Key Events

- OPEC Monthly Report (Monday)

- IEA Monthly Report (Tuesday)

- Chinese Q3 GDP (Friday)

- US Hurricane Activity

- Ongoing Geopolitical Conflicts

- Technical Analysis: USOIL

OPEC Monthly Report

Historically, global oil demand averaged 1.4 million barrels per day (mb/d) prior to COVID-19. In its September report, OPEC downgraded its demand growth forecast for 2024 to 2.0 mb/d and 1.7 mb/d for 2025, with supply growth projections of 1.2 mb/d in 2024 and 1.1 mb/d in 2025. However, recent developments, including Chinese economic stimulus measures and escalating geopolitical tensions, could impact these forecasts. This week’s OPEC report will be closely monitored for any updates reflecting these evolving conditions.

IEA Monthly Report

Similarly, the International Energy Agency (IEA) has also adjusted its oil demand outlook downward, mainly due to the economic slowdown in China. The latest Chinese stimulus initiatives are still in their early stages, and their effects have yet to fully materialize.

Monetary Policies: US – China

Recent U.S. economic data has pointed to a less aggressive cycle of monetary easing, which implies more modest support for oil demand and economic growth. In contrast, China is pursuing a more aggressive approach to stimulus as it aims to hit a 5% GDP growth target. If these measures succeed, they could prompt an upward revision in global oil demand, particularly in Q4 2024 and into 2025.

Ongoing Geopolitical Conflicts

Geopolitical tensions are escalating across various regions, posing risks to global economic growth and, more directly, to oil supply. These conflicts have the potential to disrupt key oil-producing regions and facilities, adding upward pressure to oil prices. This uncertainty is driving market participants to hedge against potential supply shocks, often through call options, as they anticipate further price gains.

Technical Analysis

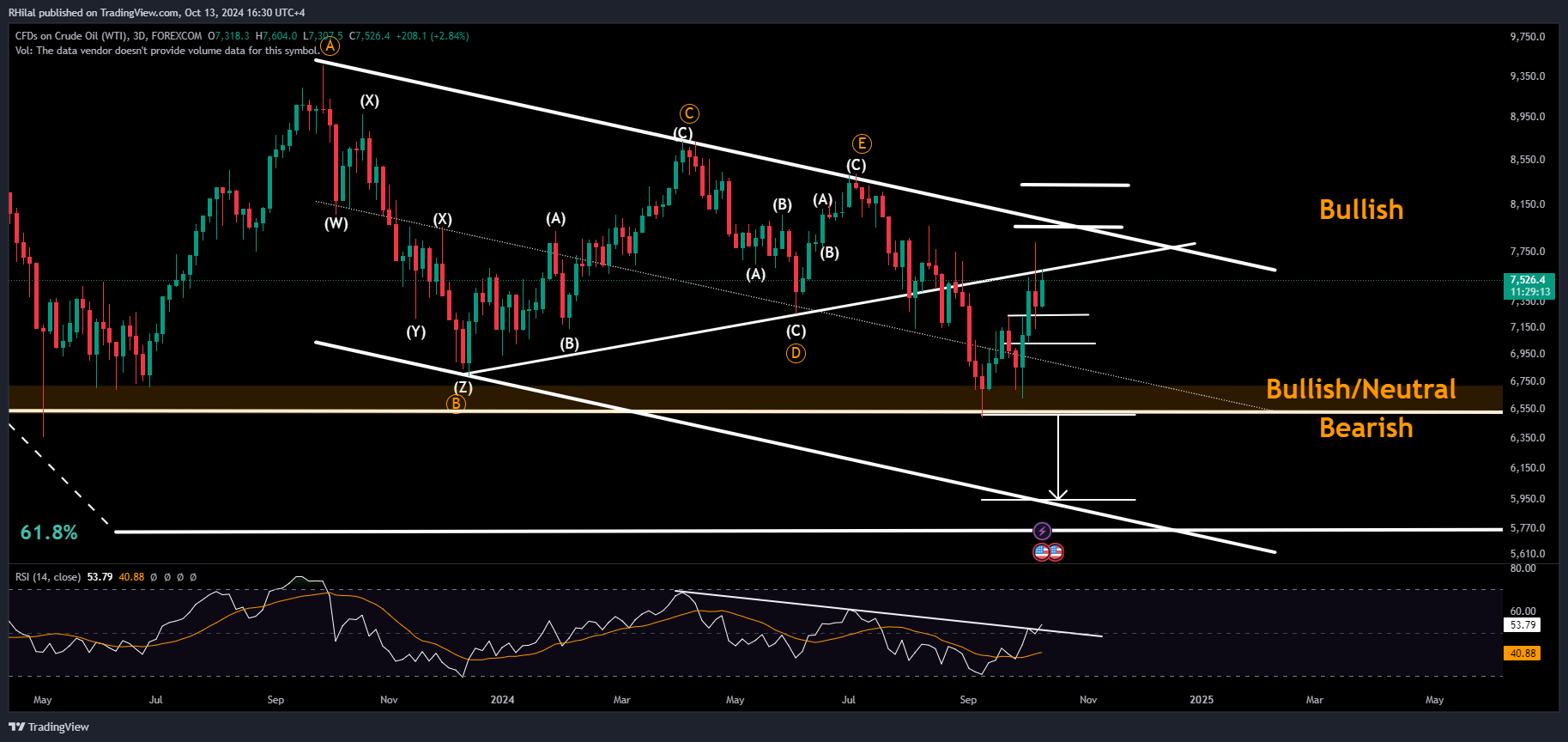

Crude Oil Weekly Outlook: USOIL – 3Day Time Frame – Log Scale

Source: Tradingview

Oil prices closed the volatile week at a price of 75.26 below the borders of the primary consolidation. With oil volatility pressured below that pattern, a bias towards the bear side can still be considered. However, given supply disruption risks between Hurricanes and geopolitical tensions, further upside risk for oil prices remains possible on the charts.

Bullish Scenario:

A breakout in the 3-day relative strength index (RSI) above the resistance line formed by the lower highs between April and July 2024 could signal the start of a bullish move. If prices close above the 76-mark, a retest of 80, 83.50, and 86 levels could follow.

Bearish Scenario:

In tandem with the primary bearish track of oil prices beyond supply disruption risks, a close below 70 can drag oil prices back towards the key 65 level before extending a bearish scenario back towards 60-58.

--- Written by Razan Hilal, CMT – on X: @Rh_waves