threats by Iran. Iran is the third largest OPEC oil producer.

The monthly oil market report from OPEC will be released later today in the International Energy Agency's oil market report on Friday.