WTI crude oil managed to bounce $1 off its earlier lows to trade around $76.00 after earlier dipping to $75.00 support level. That dip was bought, supported in part by ongoing risk-rally with equity indices also still maintaining their bullish structure. With China’s improving economic conditions, demand concerns have reduced and in the short-term there is little risk of an oil glut forming, but the slightly longer term outlook is a bit murky with the potential for another supply war to emerge between US shale and OPEC+ producers.

Longer term crude oil outlook bleak amid potential for US supply surge

"We will drill, baby, drill" is what Trump promised yesterday, and this had an immediate influence on oil prices. Trump emphasized a push for increased domestic oil production, aiming to lower global energy prices by boosting supply. Let’s see if he will be able to achieve this goal. The lack of a more meaningful drop can be explained away by the fact this was something he had already announced. Still, regardless of what prices do in the short-term, the long-term outlook is bearish: The expected increase in US shale production, combined with the OPEC potentially returning withheld supplies, means the upside should be capped. Demand growth may not keep up with the potential increase in global supplies.

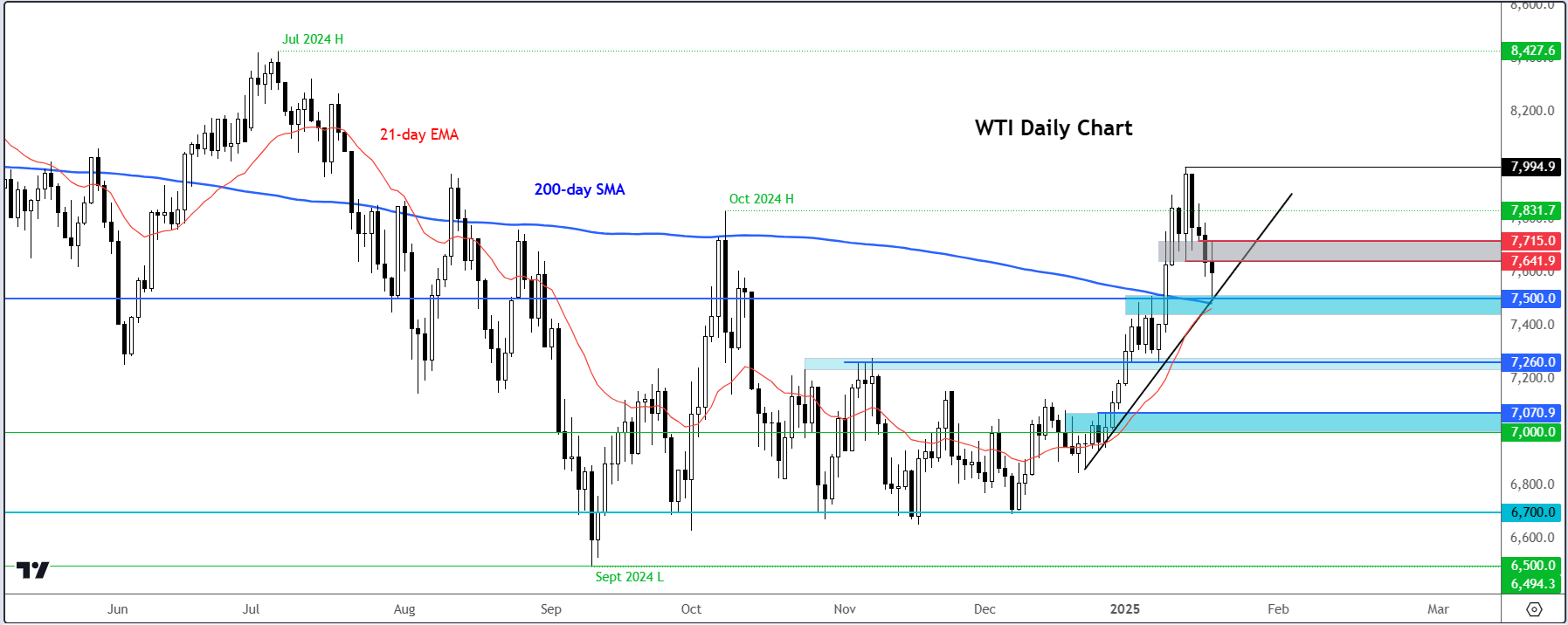

Crude oil outlook: WTI technical levels to watch

WTI has been trending downward over the past few days, breaking a few key support levels that have now turned into resistance, such as the area around the $77.00 mark.

Source: TradingView.com

Earlier, prices dipped to test the first significant support zone near $75.00, which triggered a bounce. Here, a short-term bullish trend line and prior resistance met the psychologically important level. A technical bounce made total sense.

At the time of writing, WTI was testing the broken support zone in the $76.40 to $77.15 range. The question is: will sellers re-enter the market at this level or await a deeper retracement?

With Trump's bearish oil policies at the forefront, this could reignite selling pressure again. Tactically, our crude oil outlook will turn bearish in the event WTI breaks and closes below the $75.00 handle today.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R