Key Events

- Trump’s “Drill Baby Drill” Agenda: Aims to increase oil output by 3 million barrels.

- OPEC’s Market Share Risks: Faces potential oversupply from US production.

- Output Expectations: Speculation grows over holding current production levels instead of a previously anticipated hike.

- Revenue vs. Price Risks: OPEC members weigh revenue potential against price stability.

- Geopolitical Tensions: Risks persist for 2024, with Trump warning of action in the Middle East if resolutions aren’t reached before his presidency.

In his latest statements, Trump promised a painful attack for the Middle East if a resolution was not settled by the time his presidency term begins. The following statement underscores potential upside risks for oil prices, particularly as they remain supported within the $64–$68 zone, established since December 2021.

Downside Risks:

OPEC decisions face potential downside risks for oil prices in 2025, driven by:

- Demand Revisions: A fourth consecutive downward revision for oil demand forecasts.

- China’s Economic Slowdown: Stimulus measures have yet to show significant impact.

- Compliance Breaches: Quotas breached to address economic pressures, particularly in Russia.

- Shift Toward Renewables: Growing adoption of renewable energy further challenges demand.

- Trump’s Oversupply Risks: The "Drill Baby Drill" agenda and plans to increase US oil output by 3 million barrels threaten to flood the market, further pressuring OPEC’s market share and oil price forecasts for 2025.

Technical Analysis: Quantifying Uncertainties

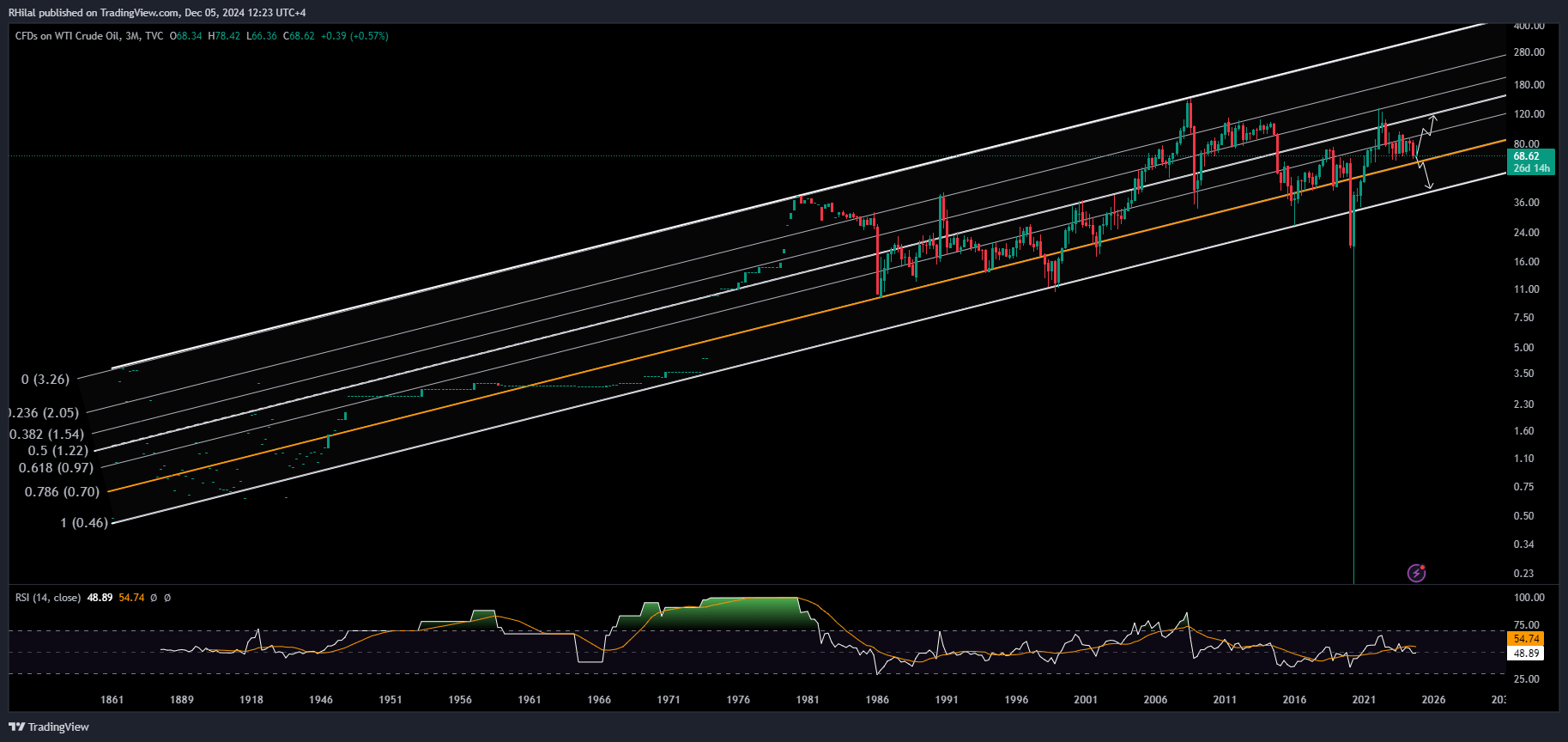

Crude Oil Outlook: 3 Month Time Frame – Log Scale

Source: Tradingview

Zooming out to the historical trend on oil prices since the lows of the 1800s, a clear up trending channel is still respected.

