Key Events:

- Geopolitical Risks in Middle East are altered with Fall of Syrian Government

- OPEC extends production cuts, and a meeting will be held on Tuesday

- Chinese economic data are monitored this week for potential influence on oil demand

- Broader market volatility catalyst: US inflation data on Wednesday

Middle East Updates

Following the ceasefire deal between Israel and Lebanon, another step toward diminishing Iran's influence in the Middle East emerged with the fall of the Syrian government on Saturday. This development also poses potential ease for US-Middle Eastern conflicts anticipated in 2025. The political landscape in the Middle East is undergoing significant transformation, but risks of supply disruptions and potential new conflicts remain until comprehensive agreements are finalized.

OPEC Meeting Recap

In tandem with market expectations OPEC+ agreed to extend their production cuts to stabilize global oil markets amid bearish challenges, including weaker demand from the Chinese economy, greater supply from non-OPEC countries, and global transitions to renewable energies.

Oil prices maintained their stability above the 64-68 support zone extending from December 2021, waiting for another catalyst to record a significant bullish rebound or bearish breakout. Potential market movers include major geopolitical shifts in the Middle East, developments in the Chinese economy, or changes in the US Dollar.

US Data

US non-farm payrolls recorded an addition of 227,000 in November and unemployment rate ticked higher towards 4.2%, leaving the markets in a confused state and no clear direction ahead of the weekly close. The next catalyst in sight for potential broader volatility is the US CPI on Wednesday.

Chinese Data

The Chinese economy remains under close observation due to its influence on oil demand. Key events this week include the Chinese CPI and new loan data on Monday. November CPI figures reflected continued deflation, declining from 0.4% to 0.3%, down from October’s 0.6%. Meanwhile, producer price inflation plunged further into deflation territory at -2.9%.

Technical Analysis: Quantifying Uncertainties

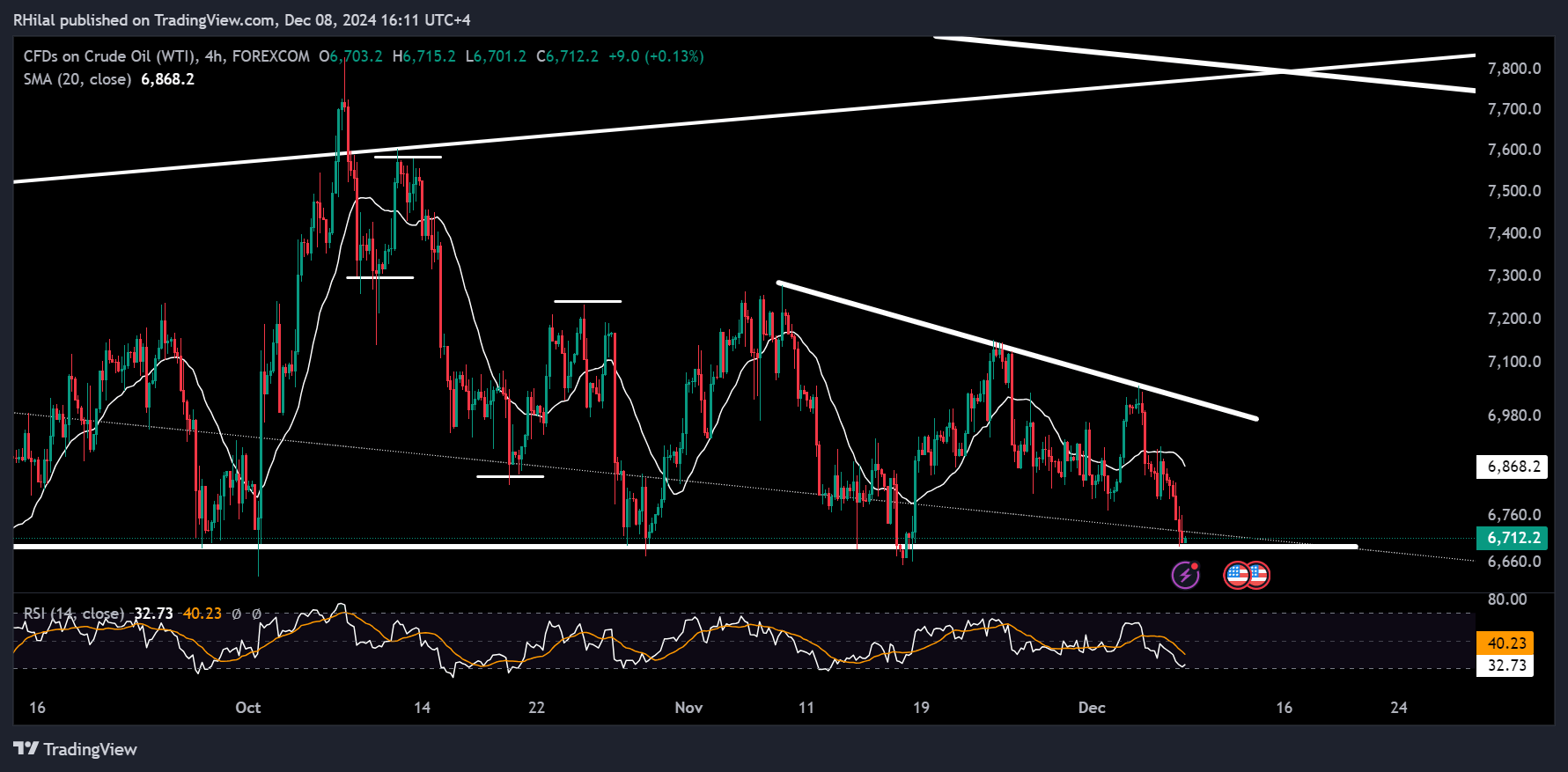

Crude Oil Week Ahead: 4H chart – Log Scale

Source: Tradingview

The current 4H time frame on the chart of crude oil mirrors that of the weekly timeframe, an impulsive downtrend followed by a sideways consolidation. The 4H chart is holding above the 66-support zone since September 10, currently trading below the 20-day simple moving average.

