- The price of WTI crude oil is preparing to break through the critical resistance level of $75, which could amplify the current bullish pressure surrounding the price.

Since the beginning of the year, WTI has increased its price by more than 8%, surpassing the psychological barrier of $75, previously regarded as the closest resistance. This bullish pressure has intensified as the market digests concerns over a possible reduction in global production and rising energy demand due to the winter season.

Supply Issues

Concerns about limited supply from Russia are growing, as the Biden administration plans to impose additional sanctions on the country’s crude exports before Trump takes office on January 20.

At the same time, Trump's incoming administration is expected to implement a similar strategy with Iran, introducing new restrictions that could reduce oil supply by an average of 1 million barrels per day, representing approximately 1% of global daily supply.

Additionally, extreme winter weather conditions could also disrupt global oil supply. Along the U.S. Gulf Coast, concerns are growing over potential power outages caused by heavy rains and winds expected in the coming weeks, potentially interrupting extraction activity in the short term. It is also worth noting that low temperatures tend to increase global energy demand for homes and factories, further boosting oil demand during this season.

Given these factors, a potential reduction in global oil production could tip the balance between supply and demand. With reduced crude oil supply, upward pressure on prices is likely to continue increasing, particularly as OPEC has not altered its 2025 strategy to maintain production cuts aimed at keeping WTI prices stable. If this trend persists, consumers may face a scenario of stable demand and limited supply, potentially driving higher crude barrel prices.

WTI Technical Forecast

The price of WTI has increased by more than 3% in recent hours, boosted by positive U.S. employment data, with the NFP showing 256k jobs added compared to the expected 160k. Improved employment prospects have heightened short-term demand pressure, playing a key role in WTI’s recent price surge.

Source: StoneX, Tradingview

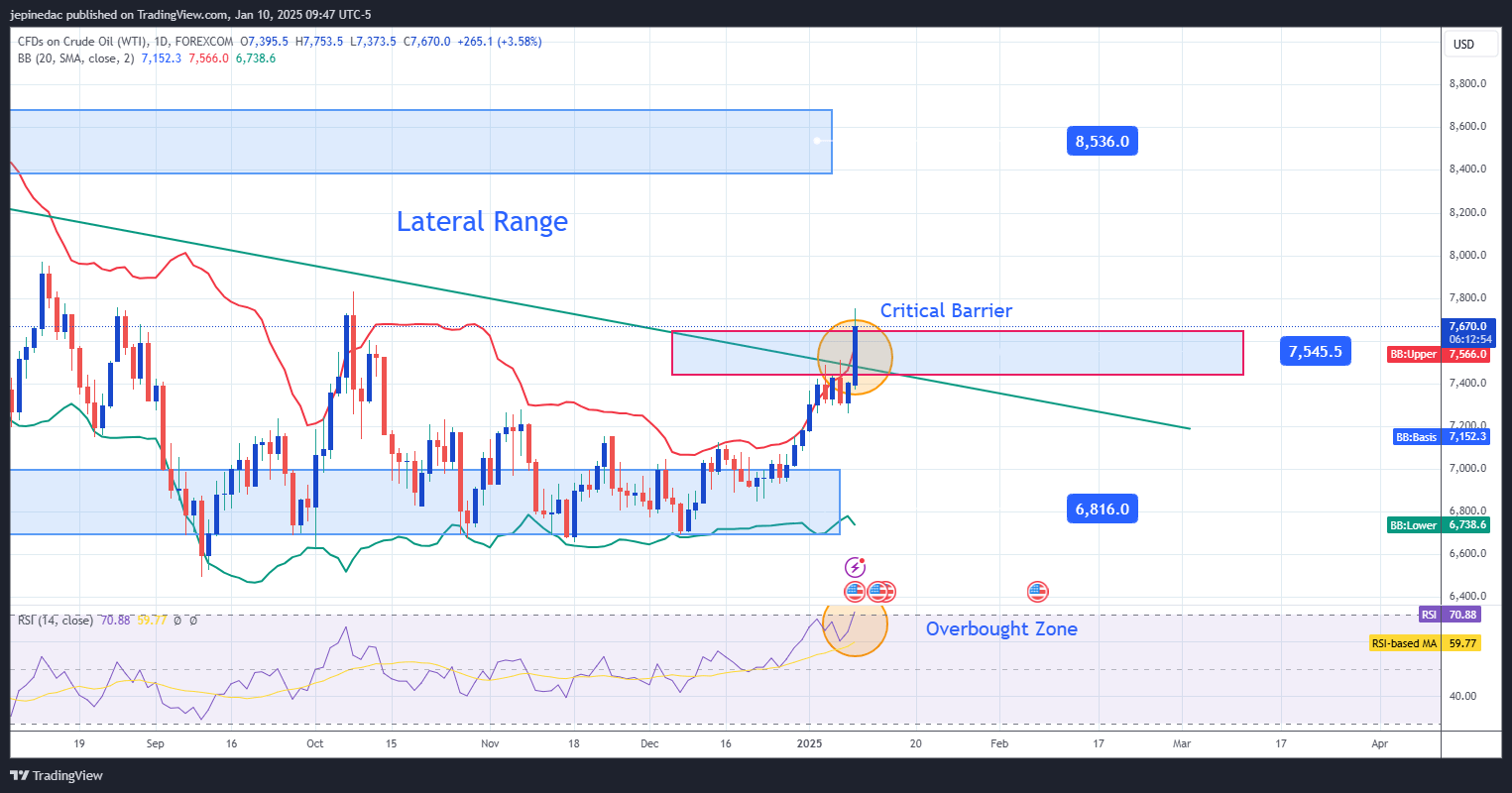

- Lateral Range: While oil continues to push for higher levels, it remains within a significant lateral range between the $85 per barrel ceiling and the $68 per barrel floor. Currently, the price is crossing the mid-range at $75, but sustained movements above this level are essential for WTI to challenge the upper resistance at $85 once again.

- Trendline Breakout: Since 2022, WTI has followed a consistent downward trendline that pushed the price down to the $68 per barrel range. Currently, the price is testing this trendline near $75, and a breakout could be crucial for initiating a more significant bullish movement in the short term.

- RSI Overbought: However, the RSI has reached the 70 level, indicating potential overbought conditions in the market. This suggests that recent bullish movements have been aggressive and fast, possibly leading to bearish corrections at the current resistance zone.

Key Levels:

- $68: The most relevant support zone, located at the lower boundary of the lateral channel. Oscillations near this level could reaffirm neutrality and indecision in the WTI market and even reactivate the previous bearish trend.

- $75: A critical resistance zone currently being tested. This level corresponds to the midpoint of the lateral range and could act as support in case of bearish corrections. Sustained movements above this level could confirm a new short-term bullish trend.

- $85: The ultimate resistance, considered the most significant barrier to oil growth in the past two years. A breakout above this level could break the lateral range and establish a much stronger bullish trend.