- Chinese stocks keep griding higher, breaking key technical levels along the way

- While not yet classified as bull markets, they have the hallmarks of those seen in the past

- China A50 and Hang Seng futures are two markets we examine in this note

- USD/CNH is also starting to look constructive, a potential positive for foreign investors

Chinese stocks continue to grind higher with some indices managing to break key technical levels, adding to the risk that more investors will participate in the rally. Amazingly, many indices are on the cusp of entering a bull market, not that many investors probably know it. After the relentless bear market bottomed earlier this year and initial intrigue about the state-endorsed rescue measures ran its course, we’ve hardly heard a peep from most financial media outlets since.

But I suspect it won’t remain that way for long.

China stock rebound follows the bull market playbook

Chinese stocks remain comparatively cheap relative to the rest of the world, with fiscal and monetary policymakers actively seeking to ease conditions further. Yes, there are ample risks but to generate portfolio and trading alpha, sometimes you need to take a contrarian view.

As famous Sir John Templeton once remarked, "bull markets are born on pessimism, grown on scepticism, mature on optimism, and die on euphoria." Right not, what we’re seeing is sticking exactly to the script. We’ve had a bull market in pessimism, now the scepticism phase has begun.

Adding to the sense the rally may have legs, many high beta sectors (those that are more volatile than the underlying market) have already entered bull markets with the Hang Seng Tech index becoming the latest to take that mantle on Tuesday, following the tech heavy ChiNext Index on Monday.

As I written numerous times over the past few months, the most important ingredient to turn China’s stock market around was confidence. Slowly but surely, that appears to be happening.

Looking at the charts, you can see why traders should be taking an interest.

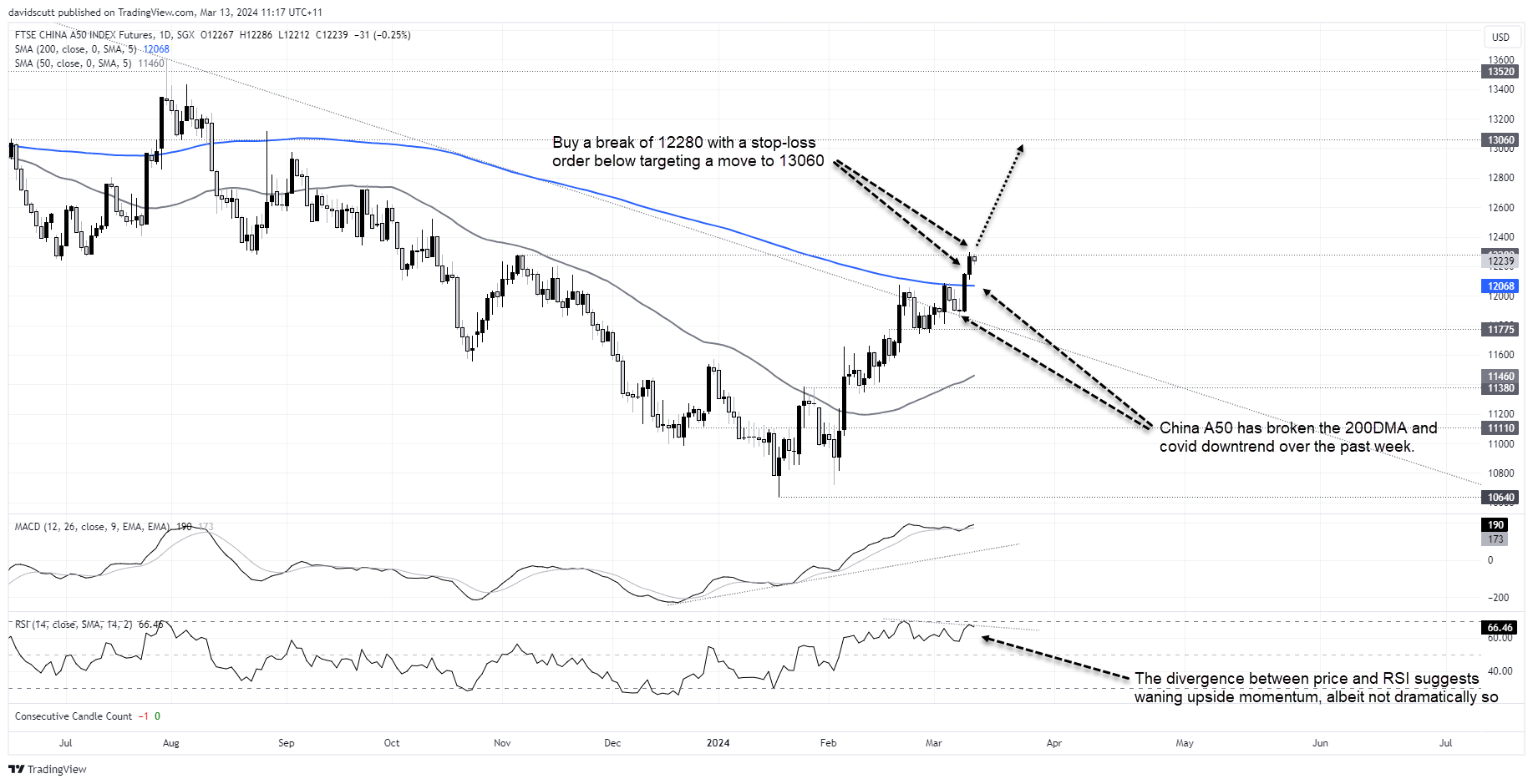

China A50 breaks key topside levels

China A50 futures have not only done away with covid downtrend but also 200-day moving average late last week, extending the rebound from January’s lows to 15%. While some may look at the move and think it’s already run a long away, you need to look at just how far these markets have fallen. You may have missed the bottom but that doesn’t mean there’s still not ample trading opportunities in either direction depending on your timeframe.

Testing horizontal resistance at 12280, we’ve now siting at level that carries decent risk-reward depending on how the price performs near-term. The bias right now is higher, meaning traders should be on the lookout for a potential topside break. If that eventuates, you could buy with a stop loss below the level targeting another a further higher.

The next major resistance level is 13060 – where it did plenty of work either side during 2023. In between, minor resistance may be encountered at 12500 and 12700, two levels where countertrend rallies stalled last year. The only concern is the divergence between price and RSI over the past month, indicating waning momentum. An upside break could change that picture quickly, should it occur.

Alternatively, should the price fail to break 12280, you could sell below the figure with a stop loss order above targeting a potential retest of the 200-day moving average. The risk-reward of this trade is not as compelling as buying a topside break, nor screens as likely given the prevailing trend.

Hang Seng hits 2024 high

Like the A50 setup, Hang Seng futures sit in a similar position even though they’re still a distance away from breaking the covid downtrend and 200-day moving average. But it may not remain that way for long.

Sitting in a clear uptrend since the January lows, futures surged to the highest level this year on Tuesday, extending its rebound to 16%. It’s now testing resistance at 17200, with a topside break bringing a retest of the 200DMA and covid downtrend into play.

Should we see a clean break of 17200, traders could buy with a stop below targeting the 200DMA. Unlike the A50, momentum indicators such as RSI and MACD continue to build to the upside, making this trade more likely that a potential reversal. Nor is the risk-reward compelling for going short right now unless you’re looking for a big push lower. Such an outcome screens as low based on the prevailing trend.

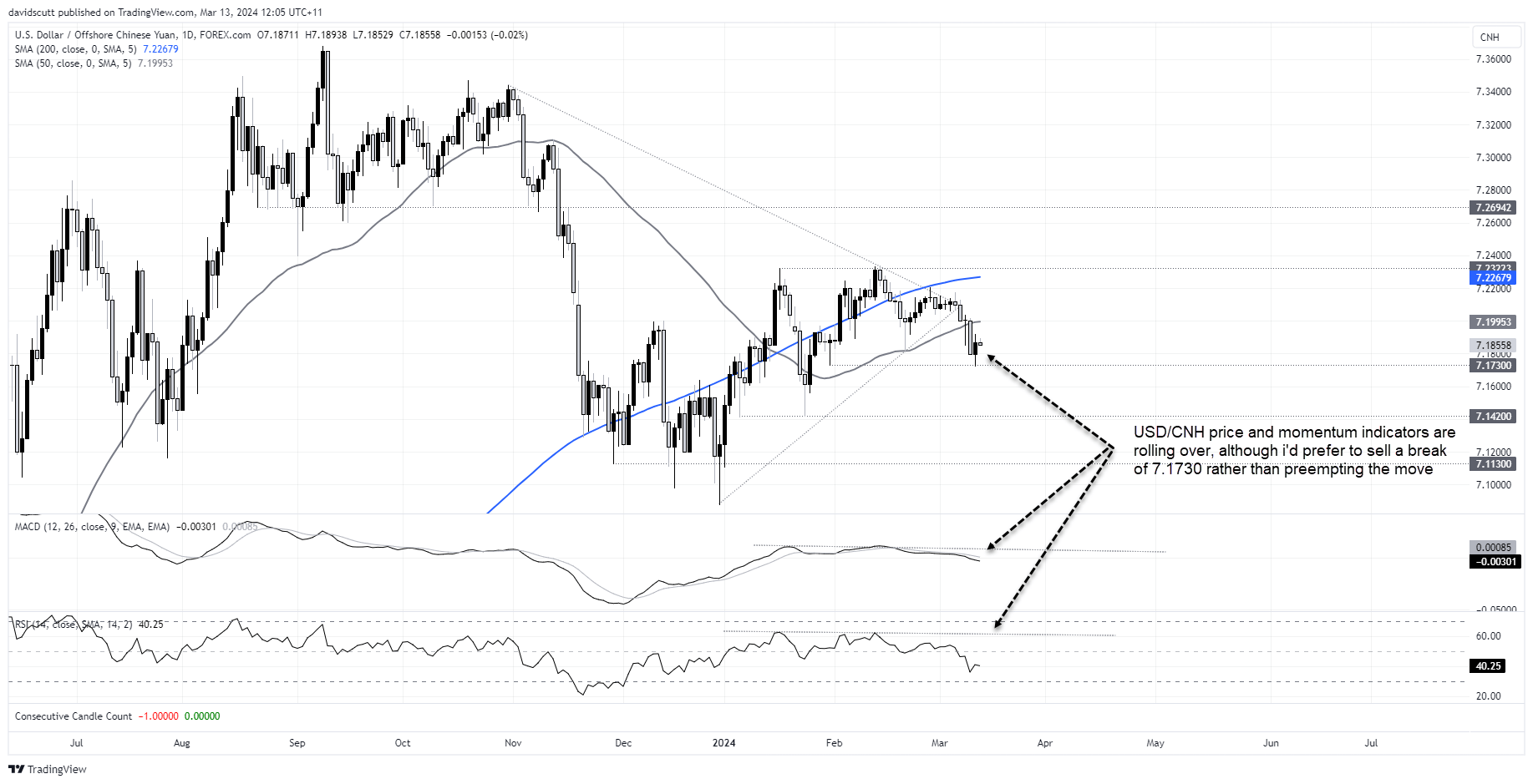

USD/CNH unwind a potential positive for foreign capital flows

While it doesn’t get anywhere near the coverage of the Japanese yen, the Chinese yuan is starting to look constructive against the US dollar with USD/CNH showing signs of rolling over. Should that trend continue, it may encourage offshore investors to buy into the equity market rally given the potential pickup on both asset and currency appreciation.

USD/CNH has already done away with the 50 and 200-day moving averages, breaking out of the triangle pattern it was trading in last week before stalling at 7.1730. February’s hot US CPI print, and the lift in US bond yields that accompanied it, has seen the price bounce marginally over the past 24 hours.

I’m inclined to buy USD/CNH near-term based on fundamentals, although looking at momentum indicators rolling over it tells me the downside break may have legs. As such, I’m prepared to be patient for now until there’s greater conviction.

A clean break of 7.1730 would bring 7.142 into play. Below, the pair tagged 7.1130 on six separate occasions in December, making that tougher test for shorts. On the topside, the 50 and 200-day moving averages are the initial targets.

-- Written by David Scutt

Follow David on Twitter @scutty