Canadian Dollar technical outlook: USD/CAD short-term trade levels

- Canadian Dollar rally halted at yearly extremes

- USD/CAD rebound off confluent support eyeing monthly downtrend resistance

- Resistance 1.3407, 1.3433, 1.3517/45 (key)– support 1.3279-1.3314 (critical), 1.3225, 1.31

The Canadian Dollar is on the defensive this week against the US Dollar with USD/CAD rebounding off key support near the yearly lows. The immediate threat is for a larger rebound within the broader monthly downtrend with the battle-lines drawn into the close of the week. These are the updated targets and invalidation levels that matter on the USD/CAD short-term technical charts.

Discuss this Canadian Dollar setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: In last month’s Canadian Dollar short-term outlook we noted that, “USD/CAD is in a contractionary range just above a key support pivot – looking for the breakout.” A break lower into the close of March fueled a decline of more than 4% with price breaking below the 200-day moving average for the first time since June. The decline was halted last week at a key support zone around 1.3279-1.3315- a region defined by the November low-day close and the yearly close-low / low-day close. The bears are vulnerable while above this threshold.

Canadian Dollar Price Chart – USD/CAD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Notes: A closer look at Loonie price action shows USD/CAD trading within the confines of a descending pitchfork formation with the recent recovery now challenging median-line. Initial resistance is eyed with the 200DMA / April opening range lows at 1.3405/07 backed closely by the 23.6% Fibonacci retracement of the March decline at 1.3433 and the upper parallel (currently ~1.35). Ultimately a breach / daily close above the monthly / yearly opens at 1.3517/45 would be needed to suggest a more significant low was registered this month.

A break below this key support zone exposes the 38.2% retracement of the May 2021 advance at 1.3225- weakness below this threshold could fuel another bout of accelerated losses with such a scenario exposing the lower parallel closer to the 1.31-handle.

Bottom line: The USD/CAD sell-off has responded to key support around the yearly lows- the focus is on this near-term recovery within the monthly downtrend. From a trading standpoint, look for a break of the weekly opening-range for guidance with the bears vulnerable while above 1.3279. Rallies would need to be limited to the upper parallel for the March decline to remains viable. Review my latest Canadian Dollar weekly technical forecast for a look at the longer-term USD/CAD trade levels.

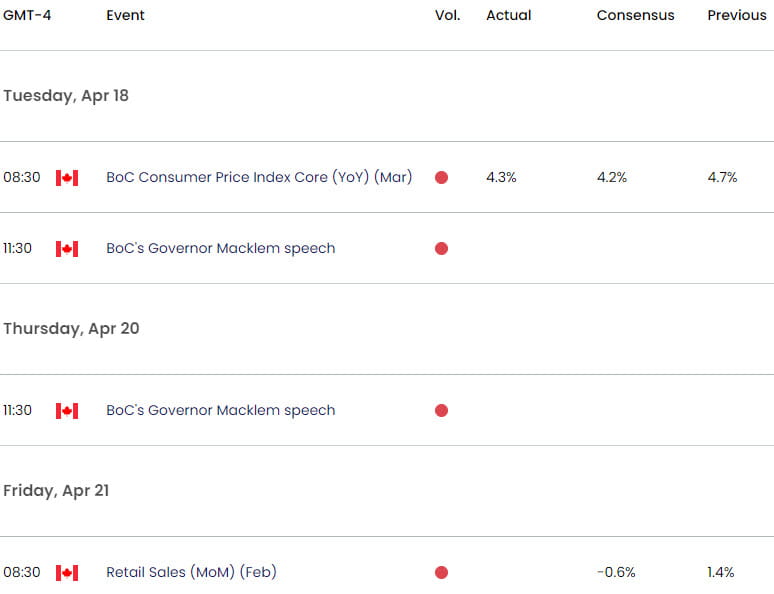

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- British Pound short-term outlook: GBP/USD threatens correction

- Euro short-term outlook: EUR/USD trend correction on the horizon

- US Dollar short-term outlook: USD collapses to yearly low- DXY levels

- Gold short-term price outlook: XAU/USD bulls run out of breath

- Australian Dollar short-term outlook: AUD/USD stalls at resistance

- Japanese Yen short-term outlook: USD/JPY searches support into April open

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com