- Middle East tensions are feared to widen beyond the borders of Israel and Palestine

- Hurricane season has kicked off strongly, raising fears of supply disruption coinciding with the usual oil demand surge of the driving season

- Declining U.S economic data versus easing monetary policies

Geo-political Risks:

Beyond the conflict with Hamas, Israel’s clashes with Hezbollah raise fears of escalating Middle Eastern tensions towards a broader conflict involving Lebanon.

Climate Risks:

In addition to the expected increase in oil demand during the summer season, supply disruption fears are rising. The NOAA predicts an 85% chance of an above-normal 2024 hurricane season, with near-record warm ocean temperatures.

Economic Risks: On one side, Chinese Manufacturing PMIs have recorded disappointing figures for oil demand potential. On the other side, declining inflation and economic growth figures in the U.S. might support oil demand potential, given the potential easing of monetary policies on the horizon. The upcoming FOMC minutes will be closely watched for insights on potential rate cut dates.

Recent figures:

May CPI: in line with the Fed’s target

May PCE: in line with the Fed’s target

ISM Manufacturing PMI: three consecutive declines below expansionary metrics

CME Fed Watch Tool: more than 60% anticipation for a rate cut in September

OPEC Quotas: Countries that have previously produced beyond OPEC quotas, such as Iraq, are aligning with their latest vows to meet supply cut quotas.

Shifting to technical analysis:

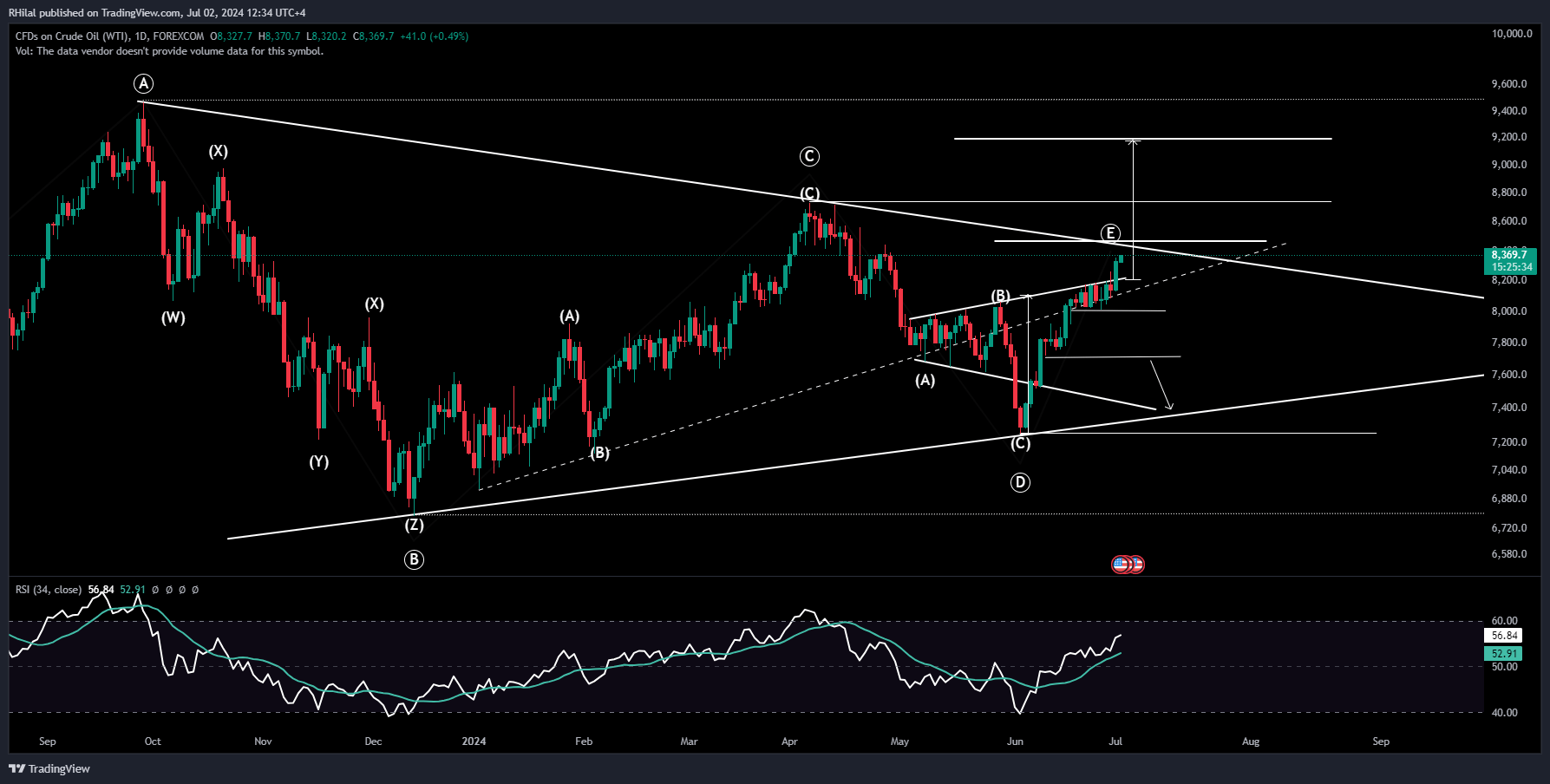

Crude Oil Update: USOIL – Daily Time Frame – Logarithmic Scale

Breaking above the resistance level connecting the consecutive highs of May, oil is on track towards the upper end of its larger consolidation. After surpassing its latest high of 83.50, the following potential resistance levels are in sight:

Resistance 1: 84.50 – 85 zone (upper end of the consolidation)

Resistance 2: 87.30 zone (2024 high)

Resistance 3: 92 zone (potential inverted head and shoulder pattern target)

Regarding the Relative Strength Index (RSI), a short-term momentum uptrend is still possible before retesting the overbought levels.

Downside Risks: After tracing the fifth wave of the consolidation, a potential retracement back towards the lower end of the consolidation is possible, starting with levels 80 and 77 consecutively.

Attention remains on developing risks, from wars to elections, economic growth figures, and monetary policies, to support the following technical projections.

--- Written by Razan Hilal, CMT