- Copper and iron ore maintain prior gains following China “data dump”

- Industrial output up 6.2% YY, steel production surges 11.8% YY

- Property investment drops 10.6% YY, worsening slightly

- Home prices stabilize, smallest decline in 18 months for new sales

Summary

China’s “data dump” delivered mixed news for industrial metals. Home prices stabilized, industrial output breezed past expectations, but the downturn in the property market—a key source of commodity demand—showed a slight acceleration.

New home prices eased just 0.08%, marking the smallest monthly decline in 18 months. Falls in existing home prices also slowed to 0.31%, according to Bloomberg calculations.

Industrial output was the standout, growing 6.2% over the year versus forecasts for 5.4%. Within that, crude steel output surged 11.8% relative to December 2023, although total output fell 1.7% over the year.

However, property investment declined 10.6% year-on-year, a slightly faster drop than the 10.4% annual decline reported between January and November. Over the second half of the year, property investment fell by about 10% on a year-to-date annual basis—not worsening significantly, but not improving either.

Overall, China's economy grew 5.4% in the December quarter from a year earlier. For the full year, growth matched government targets at 5%.

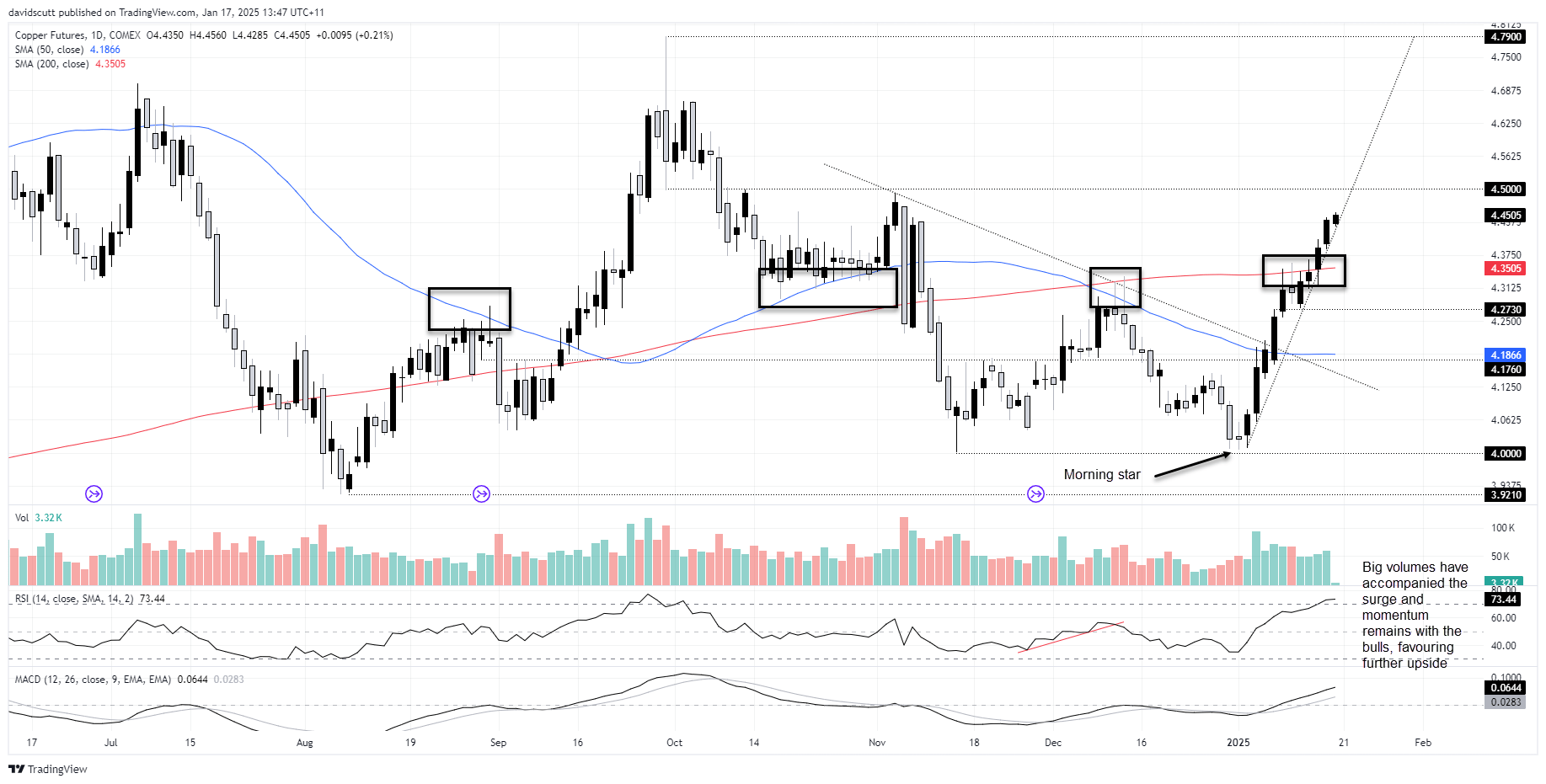

Copper: Bulls in Control

Source; TradingView

The price broke the downtrend established on November 5, then sliced through the 50 and 200-day moving averages. The latter is particularly notable given how price action has respected these levels recently.

Momentum is firmly with the bulls, with RSI (14) and MACD trending higher, although RSI is now flirting with overbought territory on the daily timeframe. Strong volumes suggest plenty of participation underpinning the move.

As long as the uptrend established in early January holds, the near-term bias remains bullish, supported by price and momentum signals. The next key topside level is $4.50, with little visible resistance beyond that until $4.66 or even $4.79.

Should the uptrend falter, however, the bullish case would need to be reassessed, with a potential pullback towards the 200-day moving average coming into play.

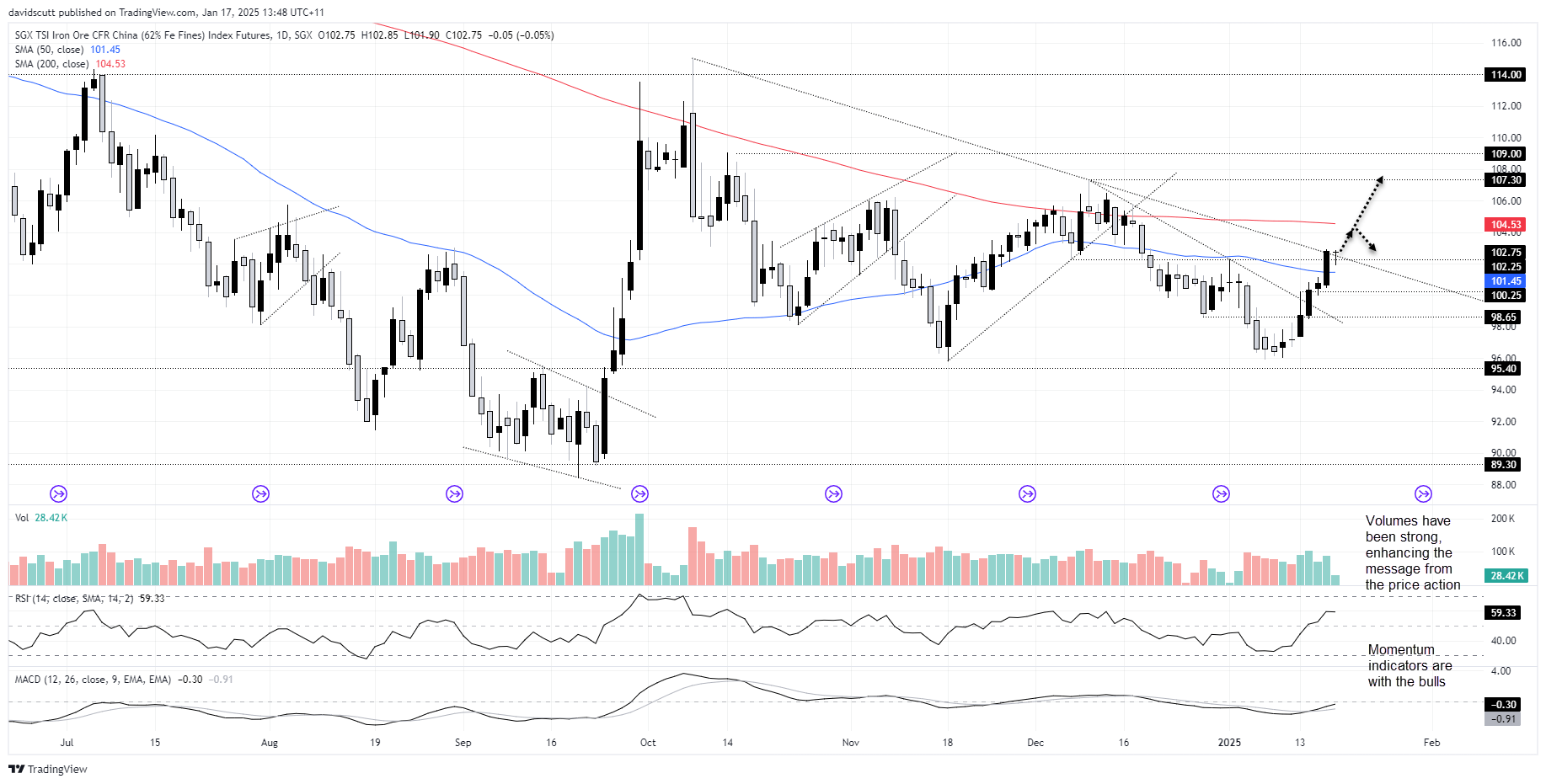

Iron Ore: Key Level Overhead

Source; TradingView

Iron ore futures have also rallied strongly over the past fortnight, rebounding from below $100 a tonne on strong volumes. The move took out downtrend resistance dating back to early December.

The price is now testing a zone that includes minor horizontal resistance at $102.25 and the downtrend established in October, when Chinese markets were riding high on peak stimulus excitement. Momentum indicators are firmly bullish, suggesting potential for further gains.

If the price pushes above this zone, longs could be established with a stop below for protection. The 200-day moving average looms as a potential target, with $107.30 the next level to watch.

However, the price has struggled to hold above the 200-day moving average in recent months. If price action falters again at this level, traders eyeing higher targets may need to rethink the merits of the trade.

-- Written by David Scutt

Follow David on Twitter @scutty