British Pound Talking Points:

- It was a strong week for Sterling. GBP/USD pushed up to a fresh monthly high at the 1.2750 level, GBP/JPY drove into a re-test of the 200.00 handle and EUR/GBP tested the .8500 level for the first time in three months.

- Behind the drive was the UK CPI report which showed Core CPI at 3.9% against a 3.6% expectation. This dashed hopes for near-term rate cuts and that further exposed deviations between the British and US, Japanese and European economies.

- I’ll be discussing these themes in-depth in the weekly webinar. It’s free for all to register: Click here to register.

The British Pound looks to close out what’s been a strong month of May next week. The big item from this week was the release of CPI data, which showed Core CPI well-above the expected 3.6% when it arrived at 3.9% on Wednesday. This is higher than Core CPI in both the US and Europe and while there were previous hopes for near-term rate cuts out of the Bank of England, those expectations have taken a step back; and along with it, GBP spot rates have pushed higher against all of the US Dollar, the Euro and the Japanese Yen both last week and so far in the month of March.

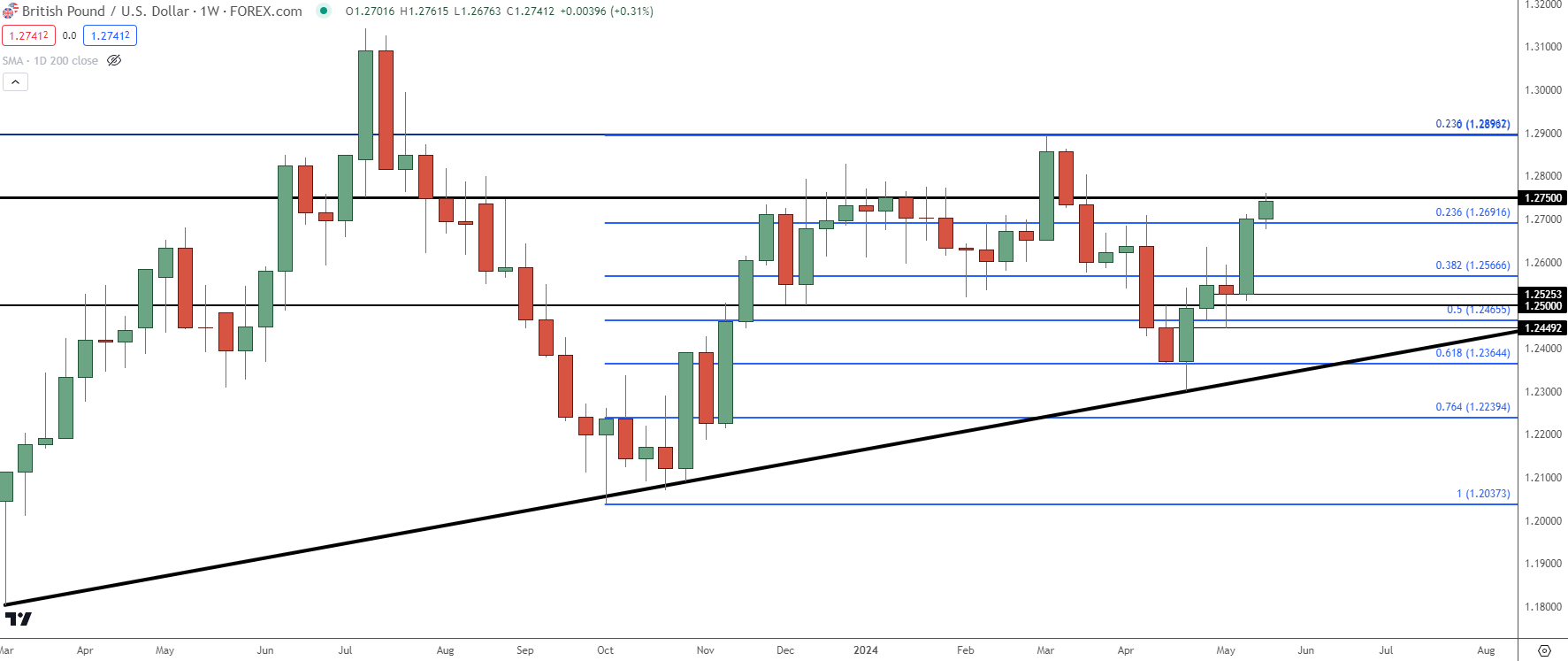

I looked into this earlier in the month, ahead of the Bank of England rate decision. And while the BoE sang a familiar dovish refrain, the weakness from that meeting was short-lived as USD weakness soon took back over, helping to push GBP/USD back above the psychological 1.2500 level. That strength continued the week after as GBP/USD jumped up to the 1.2700 handle, and that drove through last week as the pair pushed back-up to the 1.2750 level.

As I have been saying in webinars, GBP/USD can remain as one of the more attractive venues for scenarios of USD-weakness, and that inflation factor is an important push point for that theme.

GBP/USD Weekly Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

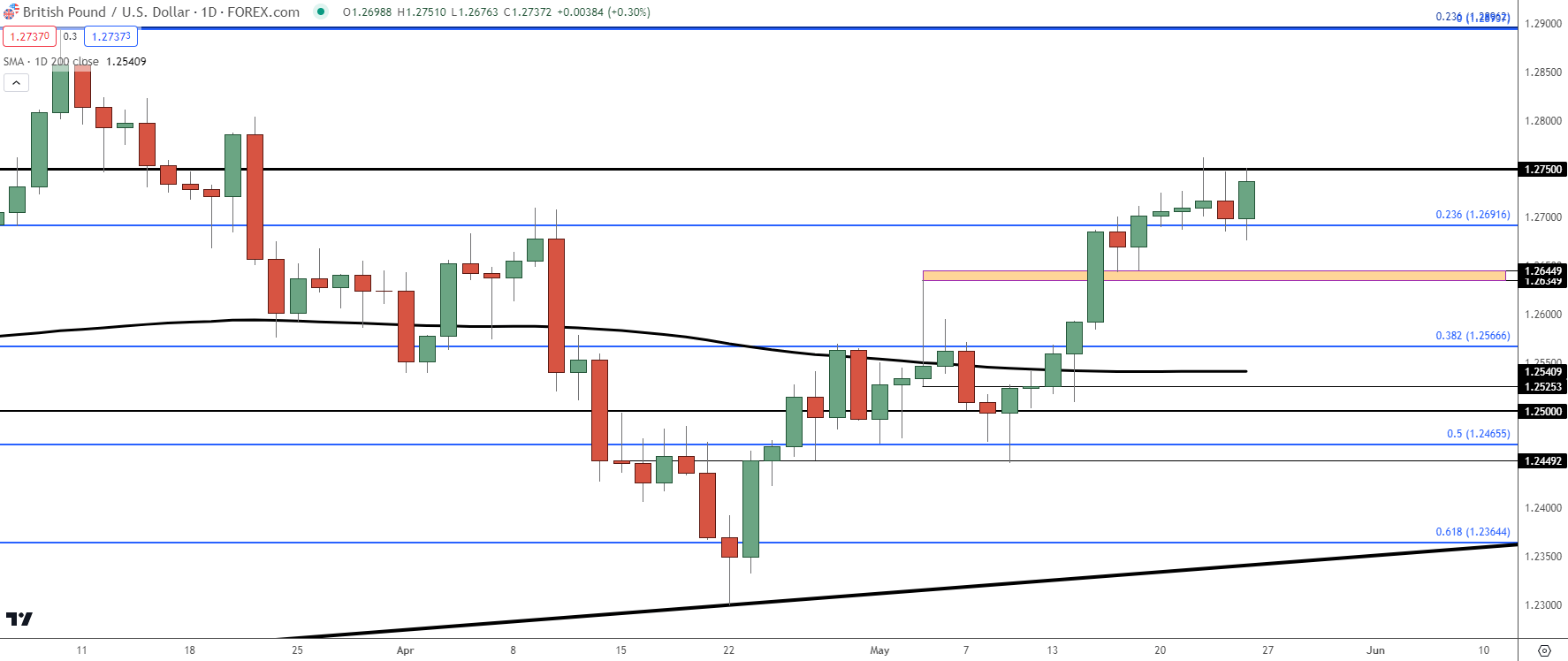

From the daily chart, we can see a bit of contention at that 1.2750 price. That initially came back into play on Wednesday, just after the CPI release; but bulls couldn’t hold the bid and price soon pulled back to support at prior resistance, taken from the 23.6% Fibonacci retracement at 1.2692. That held support on Thursday and into Friday, even with the US Dollar catching a bid, allowing for another re-test of the 1.2750 level. That keeps the door open for bullish continuation scenarios into next week as there’s been a higher-low showing after a fresh higher-high.

There’s additional context for support a little lower, from around 1.2635-1.2545 which is a zone of resistance-turned-support. If USD strength does come back into the picture, driving a larger pullback into Cable, the 200-day moving average looms large as another possible spot of support and that currently projects to around

GBP/USD Daily Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

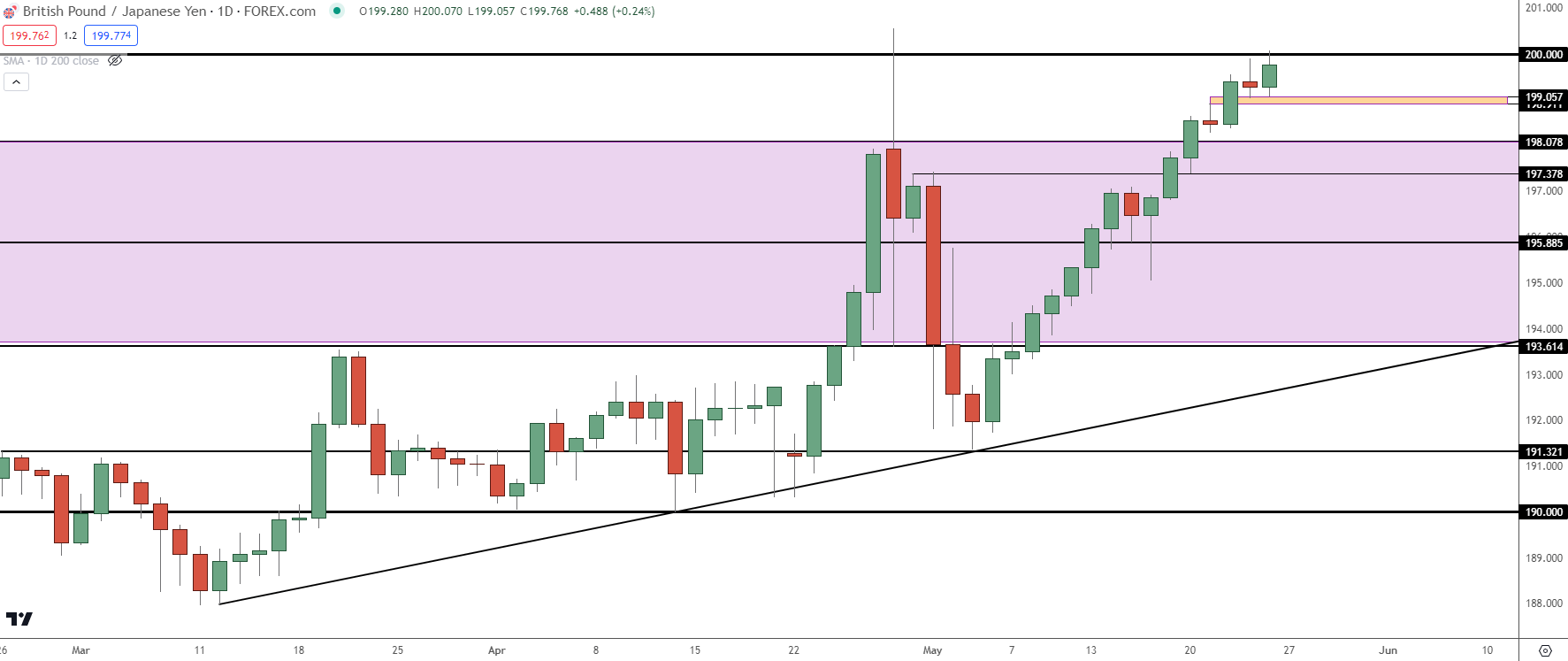

GBP/JPY

GBP/JPY has been in the midst of an aggressively bullish trend ever since the intervention-fueled pullback a few weeks ago. On the heels of that sell-off, I looked at a spot of support at 191.32. And it’s been mostly up for the pair since then, with only brief interruption in the bullish trend.

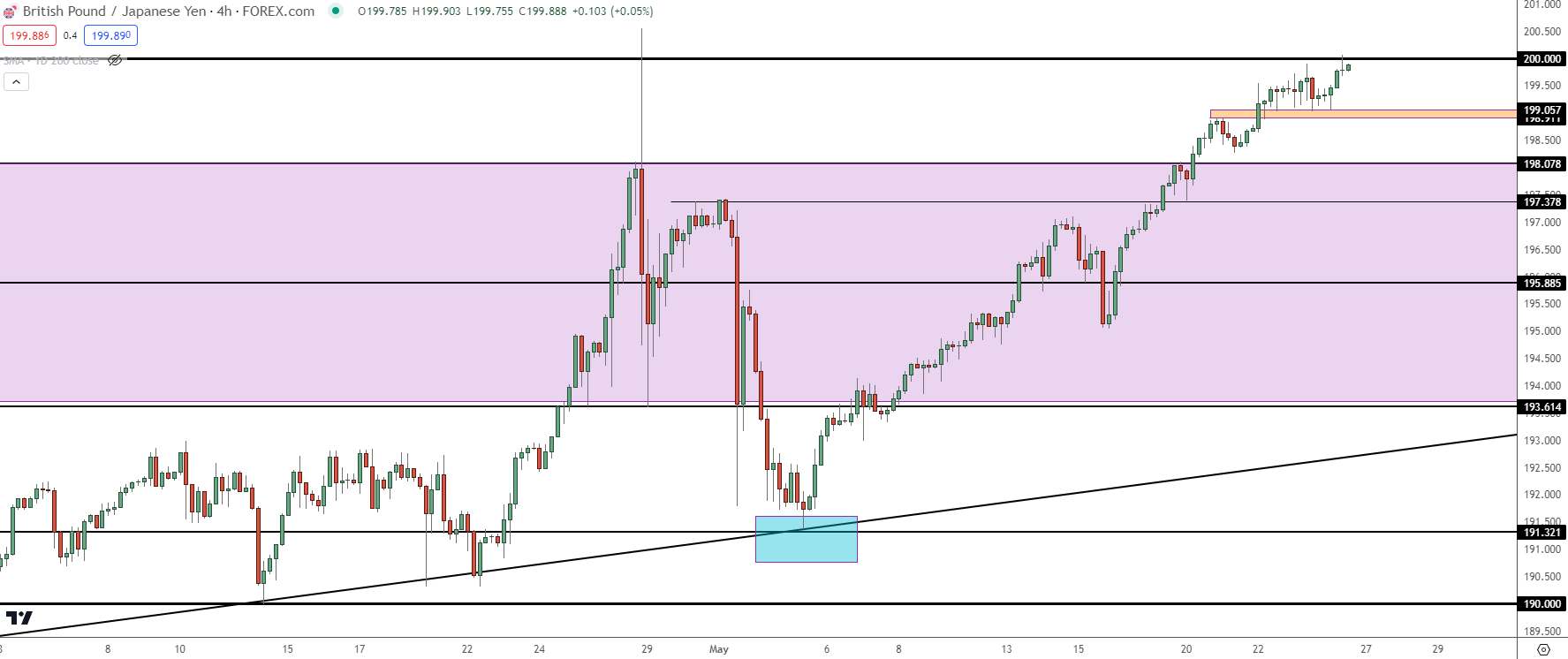

GBP/JPY Four-Hour Price Chart

Chart prepared by James Stanley, GBP/JPY on Tradingview

The big item for this week was another test of the 200.00 handle, which had only traded briefly before the intervention came into play.

That price traded on Friday and bulls were unable to put any substantial drive over that level, but there does remain potential given the dynamics around the Bank of Japan. The spot rate that seems to get the attention of the Japanese Finance Ministry is USD/JPY as it was the 160.00 level that provoked the prior intervention. And at this point, USD/JPY is well-below the 160.00 handle (which can be explained by the bullish GBP/USD outlay over the past few weeks as looked at above). This can keep the door open for continuation, even above the big figure.

But – that price will need to gain acceptance first as a major psychological level of that nature can take some time for buyers to take out. The very essence of a psychological level is that price ‘feels’ far more expensive than just two pips higher at a 200.01 quote versus 199.99, and that can lead to lesser demand above that price and as there’s evidence of stall, that can motivate longs to take profits, which can lead to more supply.

The big question at that point is where buyers return, and if it shows at a higher-low, it keeps the door open for another re-test of the psychological level and with enough persistence and force, buyers can eventually break through.

For supports, there’s an aggressive area for higher-low support around the 199.00 handle, and then another down around the 198.08 level that’s the top-side of the gap from 2008. Below that is a spot of resistance-turned-support that plots at 197.38 and if bulls can’t hold that price, the door opens for a deeper drop down to around 195.89.

GBP/JPY Daily Price Chart

Chart prepared by James Stanley, GBP/JPY on Tradingview

Chart prepared by James Stanley, GBP/JPY on Tradingview

EUR/GBP

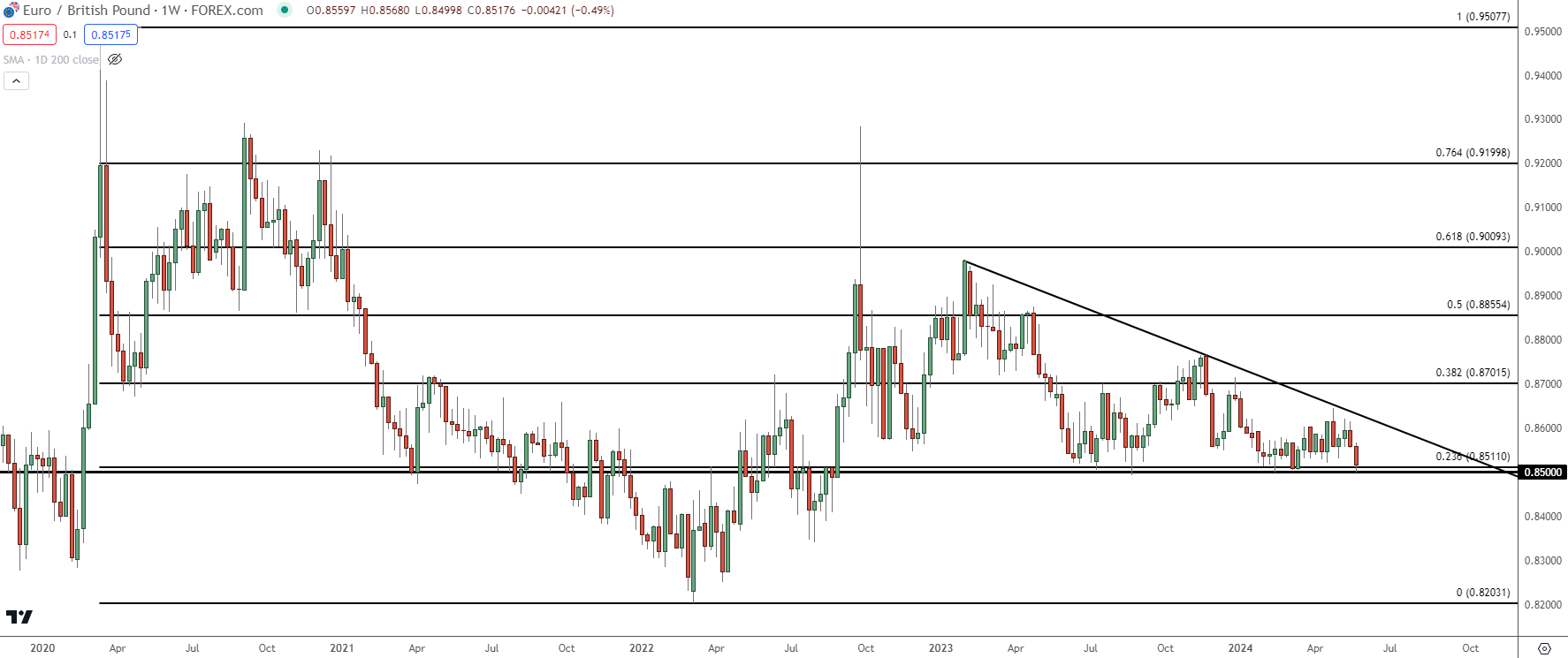

I looked into this one in the weekly forecast a few weeks ago, and as I shared there, two different bearish formations were present. There was a bear flag as taken from a bullish channel that arrived after a test of the .8500 handle; and bigger picture, there was a descending triangle present with that .8500 level helping to set horizontal support.

The other side of the matter, however, was a relative dearth of volatility so far in 2024 trade as the pair had spent much of the year within an approximate 120 pip range. But, given the fundamental backdrop where the ECB seems closer to cuts than the BoE, there’s an argument for continued divergence between the two economies.

At this point the .8500 handle has come back into play and there’s potential for the descending triangle to fill-in.

EUR/GBP Weekly Price Chart

Chart prepared by James Stanley, EUR/GBP on Tradingview

Chart prepared by James Stanley, EUR/GBP on Tradingview

--- written by James Stanley, Senior Strategist