- Corrective rebound in commodity prices extends on Monday

- Copper finds buyers at the intersection of two technical support levels

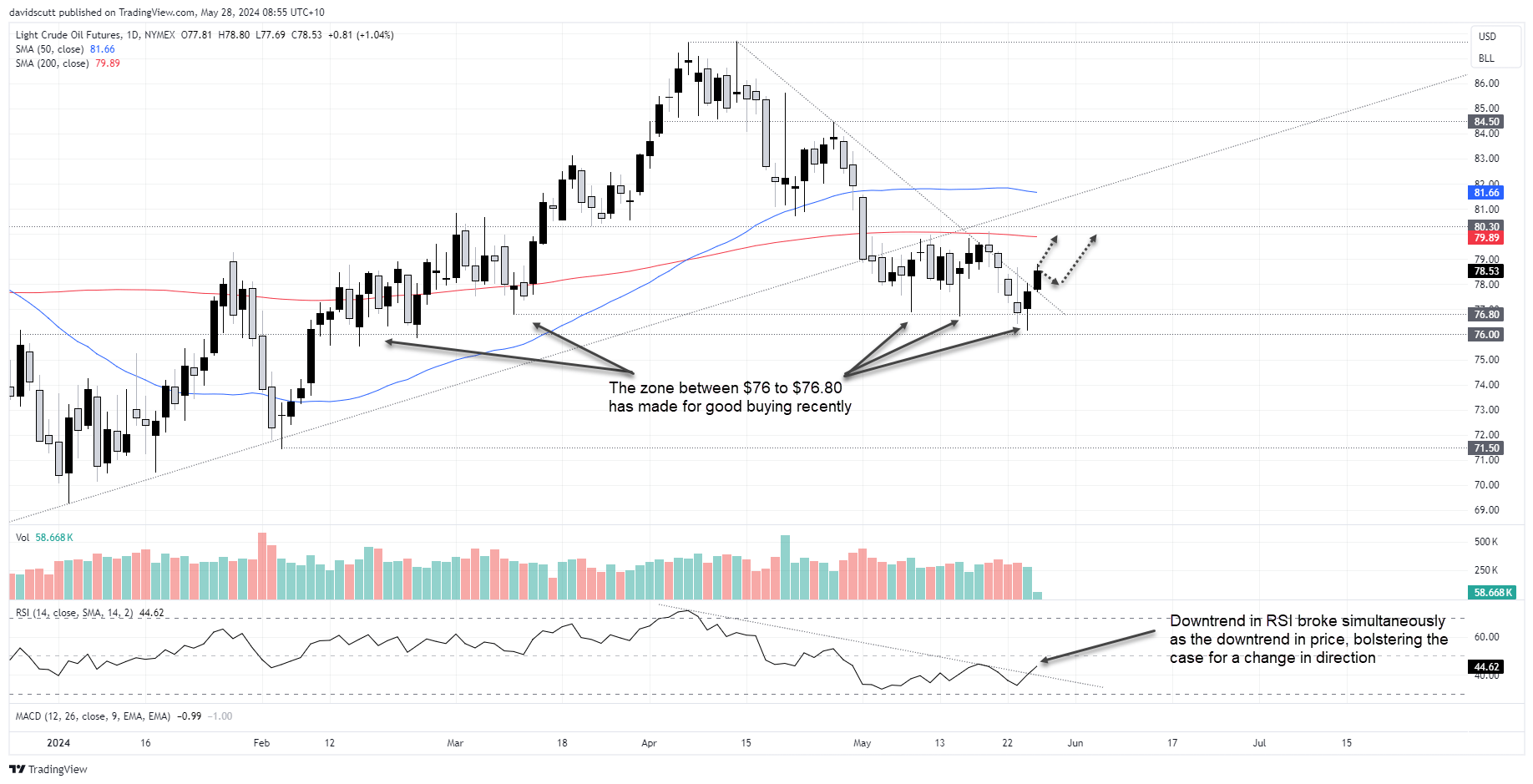

- Buying dips in WTI crude oil below $76.80 has been fruitful

Commodities bounce in holiday trade

The rout in commodity prices didn’t last long, as expected, with dip buyers emerging late last week to take advantage of better entry levels. Crude and copper look particularly constructive following the recent bounce.

With almost no new fundamental news to look at with public holidays in the United States and United Kingdom to start the week, traders are having to lean heavily on price action and sentiment for direction.

Copper buoyed by bullish forecasts, technicals

For copper, despite Chinese smelters continuing to churn out product at near record rates, sentiment remains extremely elevated, helped by bullish forecasts from prominent investors such as Jeff Currie, former Global Head of Commodities Research at Goldman Sachs.

The price action has turned positive on COMEX recently, bouncing strongly from the intersection of horizontal support at $4.746 and uptrend dating back to early April. While low volumes underpinned the move, typically a sign that warrants caution, that reflects public holidays in the United States and United Kingdom. Importantly, the rebound is consistent with the broader trend seen this year.

Considering the price action, buying dips is preferred to selling rallies in the near-term. For those keen to follow suit, any pullbacks towards $4.77 would provide a decent entry point, allowing for a stop loss to be placed either below the uptrend or horizontal support at $4.746.

Potential trade targets include $5.02 or the record high of $5.20 set last week. In between, resistance may be encountered around $4.852, where the price did work either side of earlier in May. Should no dip be forthcoming, traders could consider buying a break of $4.852 with a stop loss order below for protection. Trade targets would be the same as those mentioned above.

WTI bears unwilling to take on the 200-week MA

As flagged in a trade idea late last week, buying WTI crude oil below $76.80 proved yet again to be a solid trade with the price rebounding strongly either side of the weekend. While volumes have been weak, again reflecting key markets being closed for public holidays, the latest bounce has taken WTI through downtrend resistance dating back to the highs struck in April. With RSI breaking its downtrend simultaneously, the bearish picture looks to be shifting more positively.

Following the downtrend break, traders looking to initiate longs could buy at these levels targeting a move back to the 200-day moving average, although the preference would be to look for a pullback below $78 to improve the risk-reward of the trade. A stop loss below Monday’s low around $77.70 would offer protection against reversal.

Near-term, any indication of gasoline demand in the US over the Memorial Day long weekend could be influential on both upstream and downstream prices before key inflation data is released in the US on Friday, the latter likely to set the tone for the US dollar and US interest rate outlook into early June. From there, attention will be on the virtual OPEC+ meeting held on June 2 where it’s expected the cartel will extend existing supply curbs.

-- Written by David Scutt

Follow David on Twitter @scutty