Applying Fibonacci analysis to the historical trend

- The 50% Fibonacci mid-channel level serves as a significant resistance point, aligning with the September 2022 highs near the $100 per barrel checkpoint.

- The 0.382 Fibonacci level corresponds to the $128 per barrel high, marking another key resistance level.

- The $64 support aligns with the 0.786 Fibonacci level, providing a critical support zone for the trend.

The channel’s lower boundary, breached only during COVID-19, suggests a potential support zone near $49. From a momentum indicator perspective, the 3-month RSI is retesting neutral levels, clarifying the solid support zone between a steep bearish breakout and another bullish rebound.

Dropping towards more recent time frames and patterns

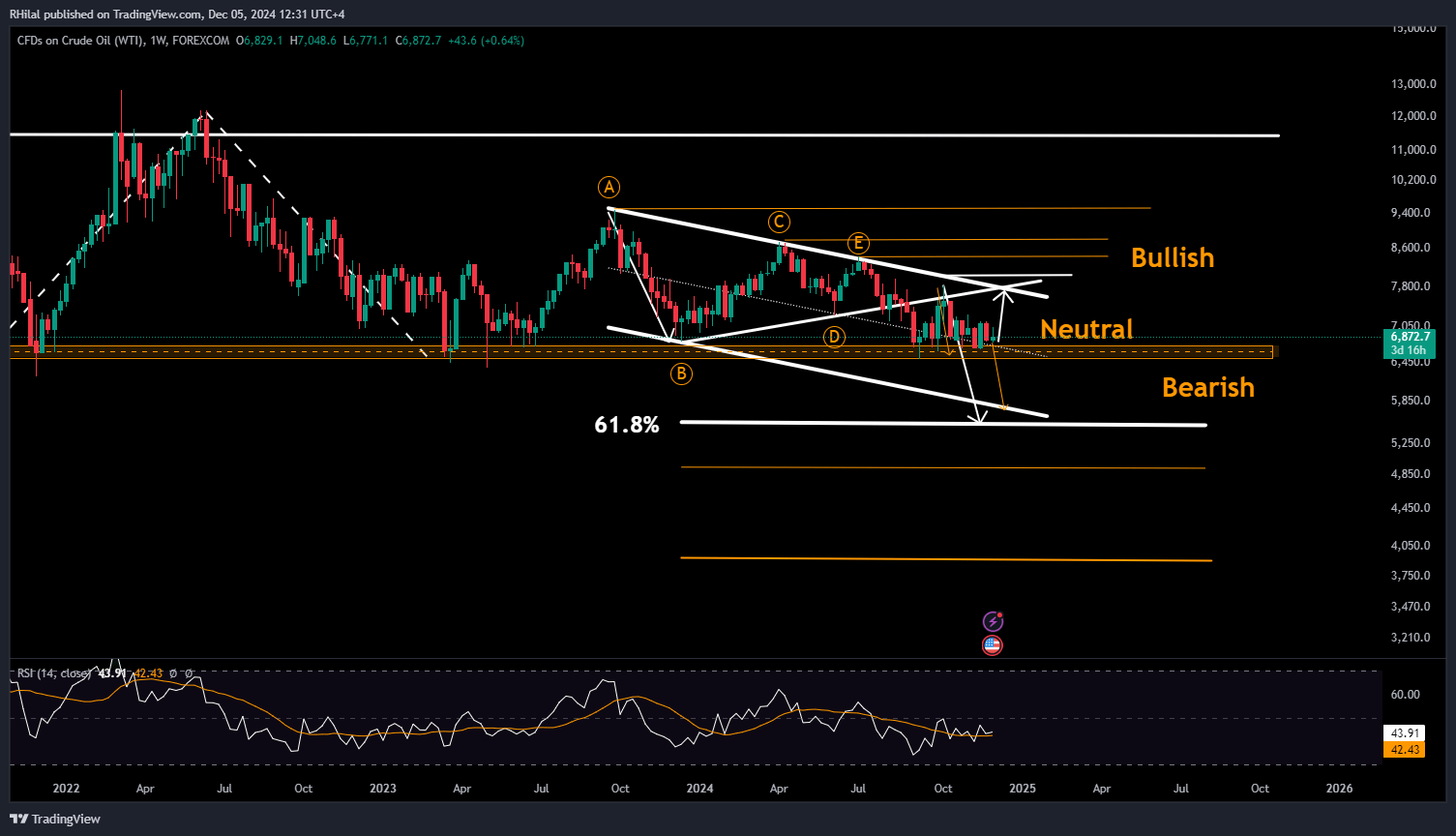

Crude Oil Outlook: Weekly Time Frame – Log Scale

Source: Tradingview

The minor consolidation below the yearlong triangle and above the 4-year support is still extending shoulders, and the strength of the current support presents two scenarios accordingly.

Scenario 1: The bearish breakout from the triangle suggests a move toward the full triangle target, aligning with the 0.618 Fibonacci retracement level of the 2020–2022 uptrend at 55. This scenario also aligns with the lower boundary of the down-trending channel, which has been respected and extended from the yearlong triangle pattern. A firm break below 64 can extend the drop towards 58 and 55.

Scenario 2: If the current support zone holds and bullish fundamentals come into play, the first resistance could be met at the triangle’s thrust point (where its borders converge) near $78. Further resistance levels could follow at $80, $84, and $88, potentially extending the uptrend toward longer-term targets at $95 and $120.

--- Written by Razan Hilal, CMT on X: @Rh_waves and Forex.com You tube Channel