- Chinese industrial profits accelerate slightly between January and July

- China’s equity markets had a fast start to the year but have since faltered

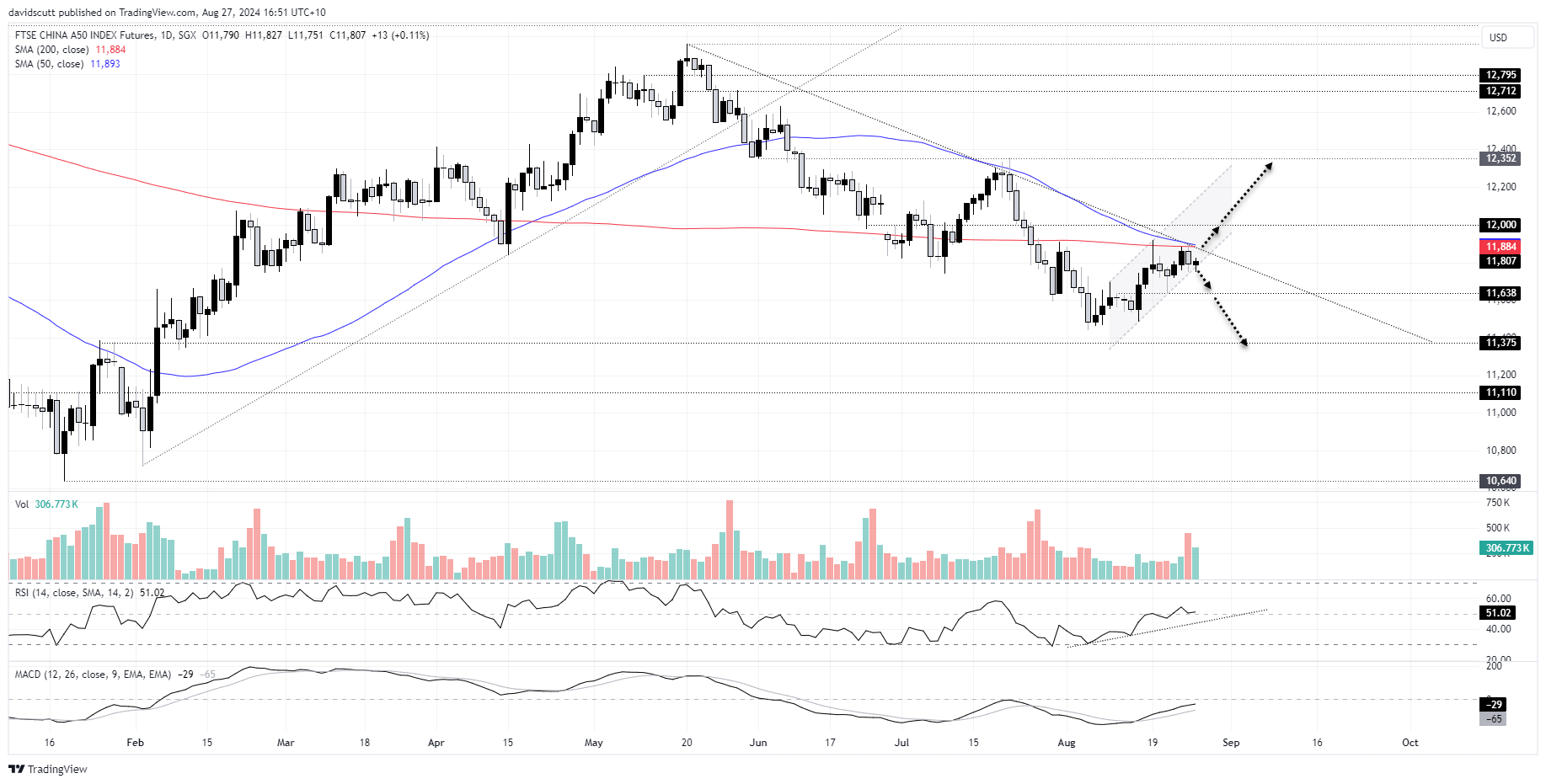

- A50 futures stage countertrend rally but struggle to break 200DMA

Overview

Chinese industrial profits accelerated on an annualised basis in the first seven months of the year, led by high-end manufacturing firms. However, it’s not been enough to deliver meaningful upside to the China A50 index which continue to struggle amidst poor investor sentiment, weak domestic demand and threat of increased trade barriers abroad.

Industrial profits improve but remain weak

According to data released by China’s National Bureau of Statistics (NBS), industrial profits rose 4.1% between January and July relative to a year earlier, accelerating slightly from the 3.6% pace in the first six months of the year. Profitability at foreign firms grew 9.9% while private-sector companies saw profits swell 7.3%, In contrast, state-owned firms lagged with profitability rising just 1%.

Despite the acceleration and recent plea from Wu Qing, chairman of the China Securities Regulatory Commission (CSRC) for state-backed and private sector market participants to help revive confidence among investors in Chinese equities, it has little impact on the A50 so far.

Important week for China A50 Index?

Looking at A50 on the daily chart, you can see the index has been stuck in a downtrend since the middle of May, with only brief countertrend rallies interrupting the broader move. The price looks to be in another right now, grinding higher after bottoming in early August. However, the index has been rejected multiple times at the 200-day moving average, including this week, seeing it drift back to test channel support.

Given the limited distance between the two levels, and proximity of downtrend resistance that now intersects with the 200DMA, it feels like we’ll get some resolution on medium-term directional risks at some stage this week. From a momentum perspective, RSI (14) and MACD continue to generate bullish signals, marginally favouring upside over downside.

My preference would be to wait for a break before entering trades. If the price manages to push through the 200DMA and uptrend, traders could initiate longs above the former resistance zone with a tight stop below for protection. Possible targets include 12,000 or 12,352. Alternatively, if channel support breaks, you could sell below with a stop above for protection. Targets include 11,638, 11450 or 11,375.

For the purpose of the analysis above, it reflects movements in futures over the underlying index listed on the SGX.

China A50 Index futures primer

The China A50 Share Index is a key benchmark that tracks the top 50 companies by market cap listed on the Shanghai and Shenzhen exchanges. This index provides a snapshot of the Chinese economy, covering the biggest players in sectors like financials, technology, consumer goods, energy, and industrials.

The full list of index constituents can be found in the graphic below.

Source: FTSE Rusell

-- Written by David Scutt

Follow David on Twitter @scutty