Asian Indices:

- Australia's ASX 200 index rose by 24 points (0.34%) and currently trades at 7,115.30

- Japan's Nikkei 225 index has risen by 206.75 points (0.67%) and currently trades at 31,094.63

- Hong Kong's Hang Seng index has risen by 153.39 points (0.84%) and currently trades at 18,387.66

- China's A50 Index has risen by 102.94 points (0.83%) and currently trades at 12,436.37

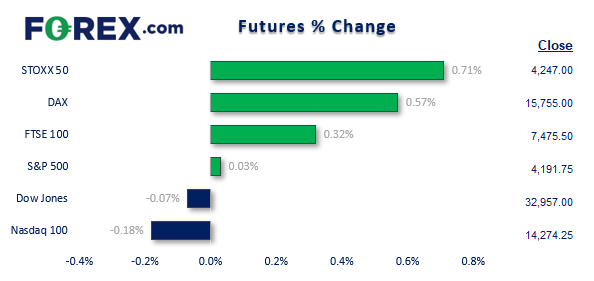

UK and Europe:

- UK's FTSE 100 futures are currently up 23.5 points (0.32%), the cash market is currently estimated to open at 7,469.64

- Euro STOXX 50 futures are currently up 29 points (0.69%), the cash market is currently estimated to open at 4,247.04

- Germany's DAX futures are currently up 88 points (0.56%), the cash market is currently estimated to open at 15,752.02

US Futures:

- DJI futures are currently down -23 points (-0.07%)

- S&P 500 futures are currently up 1.25 points (0.03%)

- Nasdaq 100 futures are currently down -25.75 points (-0.18%)

- The US debt-ceiling looks set to be raised just in time to avoid a government default, following a majority vote in favour in the Republican House of representatives.

- Tech stocks were the clear winner in May with the Nasdaq rising to a 13-month high (and the Nikkei following suit) whilst shares across Europe and Asia plunged into the4 back of the month

- A private manufacturing PMI report for China delivered a mixed message, and remains overshadowed by the gloomier government report released yesterday

- With bets now reduced of a Fed hike following dovish comments from Fed Vice Chair Jefferson, it could take some strong employment numbers (from jobless claims or ADP figures) or today’s ISM report to meaningfully support the US dollar

- We’re looking for further losses on the DAX daily chart, although we want to see how prices behave after the open to see if it can produce a minor rebound within yesterday’s range

- EUR/GBP finds itself near multi-month lows in a tight consolidation, and potentially within 1-2 trading days away from a key support level

US debt-ceiling bill passes the House

The US debt-ceiling looks set to be raised just in time to avoid a government default, following a majority vote in favour in the Republican House of representatives. It will now be passed over to the Democratic Senate and is likely to be plain sailing from here (famous last words). There was little to no market reaction as the bill’s success has more than likely already been priced in, leaving only downside potential for Wall Street should the Senate deliver a surprise blow to the deal this week.

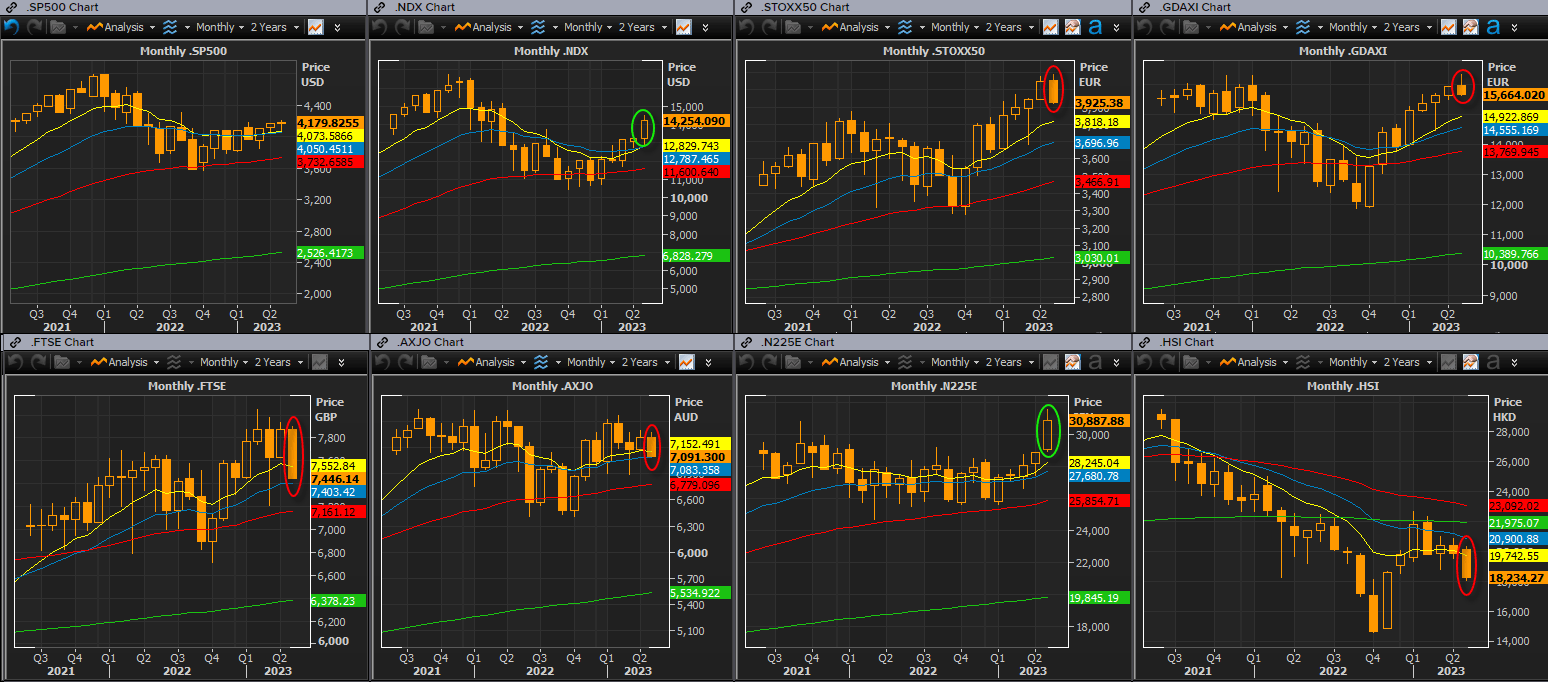

Tech stocks outperformed weak markets in May

There was a clear divergence in stock markets in May with tech stocks coming out on top and leaving all else for dust. European shares posted notable bearish candles, with the DAX pulling back from its very brief all-time high and the FTSE winning the ‘best bearish candle’ award. Several of these indices closed at the low of the month on high volume, but we also need to factor in month-end flows and seasonality, as May (and June) tend to be less favourable for bullish bets on the stock market.

It's not uncommon to see at least minor retracements against strong moves, especially at the start of a new month. So whilst the trends point lower overall for European shares, we’re on guard for some fickle price action as we head into June.

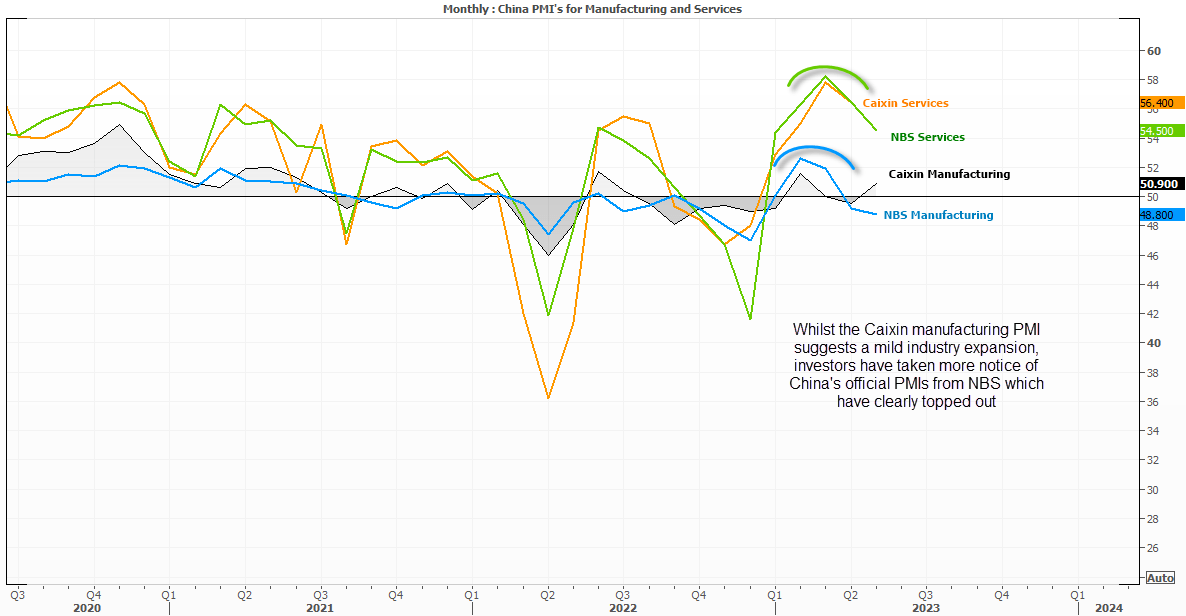

China’s slight PMI beat failed to rekindle bullish sprits in Asia

China delivered some slightly better data today via Caixin’s manufacturing PMI – a private survey which runs independently to the official NBS report. The Caixin PMI expanded for the first month in three, with manufacturing output hitting an 11-month high thanks to “firmer client demand”. However, employment contracted at its fastest pace since February 2020. A win for the global fight against inflation is to see “input costs fall solidly”.

