- Bitcoin has recorded a decline of over 15% from its peak and is now near the critical 90k barrier.

- The Fear and Greed Index for cryptocurrencies has shifted from highly positive values to a neutral zone, with the possibility of further decline. This change has increased selling pressure on Bitcoin.

The Role of the Fed

In December 2024, Federal Reserve Chairman Jerome Powell addressed the possibility of a favorable regulatory environment for Bitcoin following Trump’s arrival. During a press conference, Powell stated that the central bank's internal regulations prohibit holding Bitcoin and that any changes to this policy would require congressional approval. This directly impacts the feasibility of establishing a strategic cryptocurrency reserve.

Currently, the most concrete proposal for cryptocurrency regulation comes from Senator Cynthia Lummis, who introduced the Bitcoin Act of 2024. This legislation would allow the Treasury and the Fed to acquire 200,000 Bitcoin annually over five years, equivalent to 5% of Bitcoin's global supply. However, the proposal faces resistance in the Senate, and its approval remains uncertain.

Since Powell's statements, Bitcoin has continued its downward trend, falling from its peak of $108,000 to its current support level at $90,000, primarily due to reduced confidence in a stable regulatory plan in the U.S.

Market Confidence

The Fear and Greed Index for cryptocurrencies currently stands at 47, indicating a neutral zone. This reflects weakened short-term confidence, as bullish positions have lost strength in the market. The lack of consistent buyers has given way to a dominance of selling positions.

Table of CMC Crypto Fear and Greed Index Performance

Source: Coinmarketcap

In the chart, the index dropped from extreme greed values (88 in November) to neutral levels (below 60) between late December and early January. This decline aligns with a significant correction in Bitcoin's price. If the index continues to fall, market confidence is likely to erode further, maintaining selling pressure in the short term.

Chart of CMC Crypto Fear and Greed Index Trend

Source: Coinmarketcap

Bitcoin Technical Outlook

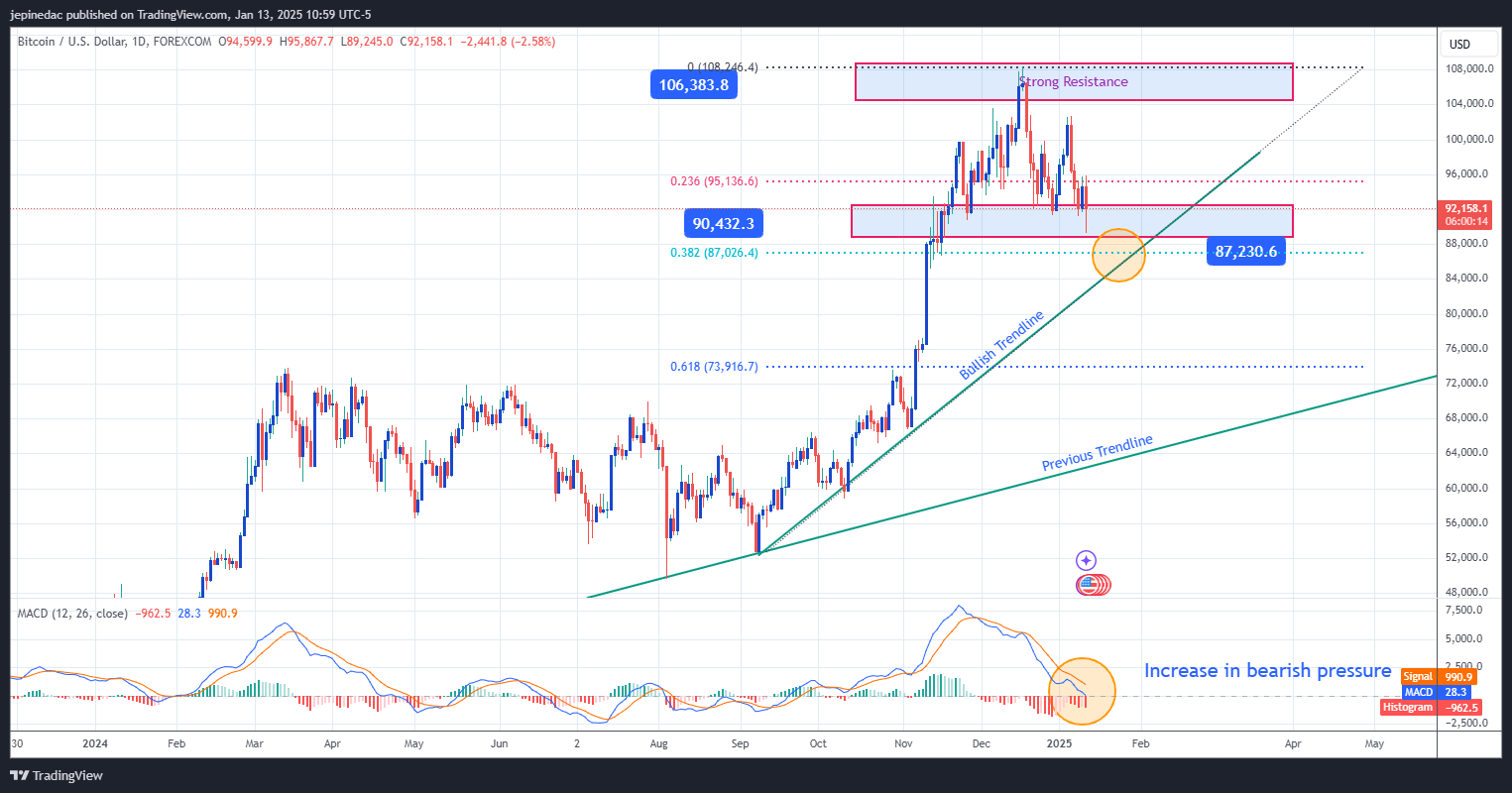

From its all-time high of $108,000, Bitcoin has experienced one of the largest bearish corrections in the past three months. It has now fallen over 15% since mid-December and is facing a critical barrier at the $90,000 level.

Source: StoneX, Tradingview

- Lack of Clear Trend: The market is showing indecision, creating a short-term lateral range between the $106,000 ceiling and the $90,000 support.

- 106k: This level represents the comfort zone for bullish movements over the past month and corresponds to the all-time high. Oscillations near or above this level could restore confidence and create new opportunities for an upward trend.

- 90k: Currently acts as the key support level for bearish movements. This is the third time the price has tested this barrier. A sustained break could extend the bearish trend in the short term.

Below $90k lies the $87k level, marked by the 38.3% Fibonacci retracement and a key trendline, further reinforcing this price zone as a critical barrier. Breaks below $87k could accelerate selling pressure in the coming sessions.

- MACD:

- The signal line and the MACD line show a negative slope, approaching the neutral zone at 0.

- The MACD histogram continues to oscillate below the 0 level, indicating that recent movements have been predominantly bearish.

- The signal line and the MACD line show a negative slope, approaching the neutral zone at 0.

The indicator reveals that most recent oscillations have remained in a bearish zone, highlighting the dominance of selling positions in the market. As the histogram moves further from the neutral line, bearish pressure is likely to intensify. At present, there are no extreme signals from the indicator suggesting a potential short-term bullish correction.