The latest from Downing Street is that both sides are working hard towards a deal but little progress has been made. The weeks pass but the rhetoric doesn’t appear to change.

The unofficial deadline for a deal for both the UK and the EU was the end of this week. Expectations are that this soft deadline, like so many other before it will be pushed back, slipping into the coming week. Talks have been in progress in London through the week with the two side redoubling efforts.

Joe Biden as President Elect bodes well for a Brexit trade deal

Joe Biden is President elect. Biden, who has Irish ancestry is adamant that a post Brexit trade deal must not compromise peace in Northern Ireland. The Brexit Withdrawal included a protocol guaranteeing no customs posts at the Irish border. However, Boris Johnson’s internal markets bill could renege on the withdrawal agreement, a move that Biden ha vocally disapproved.

Trump had been a vocal supporter of Brexit leading to optimism of a quick trade deal with the US, making a trade deal with the EU less important. Biden, has adopted a very different stance offering support to Ireland and insisting that a US -UK trade deal could only happen if the Good Friday agreement is protected. With a deal with the US no longer feeling certain, a deal with the EU once again becomes very important.

Whilst this could make a trade deal more likely it by no means that there will be a trade deal. So how is this playing out in the stock market?

GBPUSD

GBP has been the Brexit barometer through the years. At $1.31 pound investors are still confident that a deal will be agreed in time. That said GBPUSD has sold off over the past two sessions as nerves grow ahead of this soft deadline.

Tesco

Choosing single stocks to trade ahead of Brexit is more challenging, especially when the covid complication is thrown in. Tesco could be a solid choice given that people will continue shopping for food regardless of Brexit & Covid. Whilst a no deal Brexit will certainly mean that Tesco faces higher costs and more regulation, given the sheer size of the retailer it can probably cope better than most.

Unilever

Looking at companies which make the majority of their earnings abroad could also be a solid strategy rather than trying to second guess the politicians. Unilever could be an interesting play. Not only is does to make most of its sales abroad with a strong focus on emerging markets such as India & China, but it has also showed resilience through covid.

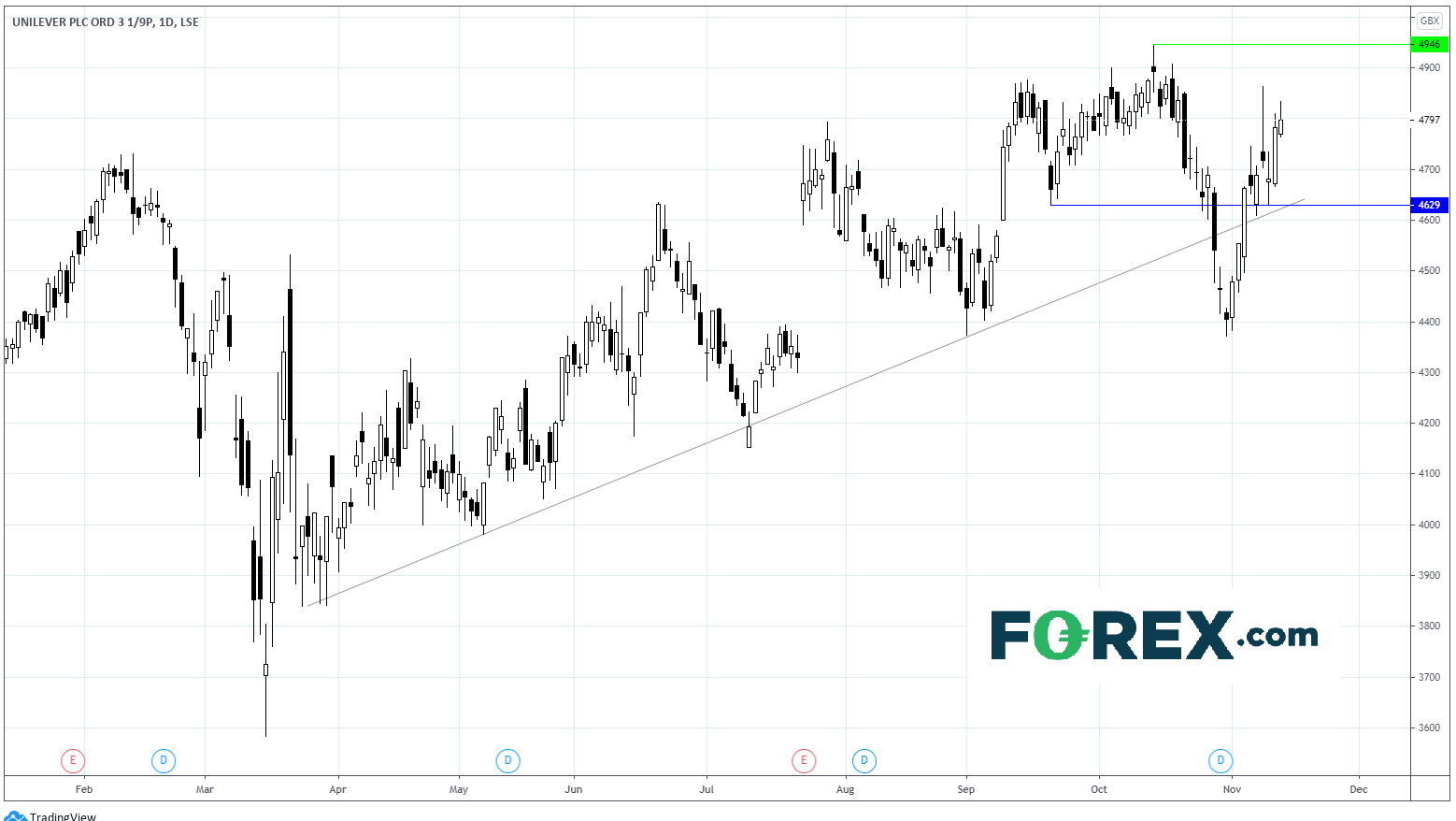

Unilever Chart

The stock has put in a solid performance from mid-March lows and now trades +10% YTD. The stock remains comfortable above its 8-month-old ascending trendline. Immediate resistance can be seen at 4946, its October high, prior to 5000p the psychological figure and its all-time high close to 5200p. On the flip side, immediate support can be seen at 4629p It would take a move below the ascending trendline at this same level to negate he current bullish trend.