- DAX analysis: Risk appetite diminishes after some disappointing earnings

- China’s deflation threat holding back equities despite stimulus measures

- DAX technical analysis point to fading bullish momentum at all-time highs

Market sentiment was a bit cagey this morning, with the US dollar rising and stock indices struggling somewhat. The USD/JPY rallied past 149 handle to reach its best level since November, after the BoJ Deputy Governor said the central bank won't hike aggressively upon ending negative rates, sending all JPY crosses higher. The US dollar was also looking to rebound against other major currencies after a two-day pullback, potentially resuming a rally that was triggered by hawkish Fed comments and strong employment data. US index futures traded a bit lower, tracking mostly weaker European markets in the first half of Thursday’s session. The FTSE was weaker at the time of writing, relinquishing small gains made earlier in the day, while the DAX was trading flat.

Risk appetite diminishes on mixed earnings results

In Europe, we had one of the busiest days of the earnings season, with mixed fortunes. Unilever’s stronger sales growth helped the Stoxx 600 index to trade in the positive, while Maersk, the world’s second-largest container shipping group, saw its shares tumble as it predicted the industry to take a hit later in the year and suspended buybacks. Credit Agricole saw its shares fall despite beating profit as underlying pre-tax income fell short. London-listed shares of AstraZeneca fell more than 5% to drag the FTSE lower, while other notable fallers included Mondi and JD Sports.

China’s deflation threat holding back equities despite stimulus measures

Investors were unimpressed by the lack of any further bullish momentum in Chinese markets on the final trading day before the week-long Lunar New Year holidays, despite signs that suggests more forceful measures to support the stock market are on the way from the government.

Scepticism among investors about China’s equity markets was highlighted by the lack of follow-through in the rally there, as the government is increasingly eager to arrest the equity rout amid concerns about the economic and social damage of a struggling market. Already, several measures of rescue measures have been announced, including trading curbs and a show of support by the nation’s sovereign wealth fund. Those measures triggered a sharp recovery that lifted the benchmark CSI 300 some 4.5% in the previous two sessions. China is grappling with the threat of deflation as consumer prices fell last month at the fastest pace since the global financial crises. CPI came in at -0.8% y/y vs. -0.5% expected and -0.3% last. The producer price index fell 2.5%, which means it has now dropped in 16 straight months. Undoubtedly, the deflation threat will increase the pressure on authorities to further stimulate the economy and support China’s stock market.

DAX analysis: Technical levels and factors to watch

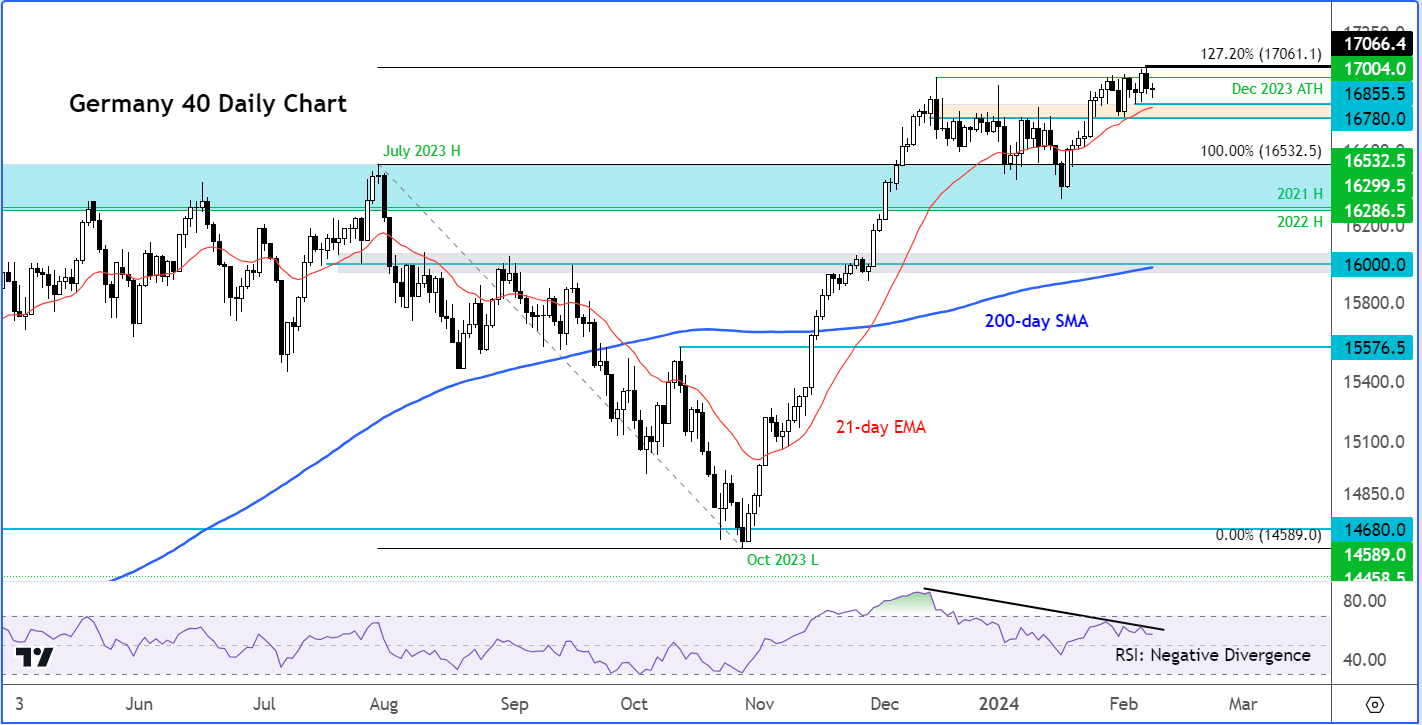

Source: TradingView.com

The German DAX index hit a new all-time high in the previous session, as it has been doing consistently in recent weeks with minimal pullbacks. This argues against looking for bearish setups. Yet, momentum indicators such as the Relative Strength Index (RSI) suggests there may be a case to be extra cautious moving forward.

Admittedly, the RSI is not as ‘overbought’ as it was in December, when the index last hit a record high. It worked off its overbought conditions through time as the DAX spent the early parts of this year in consolidation mode. But after the more recent rally that lifted the DAX to new highs, we haven’t seen any real commitment from the bulls to kick on. The index has been quite choppy, with traders seemingly happy to book quick profits on their long trades. For this reason, the RSI hasn’t made a higher high, and instead created a “negative divergence”. The indicator’s divergence is a warning that the bullish momentum is fading. Interestingly, this is happening with the DAX also reaching a Fibonacci-based exhaustion zone around 17066, a level that corresponds with the 127.2% extension of the drop that took started in July and ended in October last year.

So, the correction potential is there. But the bears must await a “sell signal” first, rather than trying to pre-empt a drop. A potential move back below short-term support in the range between 16855 to 16780 could be a turning point. If that happens then I would look for technical selling below that level to get us back to the July 20203 high of 16532 as a minimum.

However, if the abovementioned bearish trigger does not happen, then the bears must exercise patience.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R