The crude oil selling resumed on Friday after a two-day respite, although the losses were not as severe as those observed earlier in the week and far less forceful than the drop in metals. This is because a strong jobs report and services PMI data both helped to reduce fears over weakening demand in the US. Still, concerns over China remained and prices resumed lower, with crude oil investors also spooked by the sell-off in other commodities such as copper and silver. In the week ahead, US inflation data and the Fed’s rate decision are the key macro events on the economic data calendar on Wednesday. These have the potential to sharply move the US dollar, which in turn could at least partially impact the crude oil forecast.

Why did all major commodities fall on Friday?

Well, we saw a big dollar rally, and that was at least partly why buck-denominated commodities all dropped. The trigger was a much stronger-than-expected headline jobs growth, even if it was boosted by part-time jobs. However, metals were already under pressure before the release of the jobs report, amid concerns that Chinese demand for industrial metals is not as high as the market had anticipated, with stockpiles of copper surging. Meanwhile, the People’s Bank of China did not add any more gold to its reserves in May, ending a run of 18 months that had helped push gold to repeated all-time highs. This pressurised precious metals and added to the bearish price action in the commodities complex.

What has been driving oil prices recently?

Oil prices have been driven lower primarily due to demand concerns and surging non-OPEC supply. On the latter point, according to the International Energy Agency (IEA), there is ‘substantial surplus’ of oil this year, thanks in large part to the growth in US shale. On the former point, it is the consistent weakness in the manufacturing data from around the world that has brought demand concerns to the forefront of investors’ minds. These concerns intensified in early parts of last week when crude oil slumped to its lowest level since February, after weak US factory data triggered a sell-off.

Meanwhile, the OPEC + failed to underpin oil prices, as the decision to extend the output cuts were already factored into oil prices. There were concerns over the OPEC+ decision to eventually phase out the voluntary output cuts at a time when non-OPEC supply is on the rise.

However, these concerns might be mostly priced in by now, which should mean that the selling could at least slow or even reverse to buying pressure, especially now that we are in the middle of the US driving season, when demand tends to pick up. So far, however, we haven’t seen any concrete bullish reversal signs.

Crude Oil Forecast: Technical Analysis

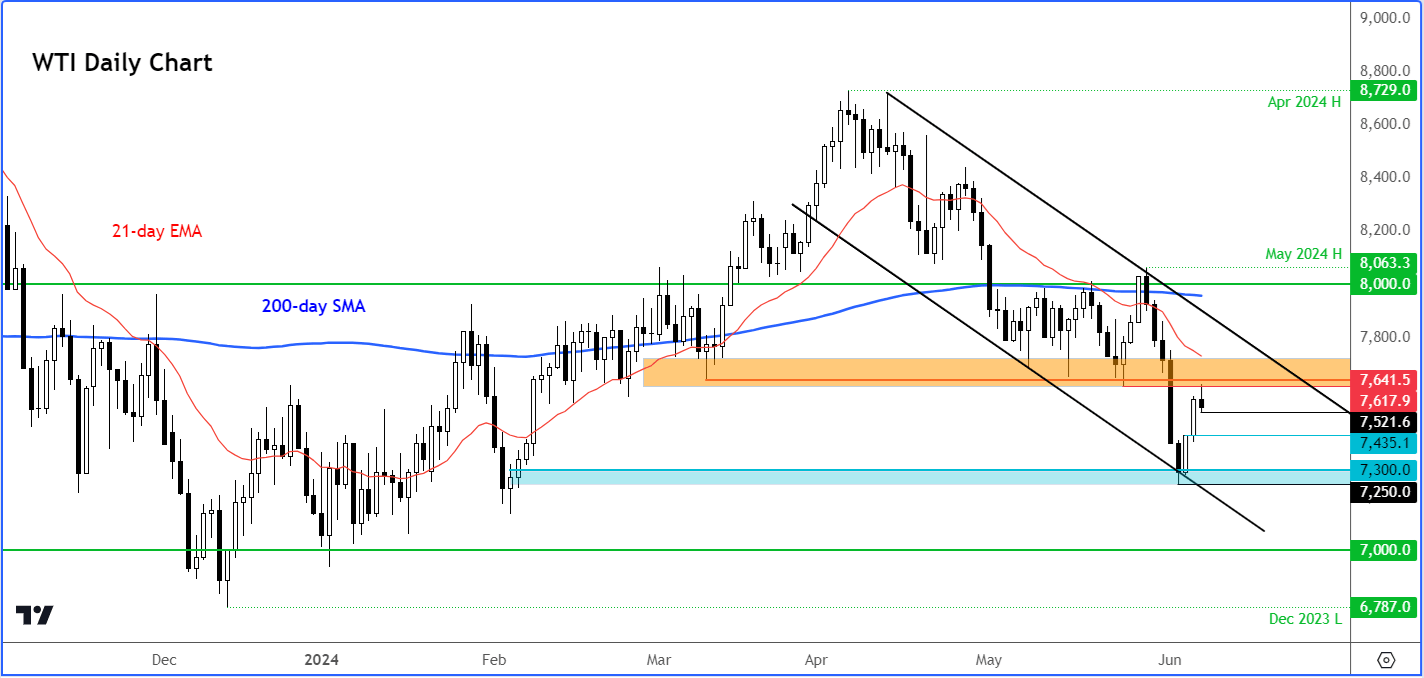

The drop in oil prices have left behind a clean resistance level to watch for future references, between $76.00 to $76.50 area on WTI. This area was tested on Friday and held. It is going to be the most important resistance area to watch in the week ahead and for as long as prices remain below here, the bearish trend would not change. We have already seen an oversold bounce in the previous week, so a drop back towards the support trend of the bearish channel cannot be ruled out in early parts of the week. This comes in around the $73.00 mark or slightly below it. WTI has been stuck inside a bearish channel since prices peaked in April. The next major support level below the support trend of the bearish channel is at $70.00, followed by the December low at $67.87.

But if WTI manages to reclaim the old broken support area between $76.00 to $76.50, then that would be a bullish sign, in which case one should expect to see some follow-up technical buying towards the top of the bearish channel, between $78.00 to $79.00 area.

For more updates on the crude oil forecast, stay tuned to our latest market insights.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R