The crude oil market has been facing heightened concerns, with weak demand data and increasing bearish sentiment among investors. Crude oil forecasts are becoming more pessimistic, driven by a combination of rising supply, weak economic indicators from key regions like China, and ongoing challenges in the global market. In this article, I will briefly break down these concerns and discuss their impact on the crude oil forecast, before turning our focus to technical factors influencing short-term price movements.

Demand Concerns Amid Weak Economic Data

Last week, US oil prices managed a small gain, breaking a four-week losing streak, thanks largely to disruptions caused by hurricanes. However, the overall crude oil forecast remains under pressure. Brent oil prices closed down for a fifth consecutive week, pointing to a bearish market despite the brighter start to this week’s trading. Investor concerns about weakening demand, especially from China, have intensified following a slew of negative data from the world's second-largest economy released over the weekend.

The major issue for crude oil investors is that demand growth may not be strong enough to offset the expected rise in supply. Both the International Energy Agency (IEA) and OPEC lowered their demand growth forecasts last week, reflecting weaker data from key economic regions such as China and the Eurozone. As a result, crude oil is likely to remain under pressure in the near term.

China’s Economic Woes Weigh on Crude Oil Forecast

A closer look at China’s latest economic data reveals why demand concerns are mounting. Industrial production in China grew at an annual pace of 4.5% in August, below the 4.7% expectation and down from 5.1% in July. Fixed asset investment growth also dropped to its lowest level this year at 3.4% year-on-year, below the expected 3.5% figure. In addition, new home prices fell by 0.73% month-on-month, marking the steepest decline so far in 2024.

China’s crude oil data paints a similarly gloomy picture. Chinese refiners processed approximately 12.6 million barrels per day (b/d) in August, marking a near 10% month-on-month decline. Apparent oil demand in China fell below 12.5 million b/d, its lowest level since August 2022. These factors continue to weigh heavily on the crude oil forecast, particularly as China’s crude oil inventories surged by 3.2 million b/d in August, the largest monthly build since 2015.

Supply-Side Concerns: Rig Counts on the Rise

While demand concerns dominate the current market landscape, rising supply also poses a significant risk to the crude oil forecast. OPEC+ recently delayed a planned oil output hike, but future increases remain uncertain, especially as the group seeks to avoid losing market share to US shale producers. In the US, Baker Hughes reported that the oil rig count rose by five last week, reaching a total of 588—the highest number since June.

Although this uptick in drilling activity could lead to more supply, it may not be sustainable given the recent price declines. Rising supply without a corresponding increase in demand could further weaken the crude oil forecast in the coming months.

Speculators Turn Bearish

The growing concern over weak demand has led speculators to adopt an increasingly bearish stance on the oil market. Recent positioning data reveals that speculators sold off 54,325 lots of ICE Brent, leaving them with a net short of 12,680 lots. This marks the first time in recent history that speculators have held a net short position in Brent, driven by both long positions being liquidated and new short positions being established.

The combination of bearish sentiment and negative market fundamentals is casting a long shadow over the crude oil forecast, as traders anticipate further downside risks.

WTI Technical Analysis: The Bearish Trend Continues

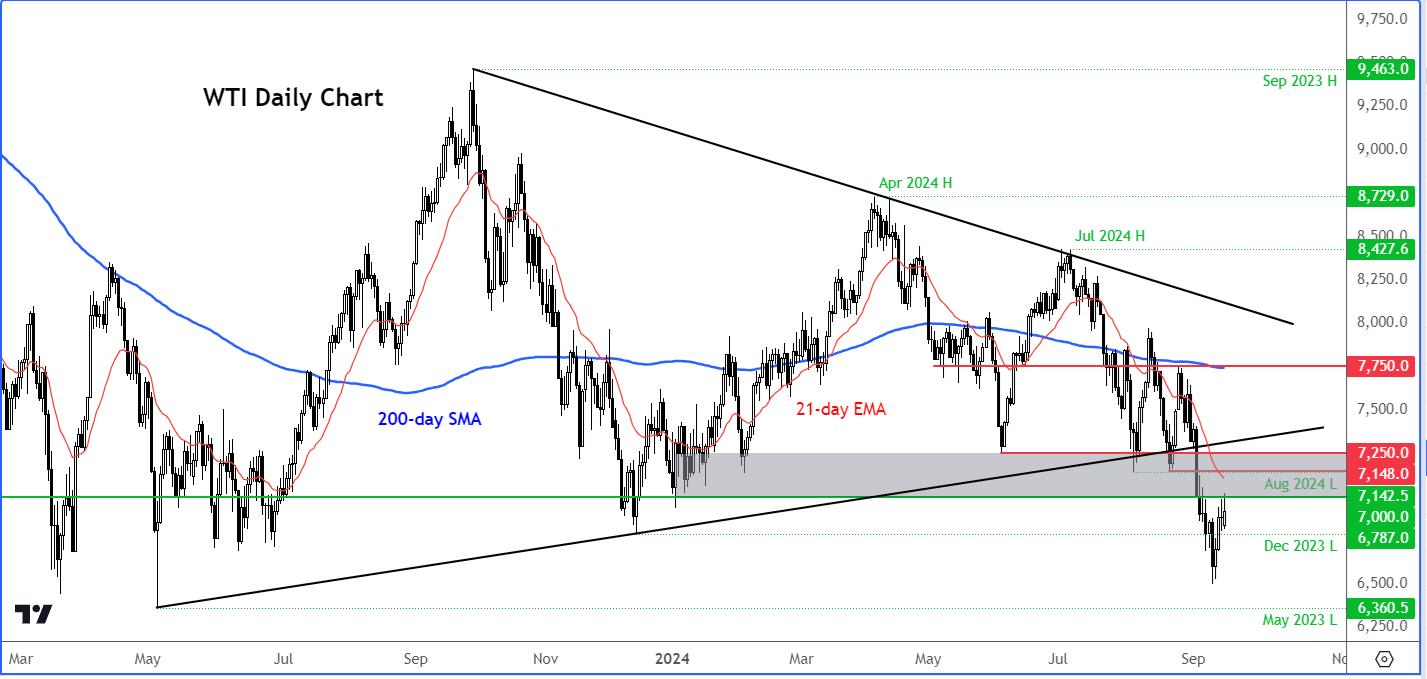

From a technical standpoint, West Texas Intermediate crude oil has been forming a series of lower highs and lower lows in recent weeks. The 21-day exponential moving average has dipped below the 200-day simple moving average, and both have taken on negative slopes. This indicates that the market is in a bearish trend.

Short-term resistance is seen around the $70 handle now, which was previously a key support area. Above this level, $7150 and then $7250 are the next potential areas of trouble for oil. WTI therefore faces several hurdles from here on, which may limit its upside potential. On the downside, liquidity resting below last week’s low of $64.95 is the next bearish objective, followed by the May 2023 low of $63.60.

So, the path of least resistance still appears to be downward despite the positive start to this week’s trading. Until there is a clear reversal in the technical indicators, it makes more sense to fade short-term rallies rather than attempting to catch a bottom. The crude oil forecast remains negative until proven otherwise by the charts.

Conclusion: Crude Oil Forecast Outlook

Source: TradingView.com

The overall crude oil forecast remains clouded by weak demand, particularly from China, and rising supply pressures. As speculators turn increasingly bearish and technical signals point to further downside, oil prices could continue to face headwinds in the near term. Investors and traders should remain cautious, with a focus on key economic data releases and OPEC+ policy decisions that could shape the future direction of crude oil prices.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R