Crude oil analysis: It is all about Middle East conflict now, when it comes to oil prices. The extent of Israel's potential response to Iran will influence how much further geopolitical risk markets are likely to factor in. Crude oil could rise another $5 in the next few days if we see further escalation in the conflict. While markets await response from Jerusalem, prices are likely to maintain much of Tuesday’s gains. That said, for as long as there are no actual disruptions in supply, ongoing demand concerns and expectations the OPEC will slowly return withheld supplies back into the market should keep the upside limited.

Crude oil analysis: What will be Israel’s response?

The escalation in the Middle East has pushed markets to price in an increased risk of a broader conflict in the region, possibly involving the US in some form. At least that is what markets fear right now, after Iran launched missiles at Israel last night. Though the US called the attack "ineffective," some targets were reportedly hit, and Israel has vowed to retaliate while ground operations in parts of Lebanon continue.

There is a situation where even if Israel responds, oil prices could fall, nonetheless. For example, if Israel’s retaliation is a measured one, like last time, and avoids strikes on Iran’s nuclear facilities. This potential response may be interpreted by traders as both nations opting to de-escalate tensions.

However, if Israel lures in the US in its fight, or responds with an even bigger attack this time, then watch out for oil prices to potentially sky rocket.

Crude oil analysis: How should traders approach oil?

Given the uncertainty over Israel’s potential response, and the subsequent repercussions that may arise, crude oil is subject to heightened volatility in the coming days. Traders will want to avoid excessive risk-taking and always ensure that some form of protection is considered – whether that means being flat on oil, guaranteed stops, or other forms of risk management. On an intraday basis, taking it from one level to the next may reduce P&L variability.

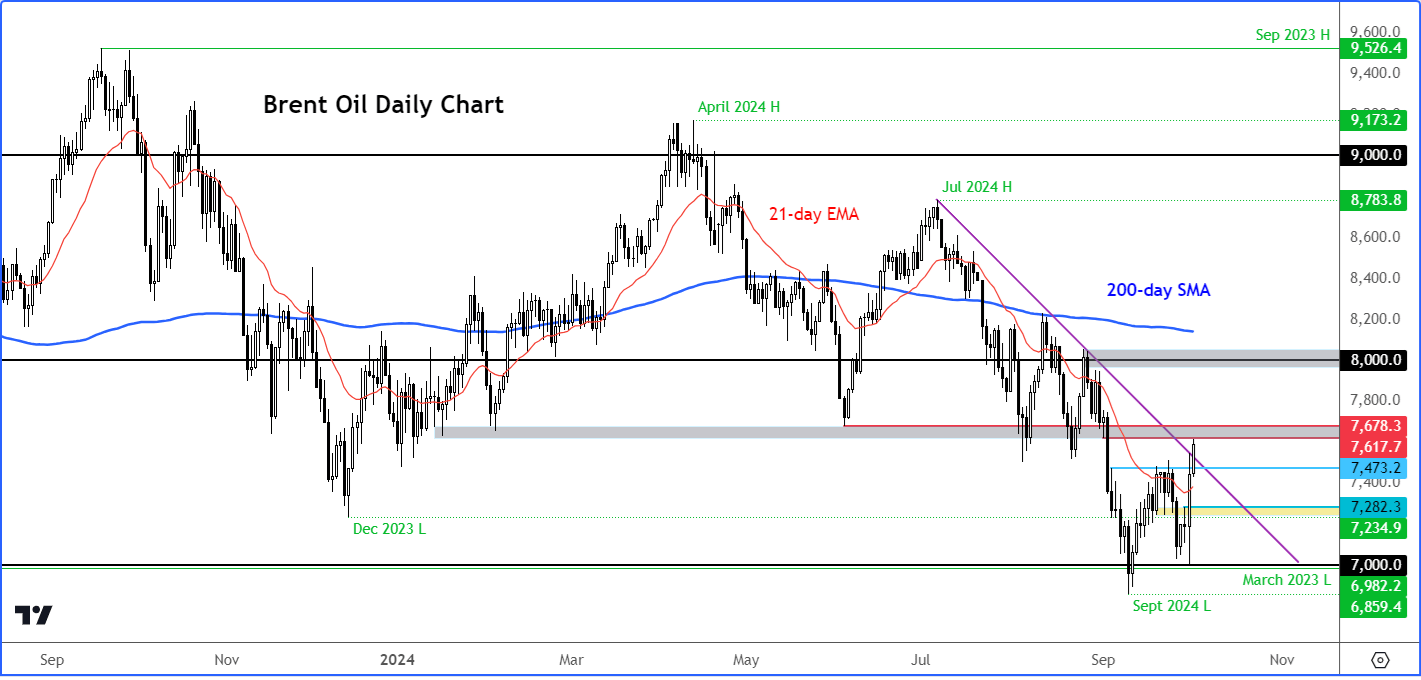

Brent technical crude oil analysis

After the big upsurge on Tuesday, we are seeing some further upside so far in today’s session as investors await Israel’s response to Iran’s attacks. The Brent contract has now broken above its bearish trend line that had been in place since prices peaked in July. This is technically a bullish sign – but only if it can sustain the breakout.

Source: TradingView.com

The fact that the upward move has been headline-driven, makes me a bit wary of a potential false break scenario – particularly if we see a quick de-escalation in the conflict. But from a purely technical point of view, the fact that we are seeing some rising prices is a positive sign for the bulls, especially with the low being formed around the round $70 handle.

At the time of writing, Brent was testing prior support area between $76.15 to $76.80 area. A close above this range would provide some more confirmation that prices have potentially formed a low.

In terms of support, the area around $74.70ish marks the first line of defence for the bulls, followed by the point of origin of this week’s breakout around the $72.80 zone. All bullish bets would be off again should we get a decisive close back below this level.

So, our crude oil analysis is that the near-term outlook is far from certain, and a lot will depend on Israel's response now. Traders should therefore try to mitigate risk as much as possible and remain nimble when trading crude oil.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R