View the latest commitment of traders reports

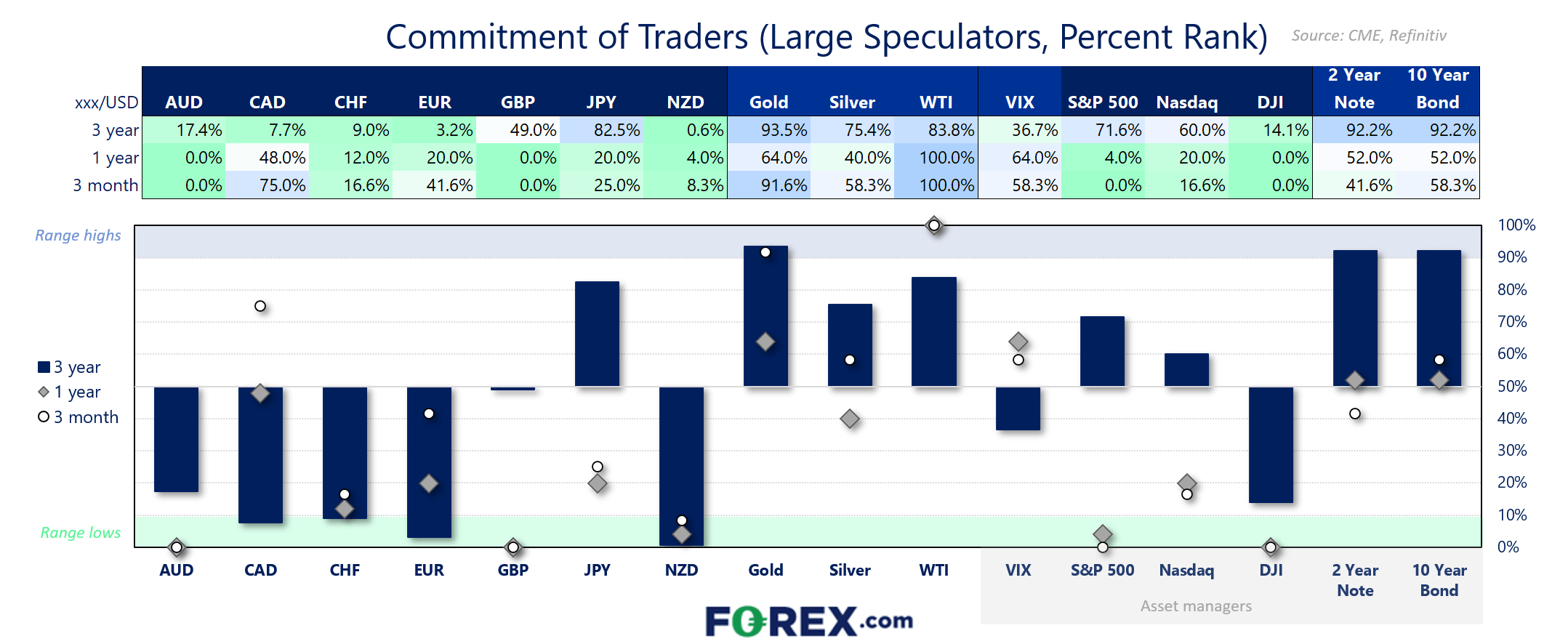

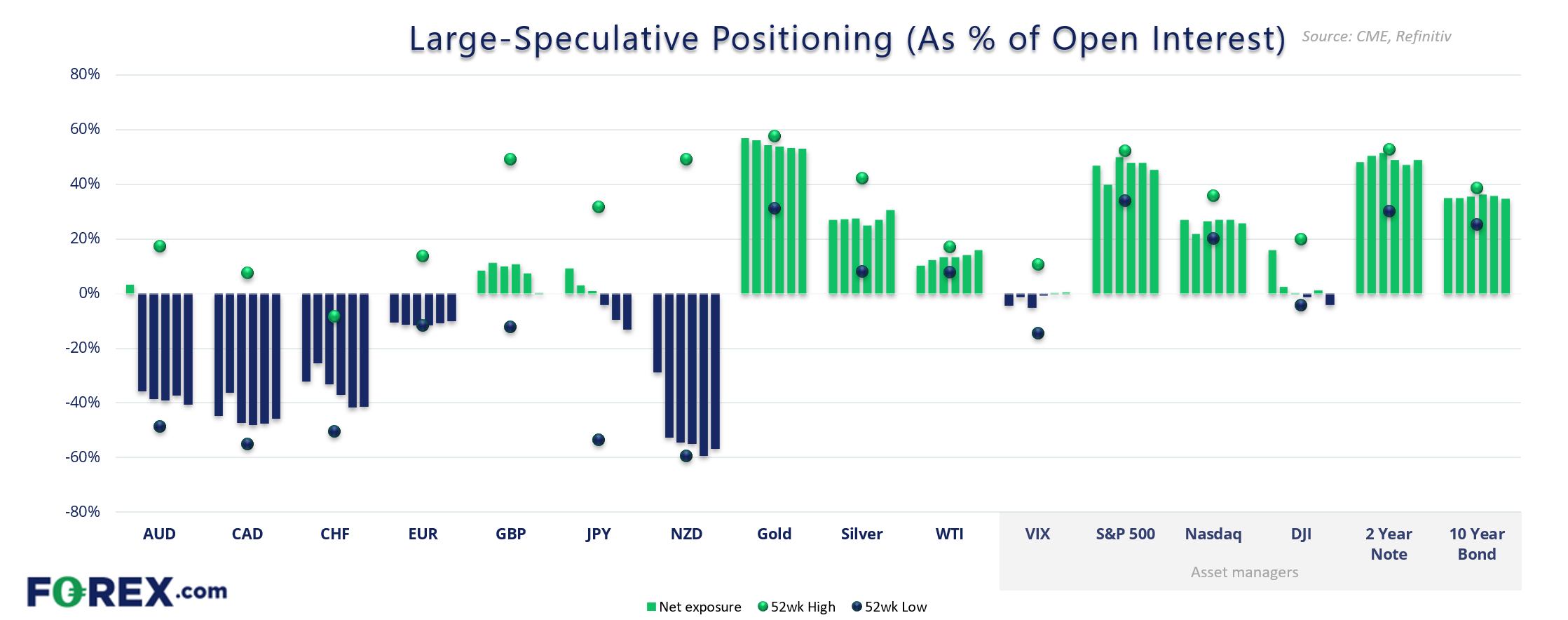

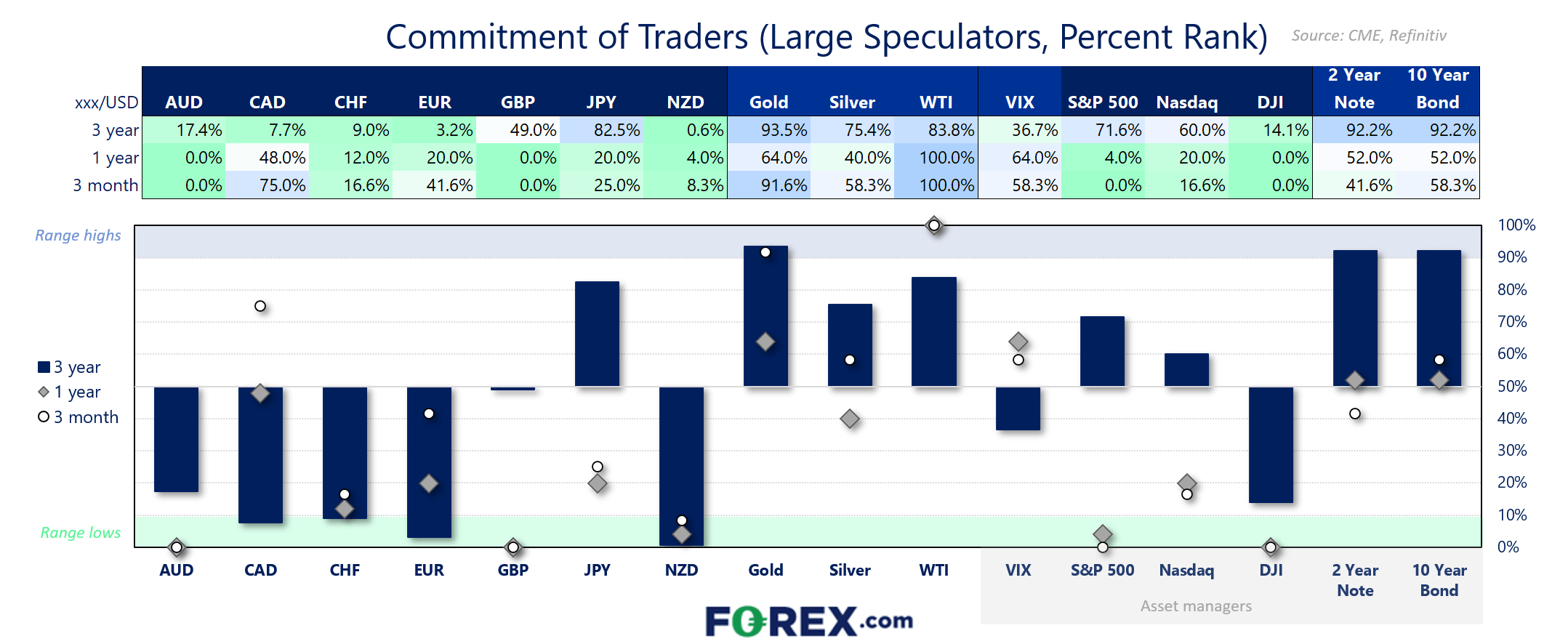

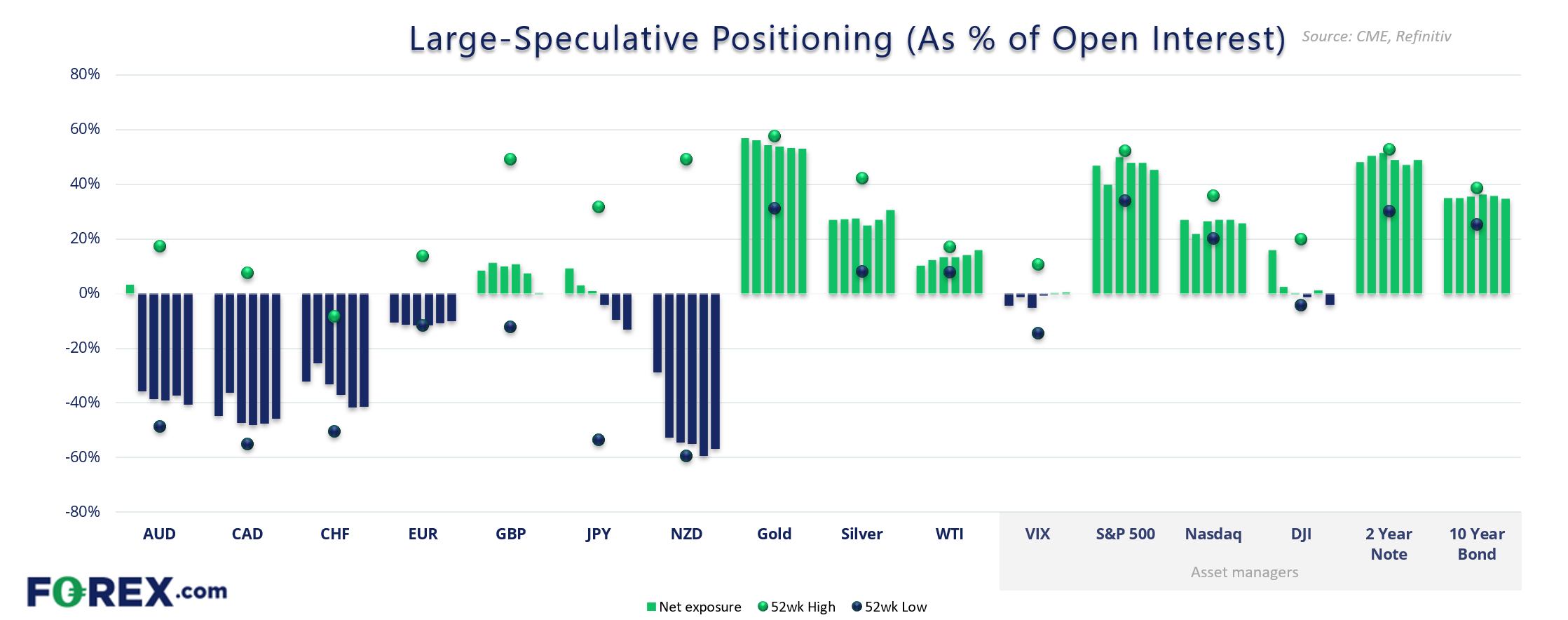

Market positioning from the COT report – 14 January 2025:

- Bears increased their gross-short exposure to GBP/USD futures by 20% (13.3k contracts)

- Gross-long exposure to AUD/USD futures were reduced by -21% (-6.9k contracts)

- Large speculators increased their net-long exposure to gold futures by 7% (20.8k contracts) and reduced shorts by -10% (-3.6k contracts)

- Large speculators had a bearish view on indices last week, increasing gross-short exposure to Nasdaq, S&P 500 and Dow Jones futures by ~10 – 14% and reducing longs

- Asset managers flipped to net-short exposure to Dow Jones futures

- Net-long exposure to WTI crude oil futures rose to a 66-week high

- Large speculators reduced their net-short exposure to the 10-year bond to a 6-month low (bullish for yields)

Latest market news

Yesterday 05:00 PM