- Limited Israeli response to Iran missile attack sees crude oil gap lower in early trade on Monday

- Targeting of military installations in line with media reports earlier this month

- Crude oil price bounces after taking out October 18 low

Overview

Israel’s weekend retaliation against Iran was in line with media reports earlier this month, avoiding a provocative move that could have escalated the conflict further. Given the lack of surprise, there may be a temptation among traders to close the opening gap created by the headlines.

Geopolitical risk premium erased

Israel’s limited military response over the weekend in response to an Iranian missile attack earlier this month has seen crude oil futures open sharply lower, reflecting relief the retaliation was more measured that what could have been the case. With Israeli fighters targeting military installations rather than nuclear or energy facilities, it instantaneously stripped out some of the risk premium that had been built into the crude price, explaining the opening cap lower.

While the reaction suggests there was scepticism among traders about what response Israel would take, it was largely in line with media reports earlier this month that generated an equally large bearish market reaction.

Essentially, traders have reacted to the same piece of information twice, the only difference being this time was the actual event rather than speculation before it took place. Sure, it’s a big distinction, but it makes you wonder whether the reaction was a little overblown considering there was no real surprise.

With a large gap created by the opening plunge, there may be now a temptation among traders to close it. One look at crude oil futures going back years shows you that it’s rare for gaps to exist in the price for considerably periods of time.

WTI gaps lower before bouncing

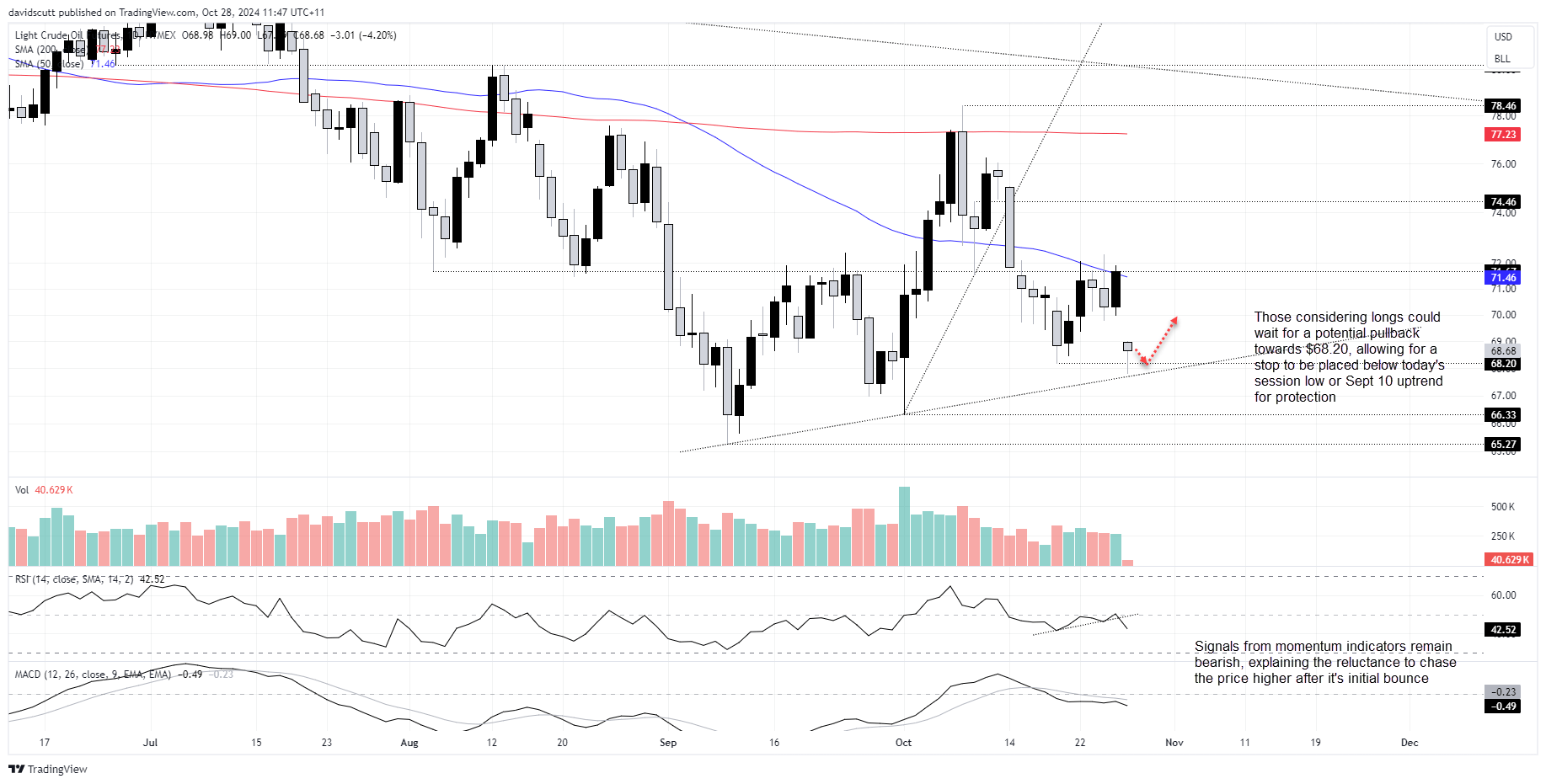

Looking at WTI crude futures on a daily timeframe, you can see that after initially falling through the October 18 low of $68.20 upon the resumption of trade, the price bounced ahead of an uptrend that began on September 10. Given the price action since, there’s obviously plenty of willing buyers around despite the fundamentally bearish news.

Even though the opening gap may be closed in the near future, to make a long trade stack up from a risk-reward perspective, it would be preferable to enter at lower levels, allowing for a stop to be placed below the session low or September 10 uptrend for protection.

If the gap is to be filled, that suggests the initial trade target would be $70 where the price closed on Friday. Beyond that, the 50DMA and resistance above $71.67 are other targets if the initial one is achieved.

-- Written by David Scutt

Follow David on Twitter @scutty