Oil prices fell for the third consecutive day before bouncing off their lows late in the session. The weakness was driven at least partially by the general risk off trade observed in the European session, with major indices all trading lower. Some of the oil price softness can also be attributable to a less damaging US hurricane than feared. Recent softness in global data has weighed on oil investors’ expectations about the level of demand growth. Yet, some oil forecasters like the Energy Information Administration (EIA) continue to envisage higher oil prices, thanks largely to lower output growth. We also share this view and reckon oil prices are heading further higher in H2 as the market tightens. Our crude oil forecast thus remains bullish.

Hurricane less damaging than feared

Crude oil prices dropped after Hurricane Beryl hit a big oil-producing area in Texas, causing less damage than people thought it would. Even though there were slowdowns in refining and evacuations at production sites, the major refineries along the US Gulf Coast said they were hardly affected by the hurricane.

Crude oil forecast: EIA raises oil price forecasts, lowers production forecast

- EIA raised 2024 WTI price forecast to $82.03 per barrel from prior forecast of $79.70, raising 2025 forecast to $83.88 from $80.88.

- EIA lowered forecast for 2025 world oil production by 100,000 barrels per day; now expects output to grow by 2.2 million bpd

- EIA lowered forecast for 2024 world oil production by 200,000 barrels per day

- EIA keeps forecast for 2025 US oil demand unchanged at 20.6 million bpd

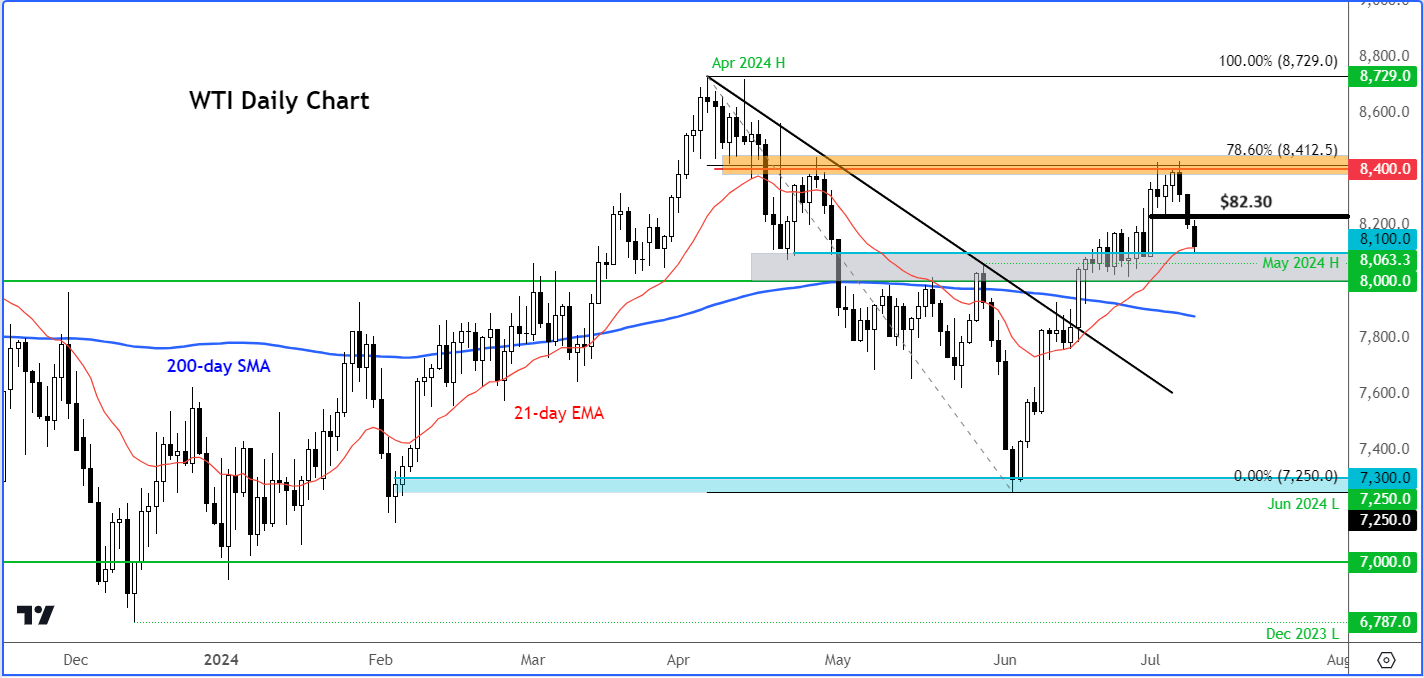

Crude oil forecast: WTI technical analysis

WTI has fallen about 3.5% or about 3 dollars in as many days. Yet, the technical outlook has not yet change materially, for we are yet to see a lower low to confirm prices have peaked. If anything, the drop to around $81.00 today means WTI has now entered the upper end of its key support range between $80.00 to $81.00. Here, we could see a rebound as short-term oscillators flag oversold conditions. In addition, the 21-day exponential moving average, which has been pointing higher, comes into focus here around the $81.00 area. Thus, we could see an oversold rebound at the very least. But the potential is there for oil prices to regain their poise and head higher again.

With interim support at $82.30ish broken, this level is now the most important short-term resistance to watch in case we see a recovery in oil prices later on in this session or week. A daily close back above this level would put the bears in a spot of bother, potentially paving the way for a break above the key $84.00 resistance level.

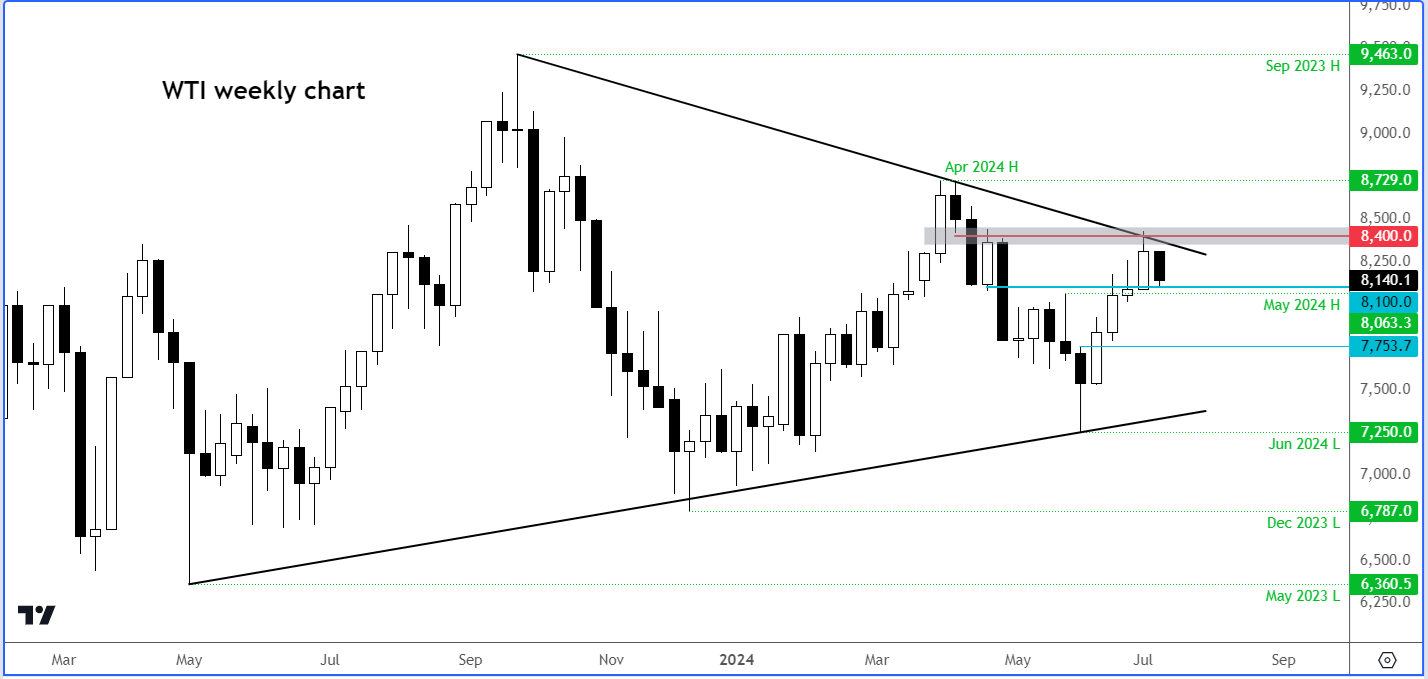

Indeed, $84 is a key resistance level, when you observe the higher time frame charts, like the weekly:

As you can see, WTI has found stiff resistance around the $84.00 level, where a resistance trend going back to September 2023 high comes into play. This was always going to draw some sellers into the market given that oil prices had been rising for 4 weeks and thus a little overbought. Now that some froth has been removed, prices may well resume higher. It is essential though that support around the $80-$81 area holds to maintain its bullish technical WTI forecast intact. If resistance at $84.00 eventually gives way, then the April high at $84.29 will come into focus next.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R