Crude oil outlook: Market remains cautious despite OPEC+

Crude oil prices are under pressure, struggling to rise despite the latest OPEC+ deal to extend output cuts. After a brief spike above $69 per barrel post OPEC+ meeting, WTI prices have since slipped to below $68 and were testing the daily lows at the time of writing. With the extended timeline for production cuts and a delayed output hike, market participants are left assessing whether these moves are enough to counterbalance global demand and excessive supply challenges. The lack of a more positive response shows the market is disappointed and thus even lower oil prices could be the outcome. Our crude oil outlook remains modestly bearish, as before.

OPEC+, controlling nearly half of the world’s oil output, faces the delicate task of managing a market riddled with uncertainties. While the recently released Chinese manufacturing data hinted at some recovery, the broader demand growth remains tepid. Crude prices have fallen 20-25% this year, leaving analysts sceptical about a swift turnaround. The challenge now lies in whether supply adjustments can offset demand-side weaknesses. The immediate repose after the OPEC+ meeting suggests that’s not the case at these prices.

OPEC+ delays output hike again

Yesterday, the OPEC+ outlined a plan to unwind production cuts gradually between April 2024 and September 2026. It remains to be seen whether they will stick with that plan, having continually postponed the planed production hikes in the last several meetings. The initial market reaction was a short-lived rally above $69 per barrel, but traders quickly turned cautious, driving prices back to intraday lows yesterday and oil closed in the red. This reflects the market’s broader sentiment, where concerns about oversupply and muted global growth remain at the forefront.

Saudi Arabia’s pricing strategy has also added to the uncertainty. Reports earlier this week suggested significant price reductions for January shipments to Asia, potentially weakening oil’s position in key markets. Without a substantial shift in demand or further supply cuts, crude prices remain vulnerable to downside risks.

The road ahead

With the OPEC+ meeting now behind us, crude oil’s outlook remains tied to evolving supply-demand dynamics. Elevated interest rates, a strong US dollar, geopolitical tensions and struggling Chinese and Eurozone economies continue to weigh on demand. Meanwhile, rising non-OPEC production, including record US output, keeps supply pressures high.

While the OPEC+ has extended its support measures, the market remains unconvinced that these actions will suffice. Until a more balanced demand recovery or tighter supply emerges, crude oil may struggle to break out of its current bearish pattern.

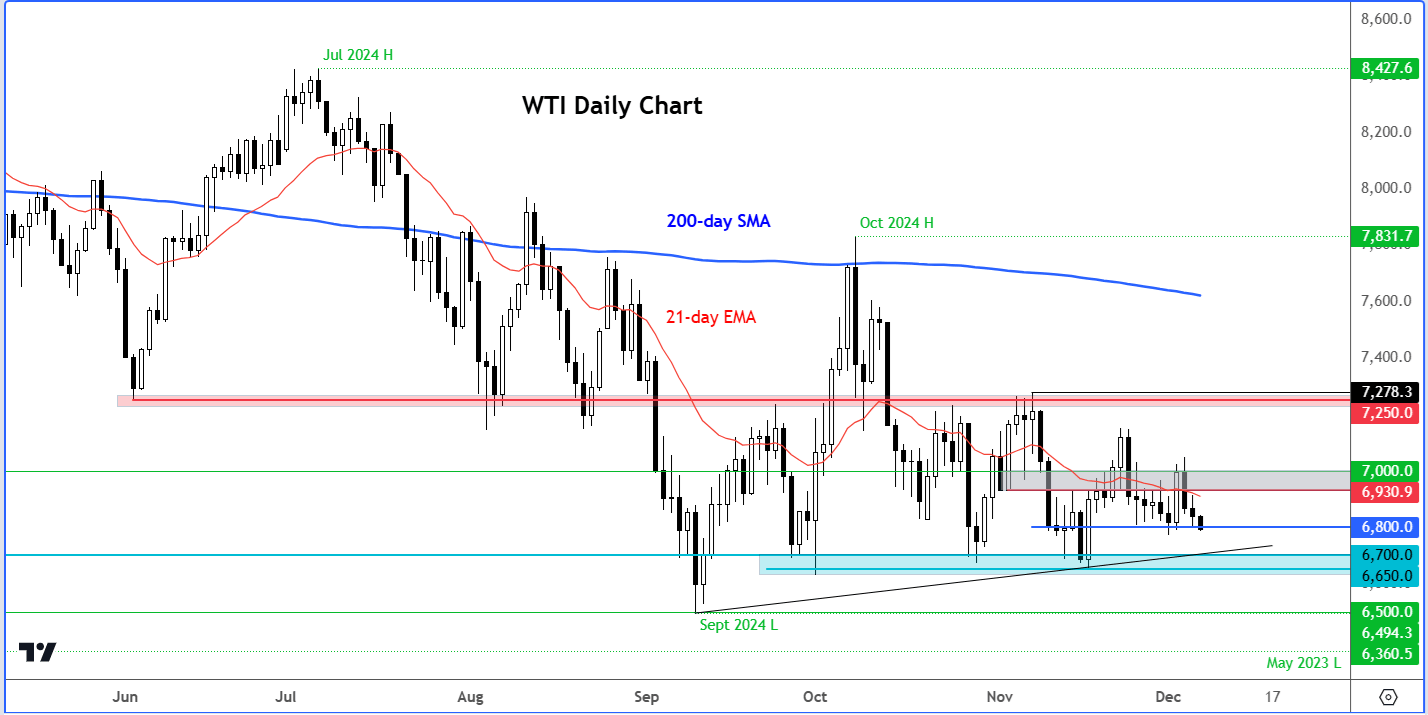

Technical crude oil outlook: WTI analysis and levels to watch

Source: TradingView.com

From a technical perspective, WTI is yet again struggling after failing to break above the critical resistance range of $69-$70 per barrel earlier this week. This zone has repeatedly capped gains, reinforcing the broader bearish trend. Traders looking for a short-term rebound may face challenges unless a clear reversal pattern emerges.

The previous key support was around $68.00, which was being eroded at the time of writing with WTI trying to break below it. A clean break below it would make this the new key resistance to watch moving forward.

Further lower, we have another range of support sitting around $66.50 to $67.00, which as well as being support in the last several weeks is also where a short-term bullish trend line established from September comes into play here. Therefore, a potential break below this zone would bring into focus September low at $64.94, and possibly even the May 2023 low of $63.60 if bearish momentum intensifies.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R