Article Outline

- Key Events: China, Trump Returns, and PMI data

- Technical Analysis: USOIL 3-Day Time Frame

- Technical Analysis (TA) Tip: Chart and RSI Patterns

Oil’s 2025 uptrend reached the $80 resistance level before retreating to the $77 zone, driven by better-than-expected Chinese economic data and traders hedging against upside risks amid U.S. sanctions on Russia and heightened winter demand. Despite these factors, oil’s primary trend remains bearish, and the sustainability of 2025’s upward momentum—amid Chinese economic growth, seasonal demand, and geopolitical risks—remains uncertain.

Trump Returns on Monday

Donald Trump is set to take office on Monday, January 20th, coinciding with a U.S. market holiday. Promising drastic policy changes from day one, Trump’s agenda introduces significant volatility risks. His "drill, baby, drill" stance poses potential downside risks for oil prices, while geopolitical tensions and oil supply sanctions keep hedging for upside risks on the table.

Chinese Economic Update:

China’s latest economic data has bolstered oil’s positive trajectory:

- New Loans: Increased from 580B to 990B, reaching a 3-month high

- Trade Balance: Surged to a 10-month high with a surplus of 753B

- Industrial Production: Rose from 5.4% to 6.7%, marking an 8-month high

- GDP: Jumped from 4.6% to 5.4%, achieving the government’s growth target for 2024

- Foreign Direct Investment: Rebounded from -27.9% to -27.1%, reaching an 8-month high

However, questions linger over the sustainability of this uptrend. Much of the positive momentum stems from a late stimulus blitz and an export boom ahead of expected U.S.-China tariff tensions under Trump’s administration.

Key Chinese data to watch this week includes loan prime rates, scheduled for release on Monday.

Technical Analysis: Quantifying Uncertainties

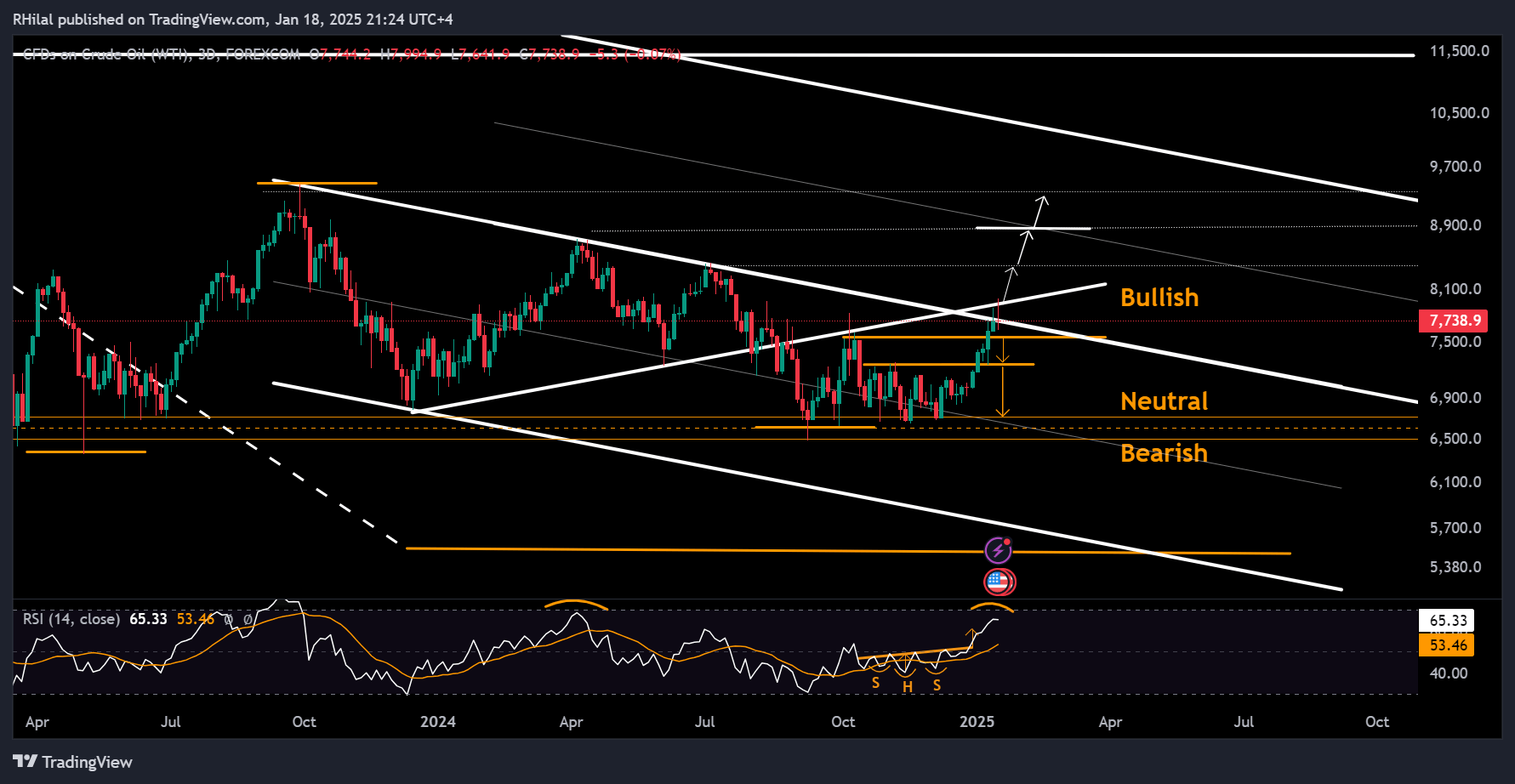

Crude Oil Week Ahead: 3Day Time Frame – Log Scale

Source: Tradingview

Oil prices rebounded from the $80 resistance level, which aligns with the lower boundary of a yearlong triangle pattern connecting consecutive lows from December 2023 to July 2024. The Relative Strength Index (RSI) has climbed toward overbought levels, last observed in April 2024 when oil peaked at $87.20 before retreating to $68. Currently, crude oil is one resistance level away from a bullish breakout, with the lower boundary of the respected triangle pattern between September 2023 and August 2024 marking the $80 zone.

Scenarios:

- Bullish Scenario: A firm close above $80 could extend gains toward resistance levels at $84 and $88.

- Bearish Scenario: Dropping below the $76–$75.50 zone, now serving as support, could trigger declines toward $72 and $68.

Technical Analysis (TA) Tip: Chart and RSI Patterns

Two key patterns stand out on the crude oil chart:

1. Triangle Pattern: The boundaries of the triangle continue to shape oil’s price trend.

2. RSI Inverted Head and Shoulders: This continuation pattern on the RSI supported the bullish trend toward recent highs.

With current resistance and overbought conditions, a reversal is possible unless a bullish breakout above $80 is confirmed.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves

On You tube: Forex.com