It helped Asian indices pick themselves up from yesterday’s lows yet failed to spark a material risk-on vibe for the session, as investors seem to be taking greater notice of the government’s gloomier take from yesterday; manufacturing contracted for a second month at its fastest pace in six, whilst services expanded at its slows pace in four months. But another driver for weak sentiment has been on the back of the Hang Seng reaching a technical bear market yesterday, having fallen over 20% from its prior cycle high as investors seemingly give up on China’s recovery.

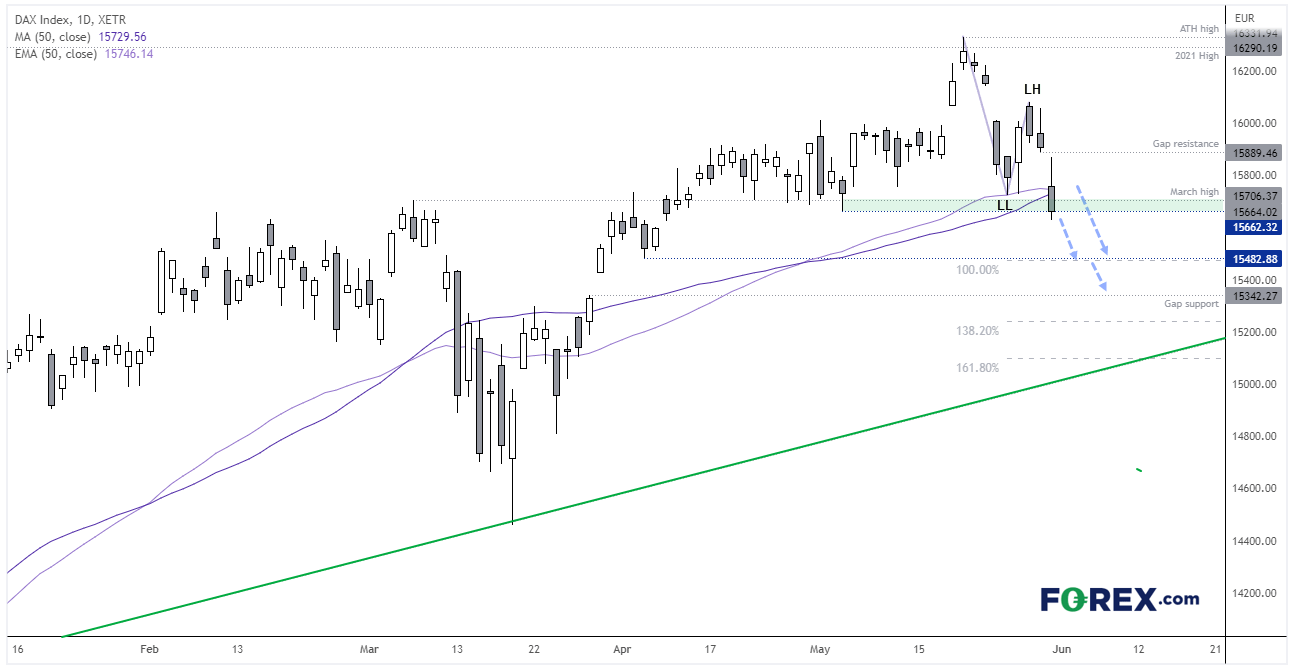

DAX daily chart:

The further price action develops, the more it appears that the DAX’s rally to it brief all-time high was a ‘last hurrah’, as momentum has turned swiftly lower and prices have printed a lower low and lower high on the daily chart. Furthermore, yesterday’s low attempted to break beneath the consolidation ahead of the fatal rally so we’re retaining a bearish bias over the near-term.

With that said, we’d prefer to see how prices react at today’s open. Perhaps we’ll see a minor rebound, in which case bears could seek area of weakness within yesterday’s range, with the 50-day EMA and 50-day MA on hand to provide potential resistance around 15,750. Alternatively, bears could wait for a break of yesterday’s low and seek a run for the 15,483 low near a 100% projection level. A break beneath which brings gap support into focus around 15,343.

