When:

- Thursday 13th February

Expectations:

- Pre-tax profit +5.2% £6 billion vs £5.7 billion (same period last year)

Barclays ids the first of the UK big 5 banks to report full year figures. With the PPI deadline firmly in the rear view mirror, Barclays will be hoping to unveil a lift to annual profits when it reports on Thursday.

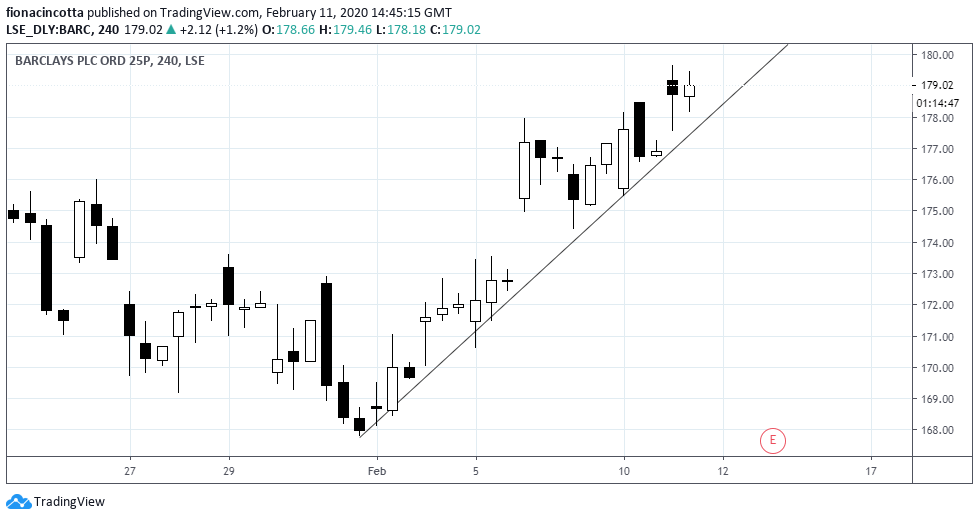

The deadline for PPI claims was last August and coincided with Barclays share price falling to its lowest level since the financial crisis. In addition to a surge of late PPI claims, shareholders also grappled with Brexit uncertainty and criticism from activist investor Edward Bramson.

Barclays last updated in October when it announced a further £1.1 billion to cover PPI claims and as it warned on the outlook for 2020.

Since then the playing field has changed, but some headwinds remain. These results will be key to shed light on the direction that the bank is traveling in.

1. Conservative election victory

Any signs of the Boris bounce in the numbers will be closely watched. Traders and analysts alike will want to see if the Conservative’s outright election victory is benefiting the banking sector in anyway. The share price of Barclays along with its peers, rallied around 12% in the days following the December vote. However, these gains were rapidly pared following a more dovish BoE and continued concerns over Brexit.

2. Brexit trade deal

Whilst the UK has now left the EU there is still lingering uncertainty over whether the UK and the EU will agree a trade deal before the end of the transition period or not. Lingering Brexit uncertainty dragged on the UK economy last year, pushing the BoE to adopt a more dovish stance. Further uncertainty could continue to drag on the UK economy increasing uncertainty surrounding the interest rate environment; a headwind discussed back in October.

3. Edward Bramson

The performance of the Corporate and Investment Bank (CIB) will be closely eyed after Barclays came under pressure last year from activist investor Edward Bramson to reduce the size of its investment bank. Bramson has extended the duration of the stake that his vehicle holds in Barclays through a complex loan deal, from December 2019 to July 2022. This raises the prospect of a fresh campaign from the US based activist.

Broker Upgrades

Over the last three weeks Jefferies and UBS have reiterated their “buy” rating on Barclays, both upping their target price to 252p and 195p respectively. From Monday’s close those target prices imply upside to the tune of 43% and 10.7%.