- Chinese stocks are keeling over as bond yields hit record lows

- Both reflect sentiment towards the economy

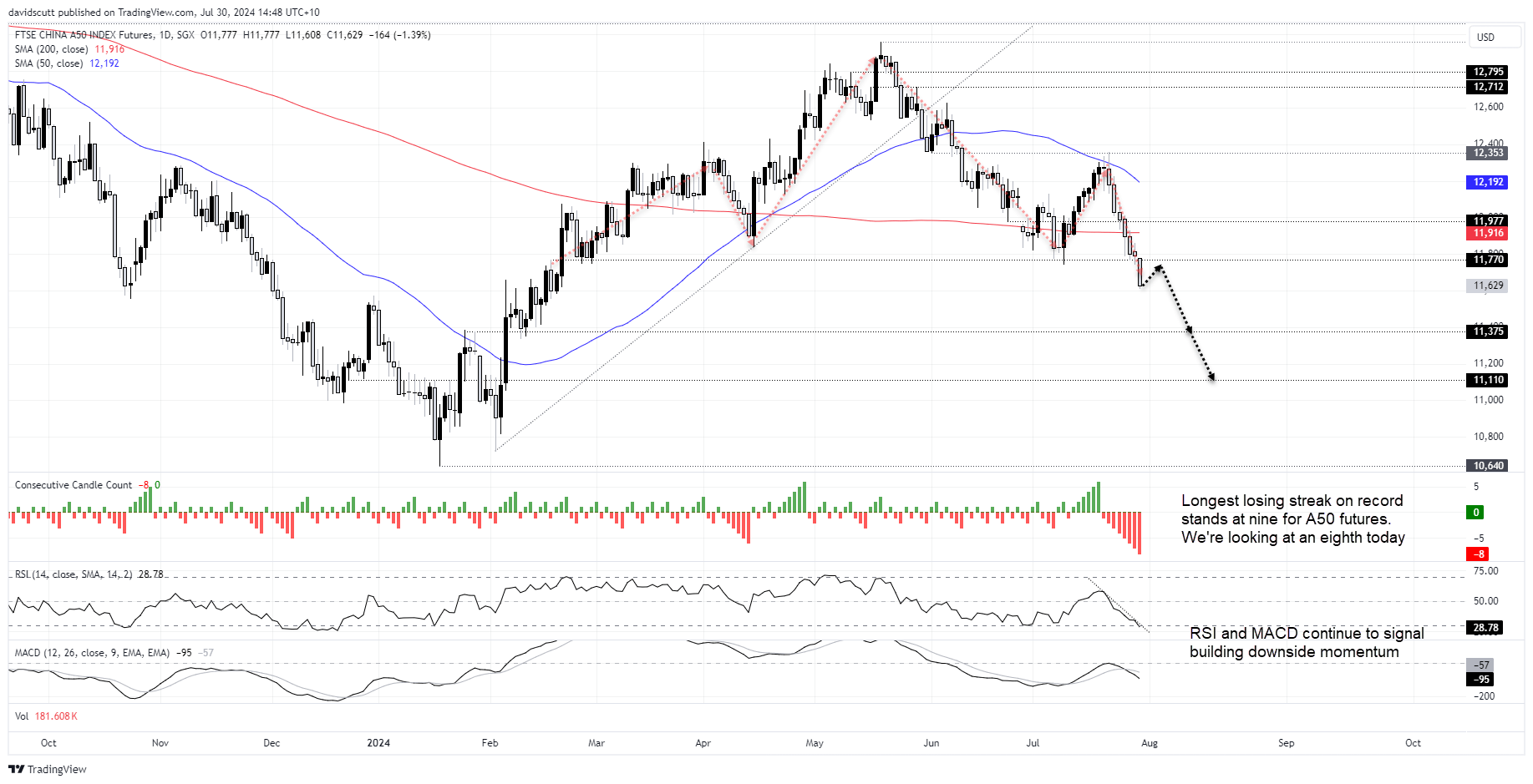

- China A 50 futures breaking down as record losing streak looms

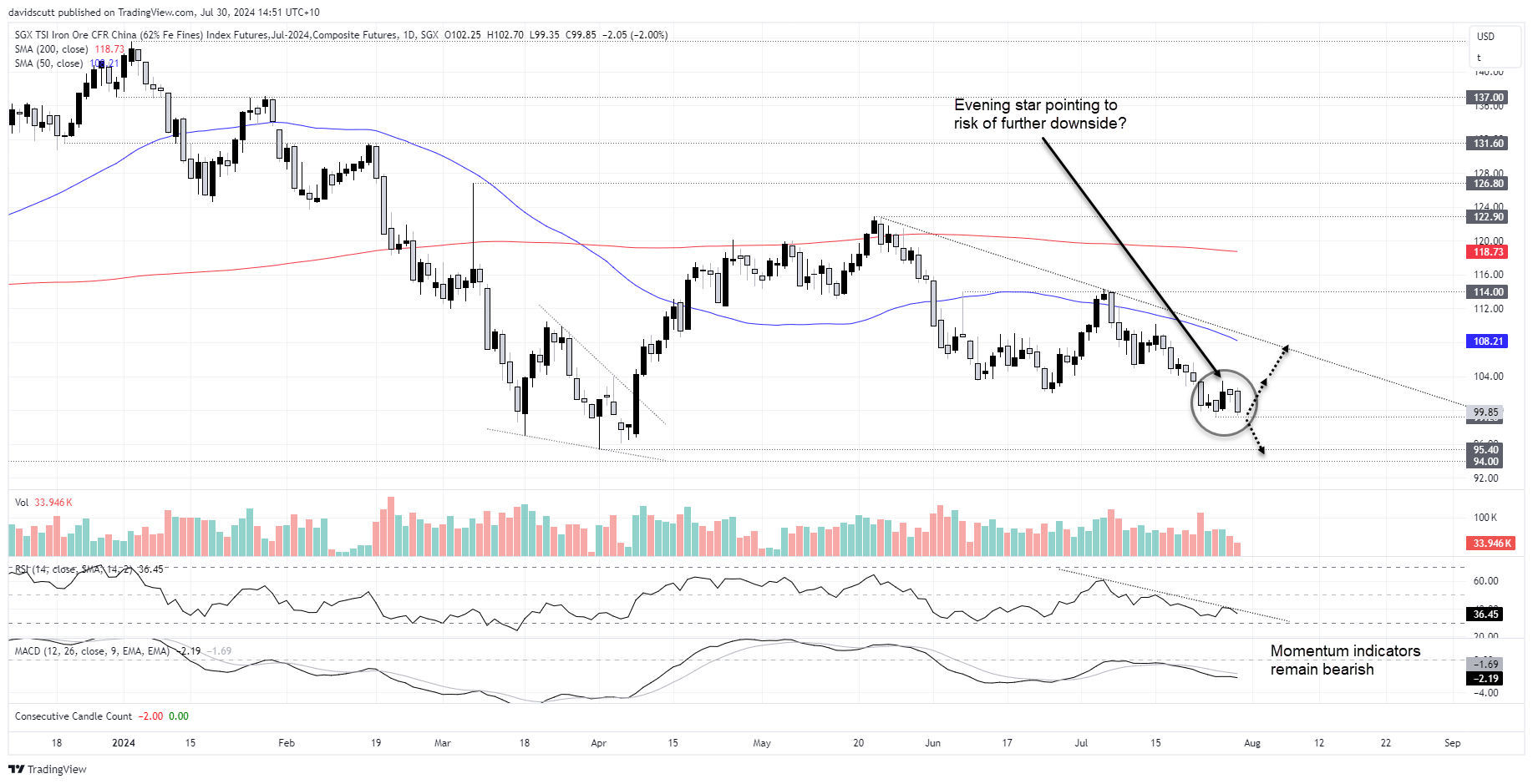

- SGX iron ore also struggling below $100

- Politburo meeting details create near-term headline risk

No news is not good news

Chinese markets are performing poorly despite policymakers cutting key policy interest rates last week. It’s been that way since the conclusion of the Third Plenum earlier this month, an event that delivered little in the way of concrete measures to help appease concerns about the trajectory for the economy.

China A50 futures look horrible on the charts, threatening to equal the longest losing streak since late December 2018. Iron ore futures on the SGX are testing the resolve of dip buyers lurking below $100.

Chinese long-term bond yields hit record lows

With Chinese 30-year bond yields hitting a record low of 2.36%, joining 10 and 20-year tenors in the club, it’s a signal that investors are nervous about the outlook for the economy.

Outside the bond market, a lot of the moves we’re seeing look like an unwind of the pre-Plenum pump thought to have been orchestrated by China’s “National Team” to boost flagging confidence ahead of the key event.

Given the underlying factor behind the move, coupled with weakening economic data and panicky rate cuts announced last week, it should come as no surprise that riskier asset classes are rolling over.

China A50 futures breaking down, nears record losing streak

China A50 futures – tracking the performance of the 50 largest and most liquid A-shares on the Shanghai and Shenzhen exchanges – are a posterchild for just how quickly sentiment has turned, slumping to six-month lows on Tuesday after taking out support at 11770.

Whether you describe it as a head and shoulders pattern or not, the price has taken out the neckline if you do, pointing to the potential for a deeper unwind beyond that already seen. Bears will be eyeing off 11375 and 11110 as potential targets given they acted as support and resistance earlier in the year.

While selling the break may be appealing for some, futures have fallen for eight consecutive sessions, just one shy of equaling the longest losing streak on record set in December 2018. It’s also oversold on RSI (14), providing another reason to be cautious about getting too bearish about the initial break. MACD is signaling building bearish momentum.

Ideally, I’d like to see a retracement and rejection at 11770 before getting short, improving the risk-reward of the trade by allowing a stop to be placed above the level for protection. Having fallen so far already, the risk-reward of entering a short now is not as appealing. But you don’t always get what you’re looking for. So even if we see a modest retracement higher, it would still be welcomed for those considering shorts.

SGX iron ore below $100 again

While a totally different asset class, you get the sense iron ore futures are trading heavy for the same reason stocks are: no concrete signs of an improvement in the economy, especially the construction sector which is the largest consumer of steel globally.

SGX iron ore futures have fallen 2% on Tuesday, sliding back below the $100 per tonne mark. As yet, it has not taken out the low of $99.20 set late last week, meaning traders should be on alert for either a break or a bounce.

As for the most likely outcome, RSI and MACD are providing bearish signals with momentum still building to the downside. There’s been no noticeable pickup in volumes often seen around a turning point. The last three daily candles resemble an evening star pattern, although the last is yet be completed.

Should we see a downside break, traders will be eyeing the April 1 low of $95.40 as a potential target. Beyond, the May 2023 low of $94 will also be on the radar. If the price were to hold $99.20, Friday’s high of $103.50 would be the first topside target with $105 and 50-day moving average the next after that.

Whichever way the price evolves, use $99.20 for protection, placing a stop on the opposite side to entry to protect against reversal.

China PMIs arrive Wednesday

While debatable whether it will influence either market, China’s government will release manufacturing and non-manufacturing purchasing managers indices (PMIs) for July on Wednesday. The bar to impress has been lowered considerably recently, so even a modest improvement could be used as an excuse to trim excessive bearish bets.

Nearer-term, headlines from the Politburo meeting being held in Beijing this week present headline risk. Concrete measures to address flagging economic activity provide the greatest potential to reverse recent bearish trends. Announcements on economic objectives in the second half of the year are expected in the coming hours.

-- Written by David Scutt

Follow David on Twitter @scutty