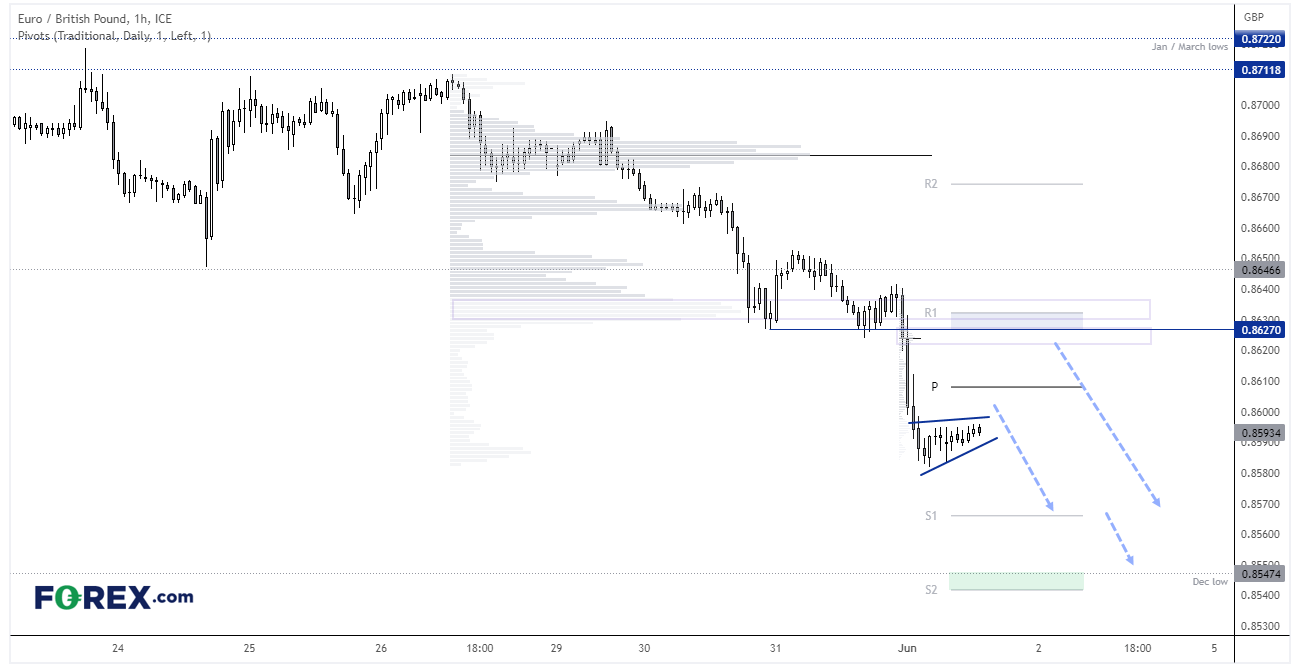

EUR/GBP chart:

Falling just over 2% in May, EUR/GBP has endured its worst month in ten. It also closed at the low of the month to really rub it in, thanks to speculation that the BOE may hike at least twice more to 5% and a slew of weaker inflation data from Europe. It has also fallen for four consecutive days following a multi-week sideways range.

Its next major support level for bears to target (or bulls to defend) is the December low around 0.8550. Prices are forming a potential bear flag which projects a target around the December low, but if prices retrace higher first we have the daily pivot point ~0.8610 and a volume cluster ~0.8630 for bears to consider fading into.

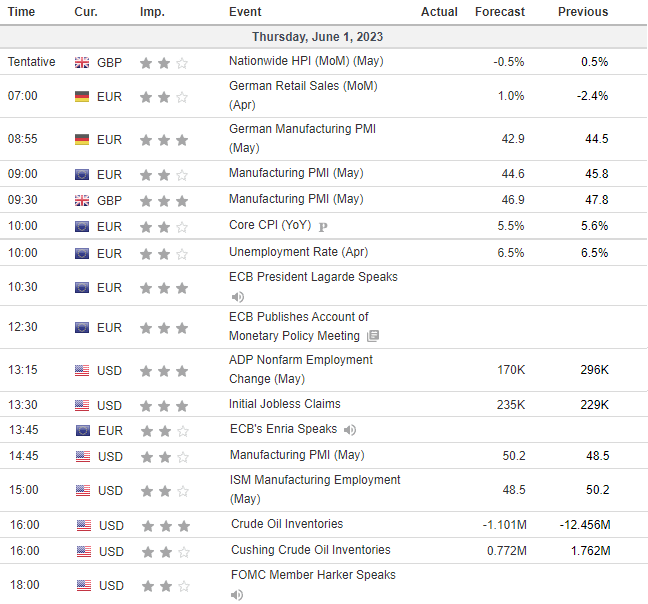

Events and themes in focus for today (times in GMT+1)

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge