Crude Oil Technical Forecast: WTI Weekly, Daily & Intraday Trade Levels

- Oil prices erase October rally- plunge nearly 15% off monthly high

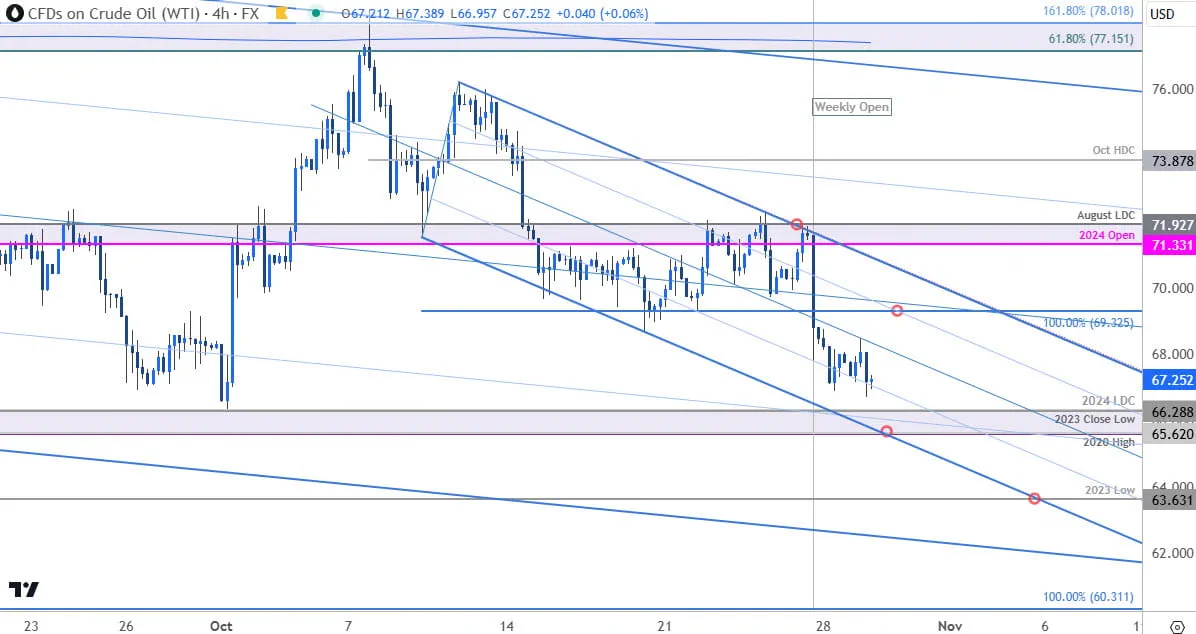

- WTI approaching key support at yearly lows into monthly cross- risk for price inflection

- Resistance 69.32, ~70.40s, 71.33/93 (key)- Support 65.62-66.31 (key), 63.63, 59.16-63.31

Crude oil prices have pared the entire October rally with WTI plunging more than 14.9% off the monthly high. The sell-off takes oil back towards key technical support at the yearly lows and the focus is on a possible price inflection off this zone in the days ahead. Battle lines drawn on the weekly, daily, and 240min WTI technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this crude oil setup and more. Join live on Monday’s at 8:30am EST.Oil Price Chart – WTI Weekly

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

Technical Outlook: In my last Oil Price Forecast, we noted that WTI had turned from confluent resistance and that we were on the, “lookout for an exhaustion low in the days ahead. From a trading standpoint, losses should be limited to 70.29 / the lower parallel IF price is heading higher on this stretch with a close above 78 needed to mark resumption.” Oil prices plunged through support later that week with a close below the objective yearly-open once again approaching critical support at 65.62-66.31- a region defined by the 2020 swing high, the September low-day close (LDC), the 2023 close low, and the objective monthly low. We’re on the lookout for a possible reaction into this threshold IF reached in the days ahead.

Oil Price Chart – WTI Daily

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

A look at the daily chart shows WTI trading within the confines of a descending pitchfork extending of the July high. Note that the 25% parallel converges on the 65.62-66.31 support zone and further highlights the technical significance of this region into the close of the month. A break / close below this threshold exposes subsequent support objectives at the 2023 low at 63.61 and the 2020 high-week close (HWC) / 100% extension of the 2023 decline at 59.16-60.31- look for a larger reaction there IF reached.

Oil Price Chart – WTI 240min

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

A closer look at oil price action shows oil trading within the confines of an embedded pitchfork with the lower parallel again highlighting key support. Initial resistance is eyed at the 100% extension of the monthly decline at 69.32 backed channel resistance (currently ~70.40s). Rallies should be limited to the yearly open / August low-day close at 71.33/93 IF oil is heading lower on this stretch. Broader bearish invalidation now lowered to the October high-day close (HDC) at 73.88.

Bottom line: The oil sell-off is approaching key technical support into the yearly lows and while the broader outlook remains weighted to the downside, the immediate decline may be vulnerable into this confluence zone. From at trading standpoint, look to reduce short-exposure / lower protective stops on a stretch towards 65.62-66.31- rallies should be limited to the yearly open IF price is heading for a break lower with a close below this key pivot zone needed to fuel the next major leg in price.

Keep in mind that the ongoing turmoil in the Middle East remains a significant risk on the geopolitical side here with the key US inflation data and NFPs on tap into the November open. Stay nimble into the monthly cross and watch weekly close here for guidance.

We’ll review these charts in-depth in the Weekly Technical Outlook Webinar on Monday morning.Active Weekly Technical Charts

- Canadian Dollar (USD/CAD)

- Euro (EUR/USD)

- British Pound (GBP/USD)

- US Dollar Index (DXY)

- Australian Dollar (AUD/USD)

- Gold (XAU/USD)

- Japanese Yen (USD/JPY)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex