Canadian Dollar Outlook: USD/CAD

USD/CAD continues to register a fresh yearly high (1.4106) after clearing the 2022 high (1.3978), with the recent rally in the exchange rate pushing the Relative Strength Index (RSI) up against overbought territory.

Canadian Dollar Forecast: USD/CAD Rally Clears 2022 High

USD/CAD continues to carve a series of higher highs and lows as it rises for the sixth consecutive day, and a move above 70 in the RSI is likely to be accompanied by a further advance in the exchange rate like the price action from last month.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

In turn, the bullish price series in USD/CAD may persist especially as the Bank of Canada (BoC) expects to ‘reduce the policy rate further,’ but the update to Canada’s Consumer Price Index (CPI) may sway the central bank as the report is anticipated to show sticky inflation.

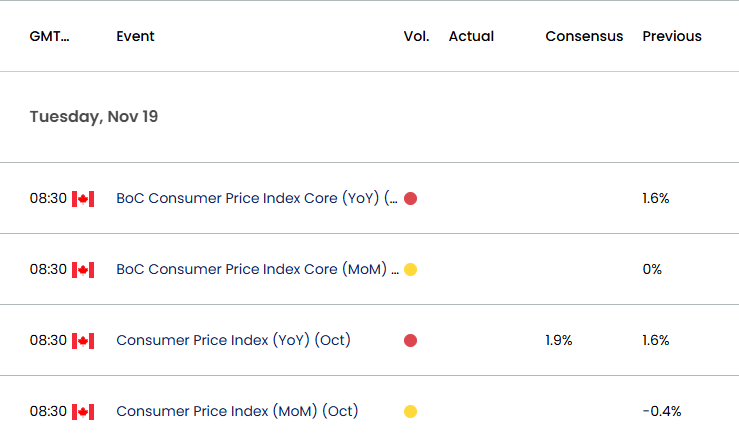

Canada Economic Calendar

The headline CPI is expected to increase to 1.9% in October from 1.6% per annum the month prior, and a rebound in price growth may push the BoC to the sidelines as ‘the timing and pace of further reductions in the policy rate will be guided by incoming information and our assessment of its implications for the inflation outlook.’

With that said, waning speculation for a December BoC rate-cut may curb the recent advance in USD/CAD, but a softer-than-expected CPI print may produce headwinds for the Canadian Dollar as it encourages Governor Tiff Macklem and Co. to implement lower interest rates at its last meeting for 2024.

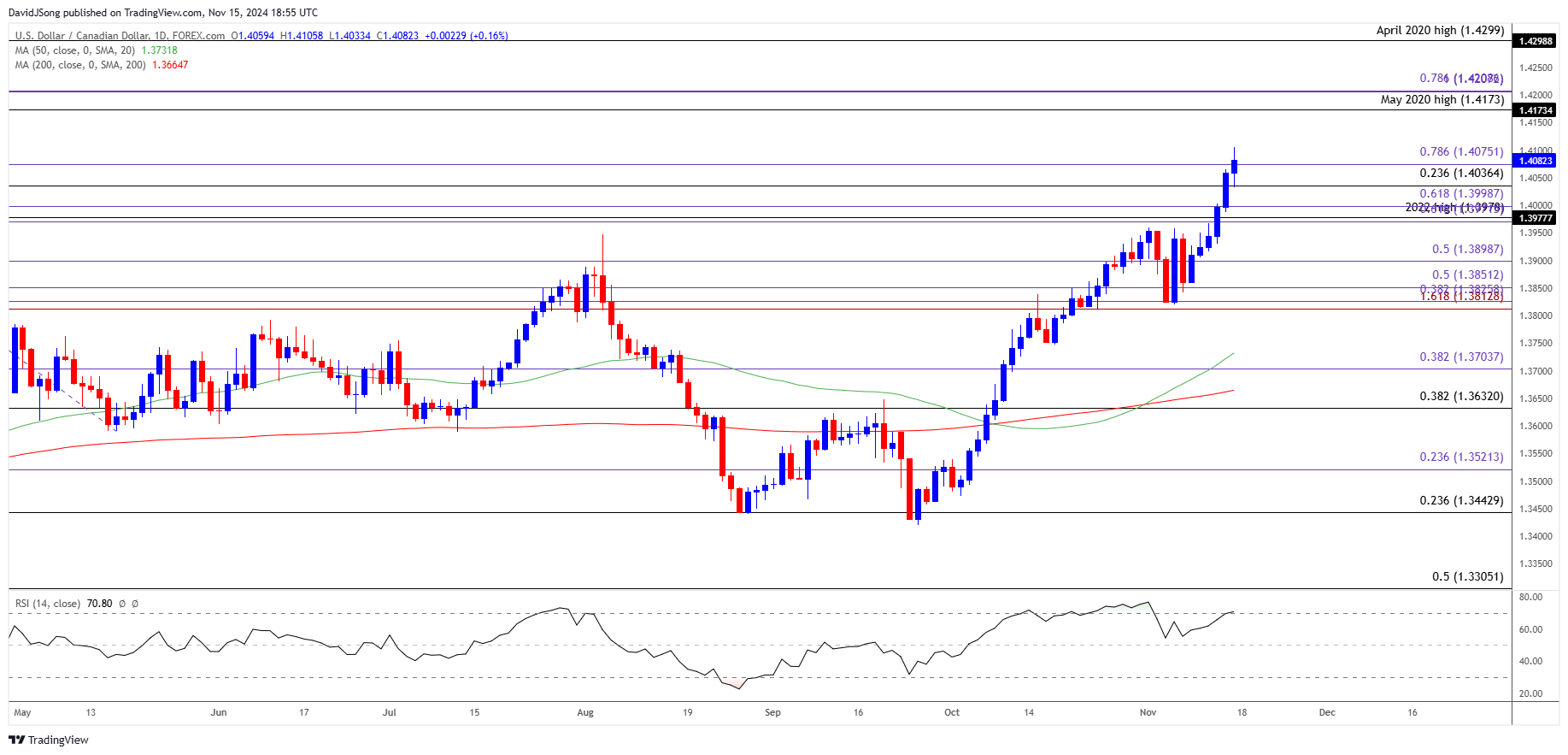

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD may continue to trade to fresh yearly highs following the breach above the 2022 high (1.3978), with the breach above the 1.4040 (23.6% Fibonacci retracement) to 1.4080 (78.6% Fibonacci extension) zone raising the scope for a move towards the 1.4173 (May 2022 high) to 1.4210 (78.6% Fibonacci extension) area.

- Next region of interest comes in around the April 2022 high (1.4299) but the Relative Strength Index (RSI) may show the bullish momentum abating if it struggles to push into overbought territory and fails to mirror the extreme reading from last month.

- Lack of momentum to hold above the 1.4040 (23.6% Fibonacci retracement) to 1.4080 (78.6% Fibonacci extension) zone would negate the bullish price series in USD/CAD, with a breach below the 1.3970 (61.8% Fibonacci extension) to 1.4000 (61.8% Fibonacci extension) region bringing 1.3900 (50% Fibonacci extension) back on the radar.

Additional Market Outlooks

GBP/USD Trades Below 200-Day SMA for First Time Since May

EUR/USD Eyes 2023 Low as RSI Flirts with Oversold Zone

Gold Price Outlook Mired by Close Below 50-Day SMA

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong