Article Outline

- Key Events: Chinese Metrics, Inventories, and the Fed

- Technical Analysis: USOIL 3-Day Time Frame (Log Scale)

- Technical Analysis (TA) Tips: Chart and RSI Patterns

Intro

The 2025 uptrend has driven oil prices to the $80 mark, reaching 6-month highs. This rise is supported by many factors including inventories, Fed rate expectations, and geopolitics.

Geopolitical Update

Recent developments in the geopolitical landscape have added complexity to oil supply dynamics:

- The U.S. has imposed expansive sanctions on Russia’s oil industry and exports, further complicating the operations of shadow fleets

- These sanctions threaten to disrupt oil supply flows, heightening market uncertainty

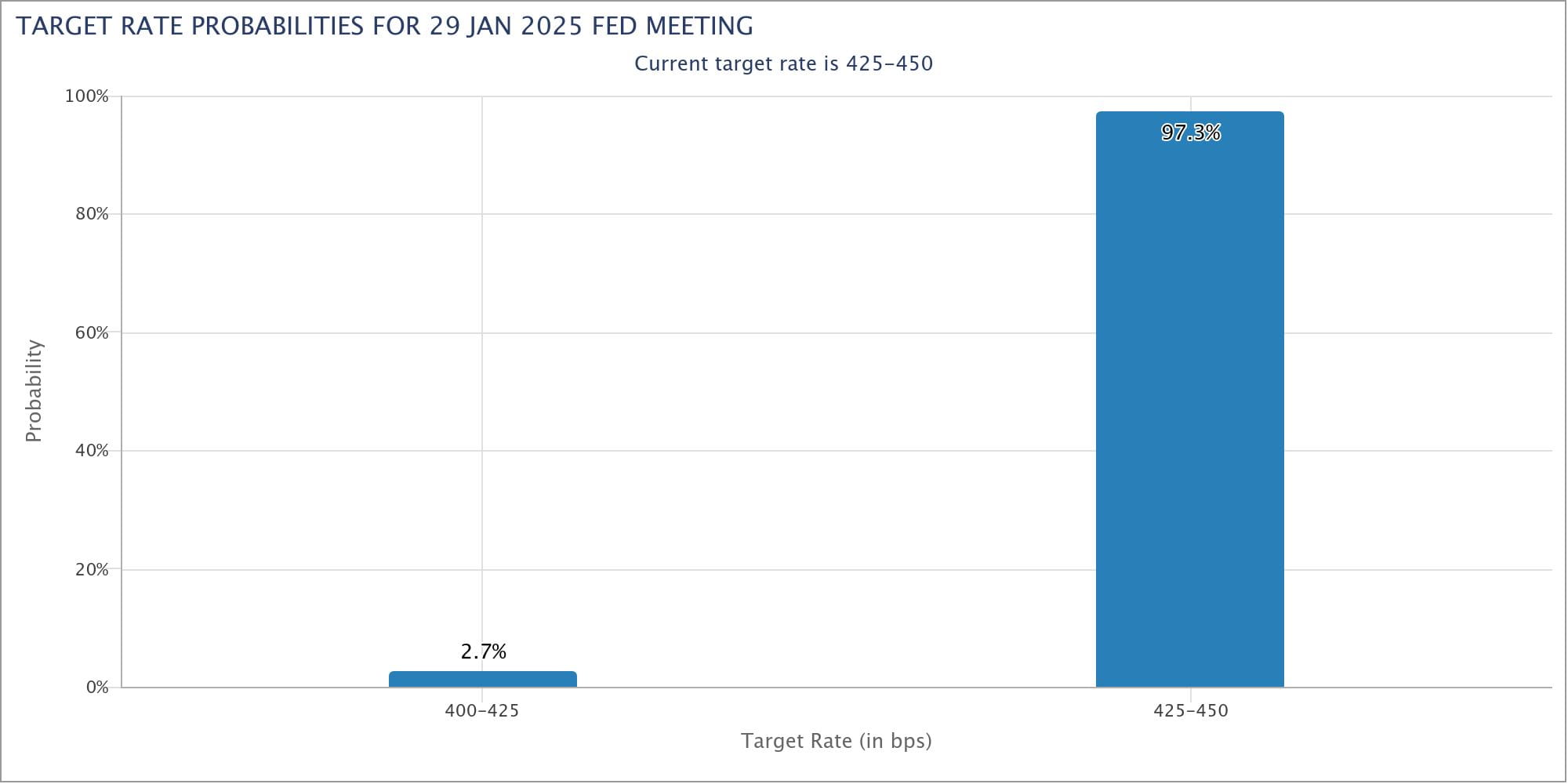

Fed Rate Expectations Update

Source: CME Fed Watch Tool

December’s U.S. inflation reports revealed a decline in both core PPI and CPI to 6-month lows. Core PPI dropped to 0.0%, while core CPI eased to 0.2%. However, monthly and annual CPI showed a slight uptick, keeping January’s FOMC rate hold expectations at 97%.

In the context of the oil market, the Fed’s rate hold dampens hopes for further economic stimulus, which could, in turn, weigh on oil demand growth.

Chinese Economic Update

China’s latest data has reinforced oil’s positive trajectory:

- New Loans: Rose from 580B to 990B, reaching 3-month highs

- Trade Balance: Surged to a 10-month high with a surplus of 753B

However, the sustainability of this uptrend remains in question, as Chinese exports face challenges from anticipated higher U.S. tariffs under the upcoming Trump administration. Key Chinese data to watch this week includes GDP, industrial production, retail sales, and FDI reports, all scheduled for Friday. These metrics will provide further insight into China’s economic strength and its impact on commodity demand.

Technical Analysis: Quantifying Uncertainties

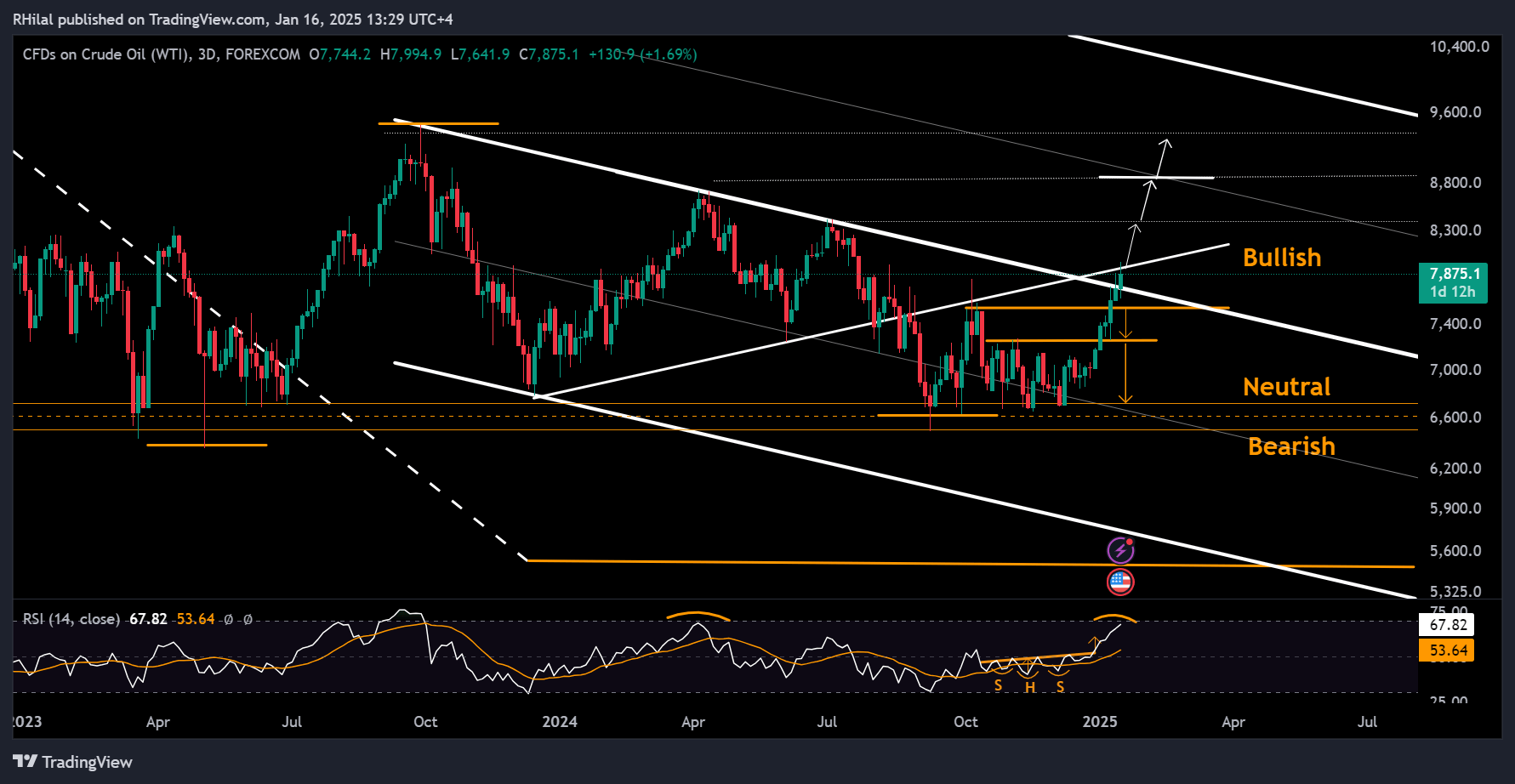

Crude Oil Forecast: 3Day Time Frame – Log Scale

Source: Tradingview

Following inventory declines, rising winter demand, and Chinese market advancements, oil’s uptrend broke above the upper border of its descending triangle. Prices are now retesting resistance near the lower border of a year-long triangle at the $80 mark.

The Relative Strength Index (RSI) has climbed toward overbought levels, last observed in April 2024, when oil peaked at $87.20 before retreating to $68. Crude oil is now one resistance level away from a bullish breakout, marked by the lower boundary of the respected triangle pattern spanning September 2023 to August 2024.

Scenarios

Bullish Scenario: A firm close above the $80 mark could extend gains toward resistance levels at $84 and $88.

Bearish Scenario: Dropping back into the down-trending channel and below the $78 level, which now serves as support, could trigger declines toward $75.50, $72, and $68.

Technical Analysis (TA) Tip: Chart and RSI Patterns

Two key patterns stand out on the crude oil chart:

1. Triangle Pattern: The boundaries of the triangle continue to shape oil’s price trend.

2. RSI Inverted Head and Shoulders: This continuation pattern on the RSI supported the bullish trend toward recent highs. With current resistance and overbought conditions, a reversal is possible unless a bullish breakout above $80 is confirmed.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves

On You tube: Forex.com