Anticipated declines in demand and increased supply statistics have implied bearish pressures over oil charts. U.S Crude Oil inventories reported a positive change of 7.3 million barrels yesterday, while major oil exporters continue to disregard OPEC’s agreed upon supply cut quota. Amidst these market dynamics:

-

Saudi Aramco Base Oil is trading near its yearly lows.

-

USOIL is trading nearly halfway down its yearly trend.

Investor expectations lean towards further supply cut quotas at the OPEC meeting on June 1st

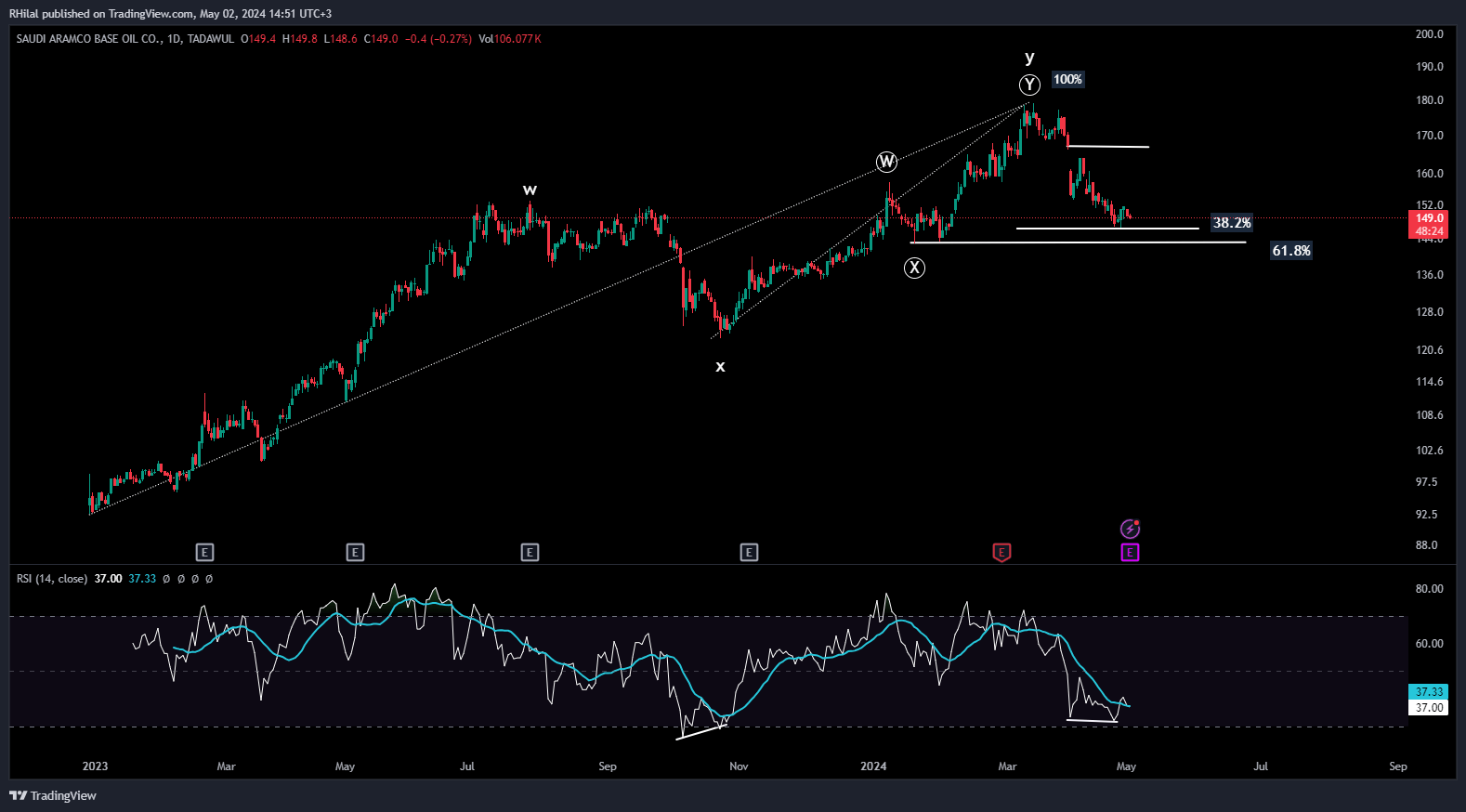

Saudi Aramco Base Oil – Daily Time Frame – Logarithmic Scale

The latest downturn in Saudi Aramco’s chart is testing the 0.382 Fibonacci retracement level of the chart’s uptrend trajectory since December 2022 at 146.6. A further downward movement is projected to potentially find support at the year’s low at 142.8, coinciding with the 0.618 retracement of the chart’s uptrend since October 2023. From a relative strength index perspective, a positive divergence with the price chart near the oversold zone suggests a potential bullish reversal.

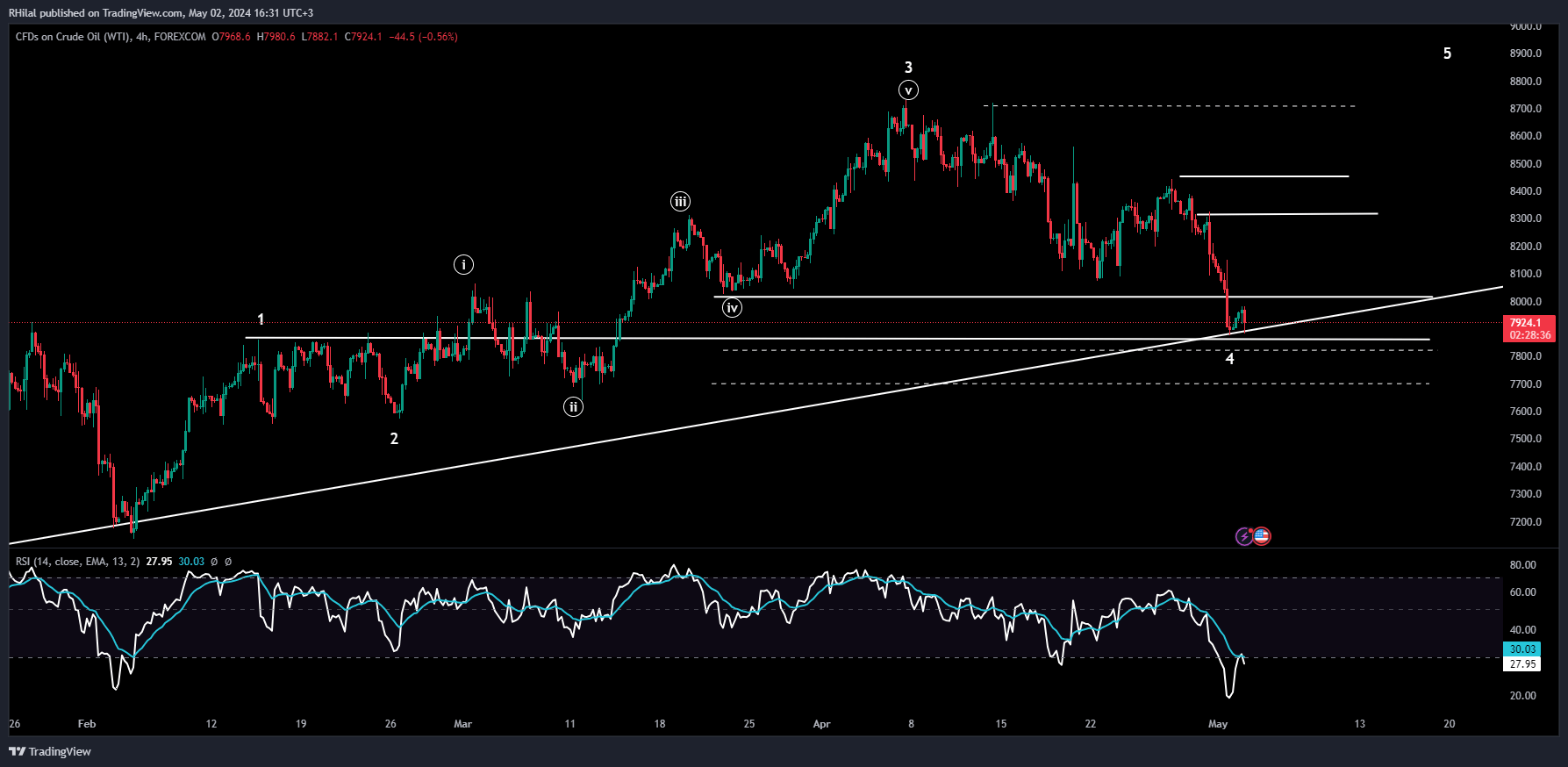

WTI Crude Oil – 4H Time Frame – Logarithmic Scale

After a bearish spiral driven by fears of economic growth and demand outlook, crude oil dropped below the 80 zone and reached the 78.77 low, near the wave one high of 78.61. The subsequent high is considered crucial for the traced Elliott wave, with a downward break potentially invalidating the count towards a different pattern with potential supports near the 78.20 and 77 zones. The relative strength index is rebounding from the oversold zone, indicating an upward movement above its smoothing average line. A rebound from the recent low can meet resistance levels near the 80.20 crucial zone and 82 in the short term. A break above the 84.60 level would confirm bullish momentum, potentially leading to oil’s uptrend towards resistance levels near 86 and 89, respectively.