British Pound Technical Outlook: GBP/USD Short-Term Trade Levels

- British Pound in consolidation just above multi-month uptrend

- GBP/USD monthly opening-range taking shape - breakout pending

- Sterling resistance 1.2450, 1.25, 1.2537 (key)- support 1.2350s, 1.2308, 1.2275 (critical)

The British Pound is trading just above multi-month uptrend support with the May decline now contracting into the monthly opening-range. The battle-lines are drawn ahead of next week’s key Fed meeting and the focus is on a breakout in the days ahead. These are the updated targets and invalidation levels that matter on the GBP/USD short-term technical.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Sterling setup and more. Join live on Monday’s at 8:30am EST.

British Pound Price Chart – GBP/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In last month’s British Pound short-term outlook we noted that the, “Sterling breakout maybe vulnerable to exhaustion on the back of a 7.3% rally off the yearly lows.” The resistance zone in focus was at the May 2022 highs around 1.2667- Cable briefly registered an intraday high at 1.2679 before reversing sharply lower with a decline of nearly 3% turning just ahead of slope support into the close of the month.

The June opening range is now being carved out between a narrowing region between uptrend support and Fibonacci resistance. We’re on breakout watch from here with the threat of a deeper correction while below last week’s high.

British Pound Price Chart – GBP/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Notes: A closer look at Sterling price action shows GBP/USD carving the weekly opening-range just below near-term resistance at the December & January highs / 38.2% retracement around 1.2446/50. Near-term bearish invalidation is eyed with the May channel (currently ~1.25) with a breach / close above the 61.8% retracement of the recent decline at 1.2537 needed to validate a breakout of the June opening-range towards 1.2667.

Initial support rests with the lower parallel (blue slope, currently near ~1.2350s) backed by the May / April lows at 1.2308 and 1.2275 respectively. A break / close below this threshold would suggest a larger trend reversal may be underway with such a scenario exposing initial support objectives at 1.2138/71 and the objective yearly open at 1.2084- both regions of interest for possible downside exhaustion / price inflection IF reached.

Bottom line: Sterling is in correction within a multi-month uptrend with GBP/USD now carving the monthly opening-range just above slope support. From a trading standpoint, rallies should be limited to the 1.25-handle IF price is heading lower on this stretch. Ultimately, a close above 1.2537 would be needed to mark resumption of the broader uptrend. Keep in mind the FOMC interest rate decision is on tap next week – stay nimble here until we get the breakout. Review my latest British Pound Weekly Forecast for a closer look at the longer-term GBP/USD trade levels.

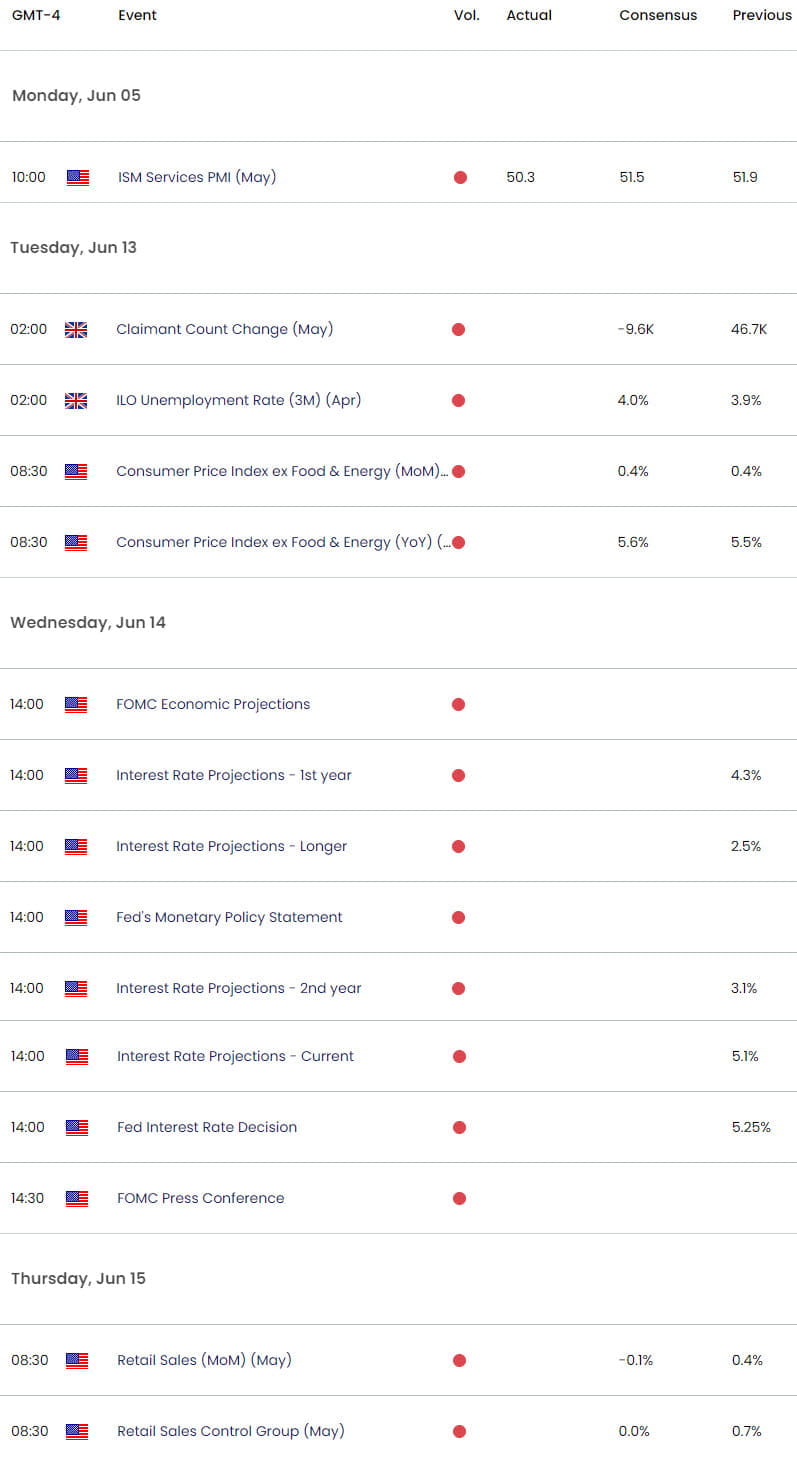

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Euro Short-term Outlook: EUR/USD Yearly-Open Support Pivot in Play

- US Dollar Short-term Outlook: USD Rips into Make-or-Break Resistance

- Australian Dollar Short-term Outlook: AUD/USD Moment of Truth at Support

- Gold Short-term Price Outlook: XAU/USD Plunge Searches for Support

- Japanese Yen Short-Term Outlook: USD/JPY Ripper Eyes May / 2023 Highs

- Canadian Dollar short-term outlook: USD/CAD moment of truth at yearly support

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex