West Texas Intermediate (WTI) crude oil was slightly off its best levels but remained on track to close higher for the fourth consecutive week as of late Friday. This crude oil analysis highlights that the rally continued despite a mixed US jobs report US jobs report, which weakened the dollar and left investors uncertain about the health of the US consumer and oil demand. This comes after a large 12.2-million-barrel drawdown in US oil stocks we saw in mid-week. That helped to reduce demand concerns that had been highlighted by weakness in factory data in the US and Germany. In the week ahead, investors will want to keep an eye on inventories data to see whether the most recent drop was just an anomaly or whether more oil will be drawn from inventories. If we see more drawdowns, then this should further support the oil price recovery. In addition, we will have some key US data in the form of CPI and UoM Consumer Sentiment to look forward to.

Crude oil analysis: technical factors and levels to watch

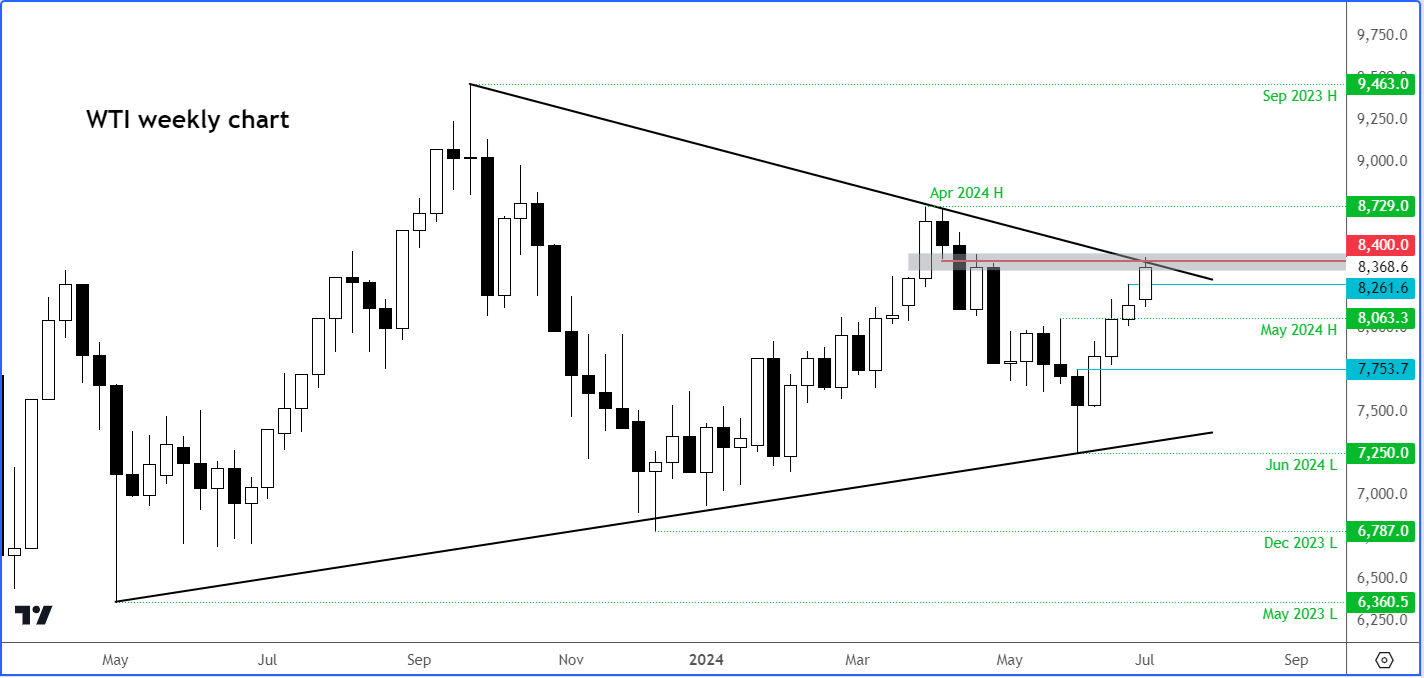

WTI has now reached a key resistance area circa $84.00. Here, a bearish trend line going back to September 2023 comes into play. A potential breakout could be on the cards, should the market become more confident next week about a tighter oil market in H2. A clean breakout above $84.00 could target the April high at $87.29 next. Support comes in at $82.61, which marks the previous week’s high, followed by May’s high at $80.63.

Source: TradingView.com

Crude oil analysis: A word or two on US presidential race and oil prices

We all know Joe Biden was anti-oil, promising to end drilling on public lands and under his leadership in the first 18 months in office, the smallest amount of public land for drilling was leased since the early 1950s. Yet, production of oil hit a record, and outpaced the Trump administration in approving new drilling permits. So, his mixed-bag policies does worry some climate-centric voters, something which the next Democratic leader will want to address in their election campaign if Biden were to drop out of the 2024 presidential race. That may boost the party’s chances of winning the election as oil-supporter Trump is leading currently in the polls. So, the reaction of oil should be a positive one if the odds of another Democratic US president rises as a result of Biden dropping out.

Conclusion

In summary, WTI crude oil's performance remains robust despite mixed economic signals. Key technical levels and inventory data will be crucial in determining the short-term direction of oil prices. Additionally, the political landscape in the US, particularly the presidential race, could significantly influence future oil price movements. Investors should stay informed about these factors to navigate the volatile crude oil market effectively.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R