The current consolidation resembles a head and shoulders pattern, extending shoulders with a need for a notable trigger to break out of the range. Upside resistance can be found between 69.80 and 70, aligning with the resistance line connecting the consecutive lower highs between November and December 2024.

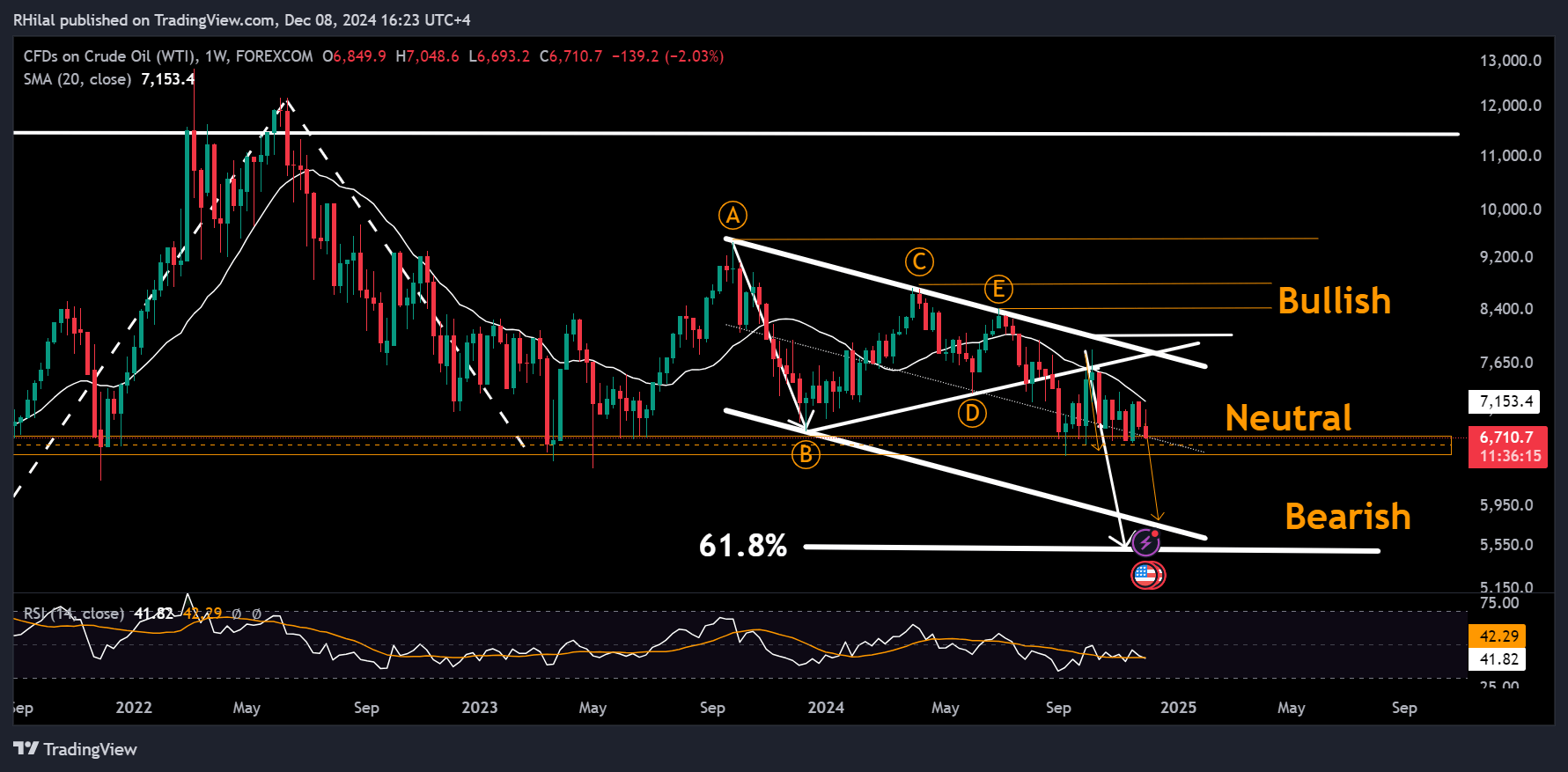

Crude Oil Week Ahead: Weekly Chart – Log Scale

Source: Tradingview

Similar to the 4h time frame, the overall price action of oil prices is holding above the 4-year support extending from December 2021 between the 64 and 68 price zone. The longer-term levels remain intact in the following scenarios:

Scenario 1: The bearish breakout from the triangle suggests a move toward the full triangle target, aligning with the 0.618 Fibonacci retracement level of the 2020–2022 uptrend at 55. This scenario also aligns with the lower boundary of the down-trending channel, which has been respected and extended from the yearlong triangle pattern. A firm break below 64 can extend the drop towards 58 and 55.

Scenario 2: If the current support zone holds and bullish fundamentals come into play, the first resistance (above 72) could be met at the triangle’s thrust point (where its borders converge) near $78. Further resistance levels could follow at 80, 84, and 88, potentially extending the uptrend toward longer-term targets at 95 and 120.

--- Written by Razan Hilal, CMT on X: @Rh_waves and Forex.com Youtube Channel