Canadian Dollar technical outlook: USD/CAD short-term trade levels

- Canadian Dollar carves well-defined monthly opening-range

- USD/CAD rebounds off long-term uptrend support – October downtrend vulnerable

- Resistance 1.3471, 1.3536/46, 1.3690– support 1.3306, 1.3225/41 (key), 1.3077

The Canadian Dollar is under pressure today with USD/CAD rallying back towards the February range highs. The stage is set for a possible breakout in the days ahead with well-defined levels in view. These are the updated targets and invalidation levels that matter on the USD/CAD short-term technical charts.

Discussing this USD/CAD setup and more in the Weekly Strategy Webinars beginning February 27th.

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: Canadian Dollar has set a well-defined monthly opening-range just above uptrend support with a defense of the lower bounds yesterday fueling a rally of more than 1.1%. The focus is on a breakout of this range with a breach / close above the objective yearly open at 1.3545 ultimately needed to mark resumption of the broader uptrend.

Canadian Dollar Price Chart – USD/CAD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Notes: A closer look at Loonie price action shows USD/CAD rebounding off uptrend support / the objective February open around ~1.3306 early in the week. Confluent support / broader bullish invalidation rests at 1.3225/41- a region defined by the 38.2% retracement of 2021 rally, the 61.8% extension of the 2022 decline and the 200-day moving average. A break below this threshold would threaten a much deeper correction towards initial support at the May 2022 swing high near 1.3077.

Initial resistance stands with the late-January swing high at 1.3471 backed by 1.3536/45- a close above this threshold is needed to validate a breakout with such a scenario exposing subsequent resistance objectives at the 61.8% retracement of the December decline at 1.3690 and the 2022 high-day close at 1.3749- an area of interest for possible exhaustion / price inflection IF reached.

Bottom line: USD/CAD has defended uptrend support twice this month and the immediate focus is on a breakout of the February opening-range for guidance. From at trading standpoint, losses should be limited to the lower parallel (currently ~1.3320s) IF price is heading higher with a breach above the October downtrend needed to suggest a more significant low was register this month.

Review my latest Canadian Dollar weekly technical forecast for a look at the longer-term USD/CAD trade levels.

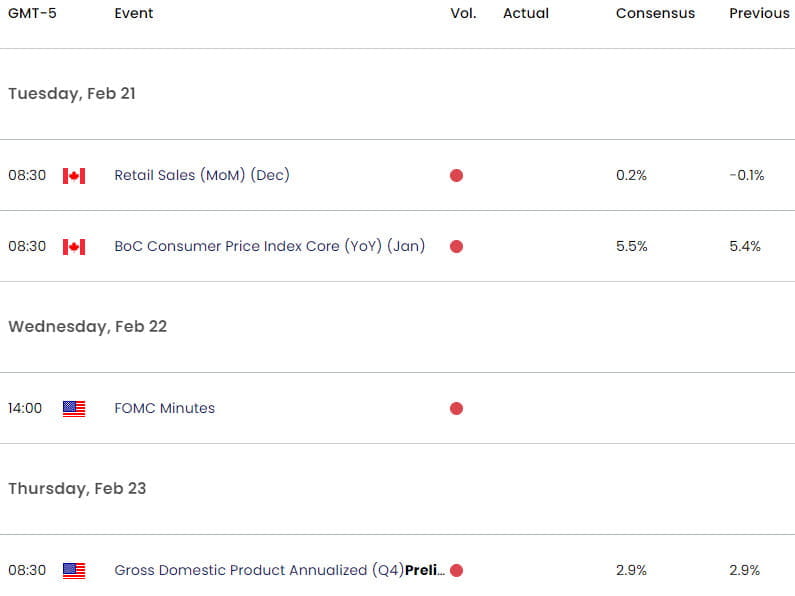

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex