Canadian Dollar Technical Outlook: USD/CAD Short-term Trade Levels

- USD/CAD rally testing technical resistance ahead of Bank of Canada interest rate decision

- Risk for topside exhaustion / price inflection- weekly opening-range break imminent

- Resistance 1.3825/34 (key), 1.3881/99, 1.3977/90- Support 1.3792, 1.3745, 1.37 (key)

The US Dollar surged more than 3.2% off the September lows in USD/CAD with price testing confluent technical resistance ahead of tomorrow’s Bank of Canada interest rate decision. Battle lines are drawn on the USD/CAD short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie setup and more. Join live on Monday’s at 8:30am EST.Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: In my last Canadian Dollar Short-term Outlook we noted that, “USD/CAD turned from multi-month lows last month and the immediate focus remains on this near-term recovery. From at trading standpoint, losses should be limited to 1.3472 IF price is heading higher on this stretch – look for a larger reaction on test of the median-line for guidance.”

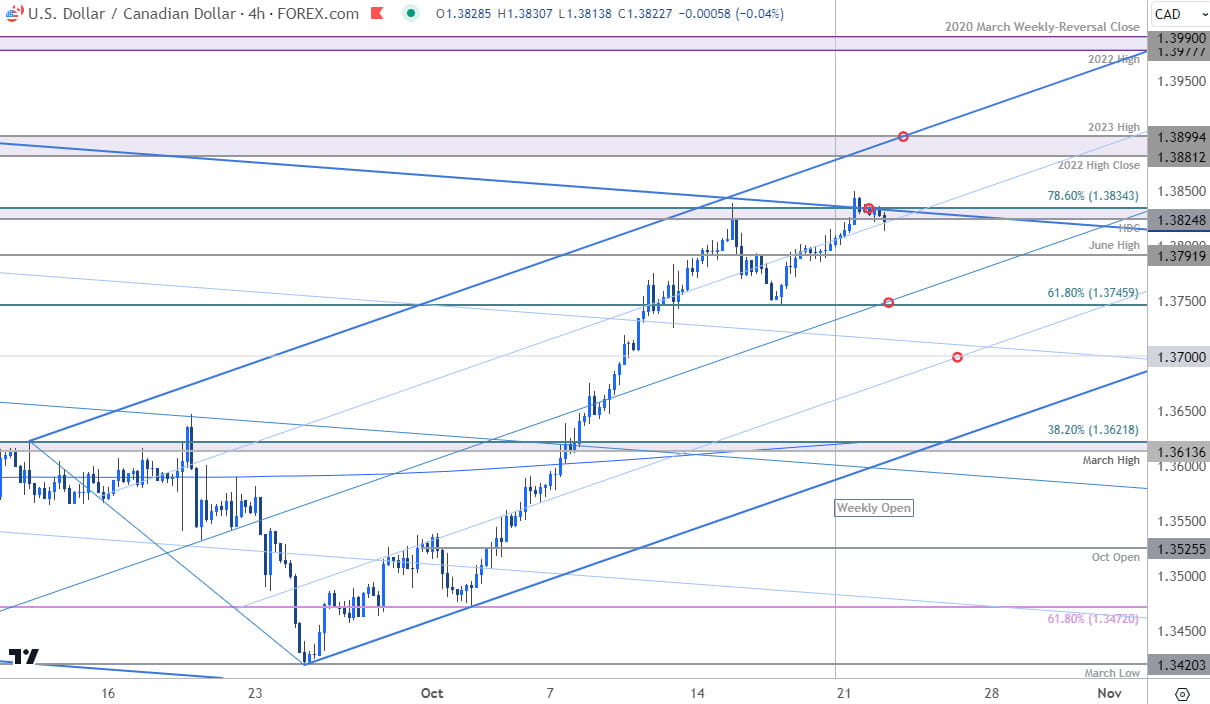

USD/CAD ripped through median-line resistance three-days later with the rally extending more than 2.9% off the September low. The bulls have been halted this week at a major technical confluence ahead of tomorrow’s BoC rated decision at 1.3825/34- a region defined by the objective 2024 high-day close (HDC) and the 78.6% retracement of the August decline. The focus is on possible price inflection off this zone with the immediate rally vulnerable while below.

Canadian Dollar Price Chart – USD/CAD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Notes: A closer look at Canadian Dollar price action shows USD/CAD trading within the confines of the ascending pitchfork we’ve been tracking off the August / September lows with the rally failing a second attempt to breach resistance this week. Initial support rests with the June high at 1.3792 and is backed by the 61.8% retracement / last week’s low at 1.3746/47 and the 1.37-handle- losses should be limited to this threshold IF price is heading higher on this stretch. Broader bullish invalidation rests at with the March high / 38.2% retracement at 1.3613/21.

A topside breach / close above this pivot zone is needed to mark uptrend resumption toward the next major technical consideration at the 2022 high-close / 2023 high at 1.3881/99. Look for a larger reaction there IF reached with a breakout of the uptrend to threaten another accelerated push towards the 2022 high / 2020 March weekly reversal close at 1.3977/90- an area of interest for possible topside exhaustion / price inflection IF reached.

Bottom line: The USD/CAD rally is wrestling resistance here for a second week with the objective weekly opening-range taking shape just below ahead of tomorrow’s rate decision. From a trading standpoint a good zone to reduce portions of long-exposure / raise protective stops- losses should be limited to the median-line IF price is going for a breakout here with a close above 1.3835 needed to fuel the next leg in price.

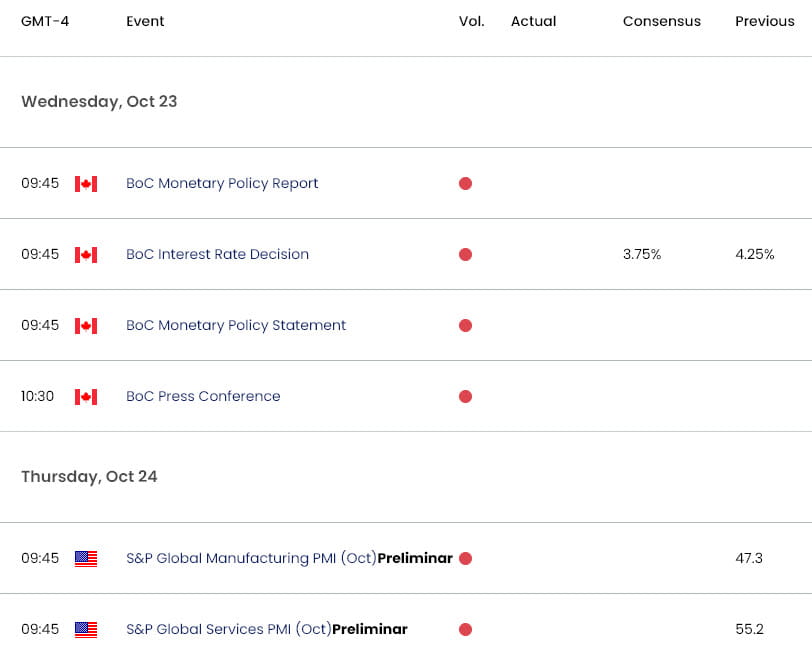

Keep in mind the markets are currently pricing a 50-basis point cut from the Bank of Canada tomorrow. Stay nimble into the release and watch the weekly close here for guidance. Review my latest Canadian Dollar Weekly Technical Forecast for a closer look at the longer-term USD/CAD trade levels.

Key USD/CAD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Gold Short-term Outlook: XAU/USD October Range Breakout Imminent

- Euro Short-term Technical Outlook: EUR/USD Bears Halted at Support

- US Dollar Short-term Outlook: USD Rally Rips to Resistance

- British Pound Short-term Outlook: GBP/USD Support Test at September Low

- Australian Dollar Short-term Outlook: AUD/USD Vulnerable Sub-6800

Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex