Over the past few days we have seen a host of data from China miss the mark and revive fears of a global slowdown. New bank loans in July were less than a quarter seen in June with job concerns, a property crisis and rise in COVID cases saw companies reluctant to take on fresh debt. And credit demand is expected to remain weak against the current backdrop of concerns. Retail sales fell to 2.7% y/y and investments hits a YTD low. Homes prices also fell for an 11th consecutive month. And this is despite M2 money supply rising to a 6-year high of 12%. As the saying goes - you can lead a horse to water, but you can’t make them drink it.

The data prompted the PBOC (People’s Bank of China) to unexpectedly cut their 1-year and 7-day lending rates by 10 basis points. However, it is debatable as to whether these cuts will have their desired effect, given credit demand is low due to fears of a slowdown.

A risk-off session endued yesterday, with metals, oil and commodity currencies all pointing lower. A bearish engulfing day formed on gold, roll over from 1800 and close beneath key support at 1783. WTI briefly fell to its lowest level since February, and its downtrend form the June high suggests a bearish breakout is soon approaching. JPY and USD were the strongest majors as they attracted safe-haven flows. Yet Wall Street looked past these concerns and continued higher, as equity traders focussed on the deflationary aspect of this weak data – which means the Fed may be reluctant to hike interest rates so aggressively.

Read our guide on the PBOC (People's Bank of China) and inflation

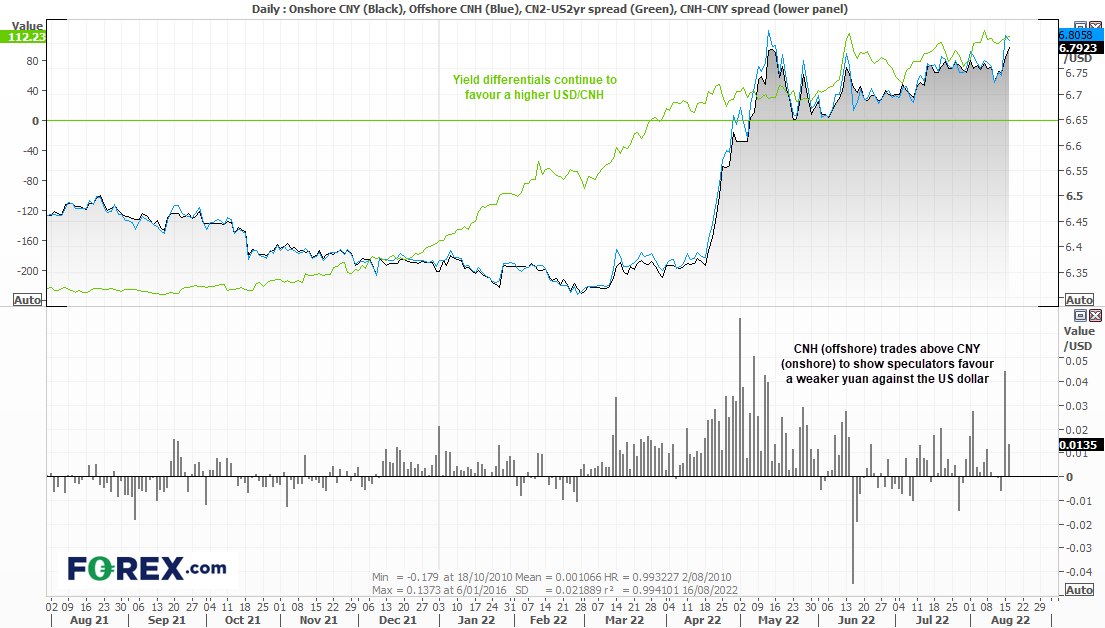

Speculators appear to favour a higher USD/CNH

A market we’re keeping a close eye on is USD/CNH. Yesterday weas its most bullish day since the pandemic (March 2020) as weak data from China likely means that Beijing could allow their currency to slide to help support the economy. Yield differentials between the US and China also remain supportive of higher prices, and we note that the offshore yuan (CNH) continues to trade at a premium to onshore (CNY), which shows speculators favours UD/CNH to continue higher.

USD/CNH daily chart:

USD/CNH began a strong uptrend on the daily chart in February, although it has been within a sideways consolidation since May. The 50-day eMA has provided support throughout the consolidation, and yesterday’s strong bullish candle confirmed a breakout from a symmetrical triangle. The pattern projects a potential target around 7.000, which is just below a historical resistance level and a 78.6% Fibonacci projection.

How to trade with FOREX.com

Follow easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.