Bank of England (BoE) Interest Rate Decision

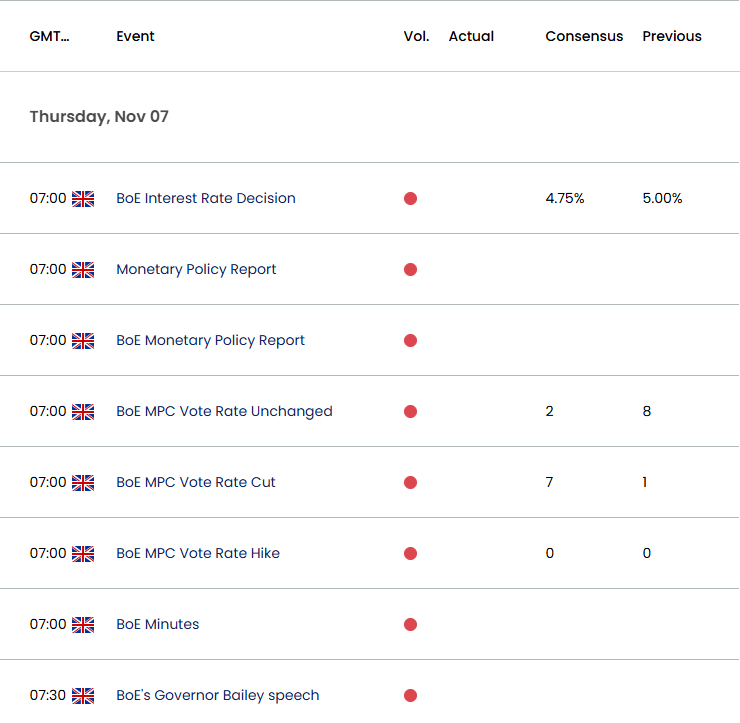

The Bank of England (BoE) moved to the sidelines following the 25bp rate-cut at the August meeting, with the Monetary Policy Committee (MPC) voting 8-1 to keep Bank Rate at 5.00% in September.

UK Economic Calendar – September 19, 2024

The BoE Minutes revealed that ‘for most members, in the absence of material developments, a gradual approach to removing policy restraint would be warranted,’ while one official preferred to lower UK interest rates in order to ‘enable a smooth and gradual transition in the policy stance, and to account for lags in transmission.’

The vote suggests the majority of the MPC are in no rush to switch gears as the committee insists that ‘monetary policy would need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term had dissipated further.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

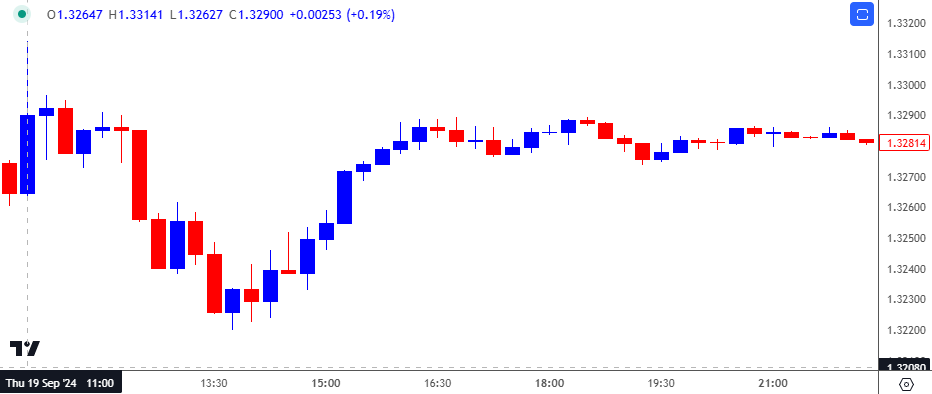

GBP/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

GBP/USD climbed to a session high of 1.3314 following the BoE decision, with the exchange rate defending the advance to end the day at 1.3284. The British Pound appreciated over the remainder of the week as GBP/USD closed at 1.3322.

Looking ahead, the BoE is expected to lower Bank Rate by 25bp in November, and Governor Andrew Bailey and Co. may retain a gradual approach in unwinding its restrictive policy as the central bank continues to combat inflation.

With that said, a hawkish rate-cut may ultimately prop up the British Pound as the 2024 UK Budget does little to influence monetary policy, but Sterling may face headwinds if the BoE shows a greater willingness implement lower interest rates at a faster pace.

Additional Market Outlooks

Monetary vs Fiscal Policy: Implications for FX Markets

US Dollar Forecast: USD/JPY Vulnerable to Looming Fed Rate Cut

AUD/USD Recovery Pulls RSI Away from Oversold Territory

USD/CAD Reverses Ahead of 2022 High with Fed Rate Decision on Tap

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong