Australian monthly consumer price index (February)

- Inflation rose 6.8% y/y (7.1% expected, 7.4% previously)

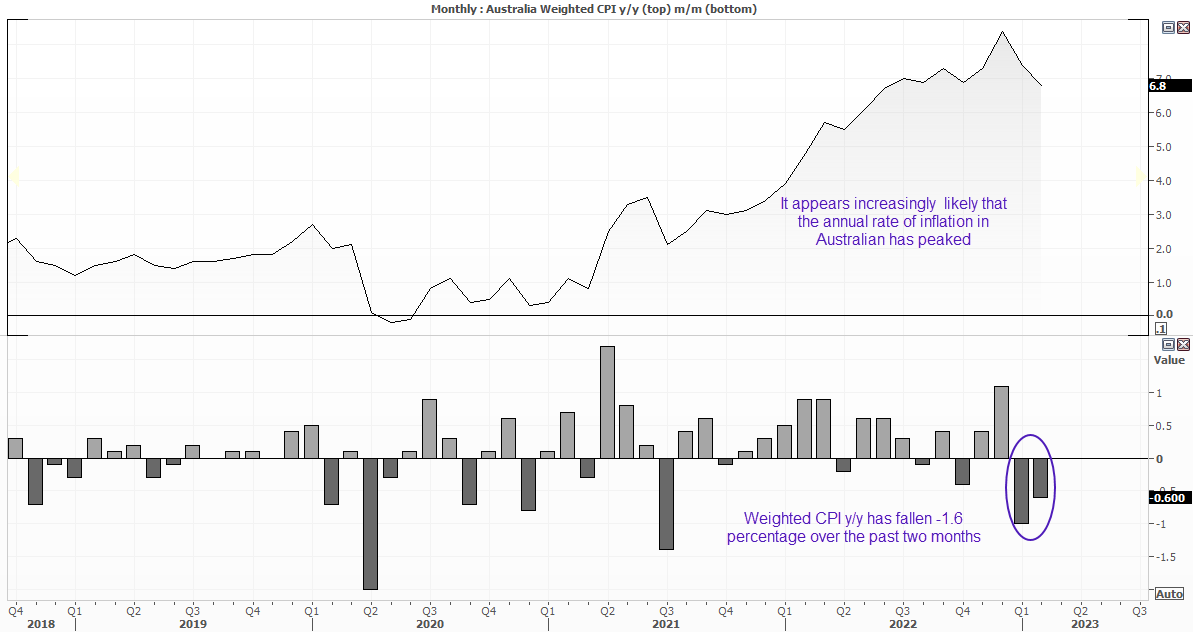

- Inflation likely peaked at 8.4% y/y

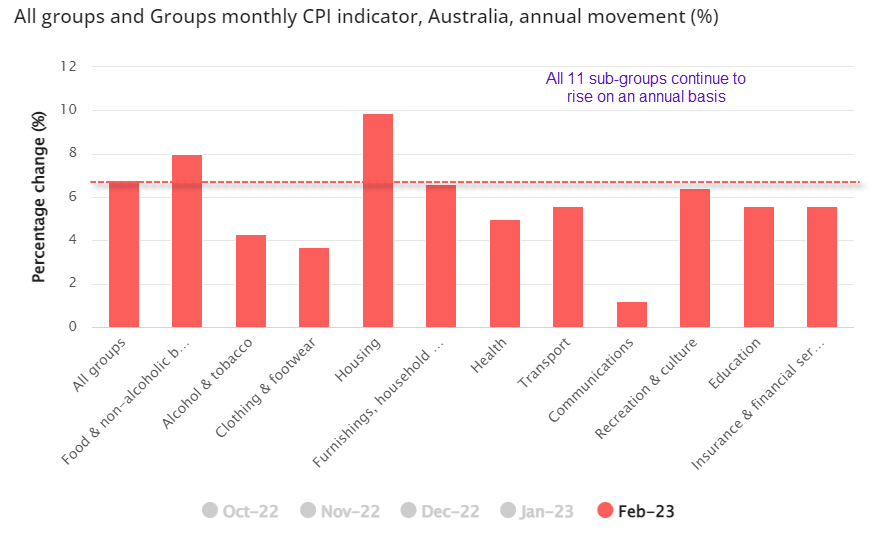

- All 11 sub-groups increased in February

- Housing rose 9.9% y/y, food and non-alcoholic beverages was up 8%

- Electricity and dairy were up 17.2% and 14.3% respectively

If there were any doubts as to whether the RBA will pause next week, today’s inflation report surely confirms that they will. Given the RBA’s dovish hike, comments of a pause from Governor Lowe and the discussion of it within the March minutes, I think the RBA have all the reasons they need to chill out, hold rates steady and assess incoming data.

Money markets and economists diverge

The RBA cash rate futures implied a 95% chance that the RBA will hold rates at their meeting next week. Yet I am seeing a growing chorus of established economists argue a case for a hike, even after today’s figures. One argument is that the RBA will want to see the quarterly inflation print before deciding whether to hold rates. And as that data set is not publicly available until April 26th, it could pave the way for another 25bp hike next week and for them to decide in May whether to pause. Whilst this argument is certainly worth considering, I personally lean towards a pause.

Why the RBA can opt to pause next week, ahead April's quarterly inflation report

Around 6 or so months ago I frequently made the case that the RBA didn’t want to raise rates any more than was necessary but, unfortunately for them (and the general public), incoming data simply did not warrant a pause. But they now have two months of softer inflation.

The RBA were quick to flag the potential for peak inflation after one soft print, and now they have two under their belt. Add into the mix the recent banking woes in the US and Europe, and the fact the minutes confirmed discussion of a pause (after Lowe mentioned the possibility publicly), the RBA have enough reasons to justify the pause they craved around 6 months ago.

Furthermore, members have faced political heat and unfavourable headlines, and it should be remembered that central bankers are still humans who can react or make decisions emotionally. And for those reasons, I suspect they will jump at the chance to pause ahead of the more ‘robust’ quarterly inflation report in late April. They can always hike again in May if the quarterly read blows out at an uncomfortable rate.

Inflation may have peaked, but we can likely forget cuts any time soon

Still, let us not lose sight of the fact that inflation remains high and there are no immediate signs of it falling quickly. All 11 sub-groups continue to rise on an annual basis, with housing up nearly 10% and food up 8%. Drilling down further, electricity is up 17.2% y/y whilst dairy and related products are up 14.3% y/y.

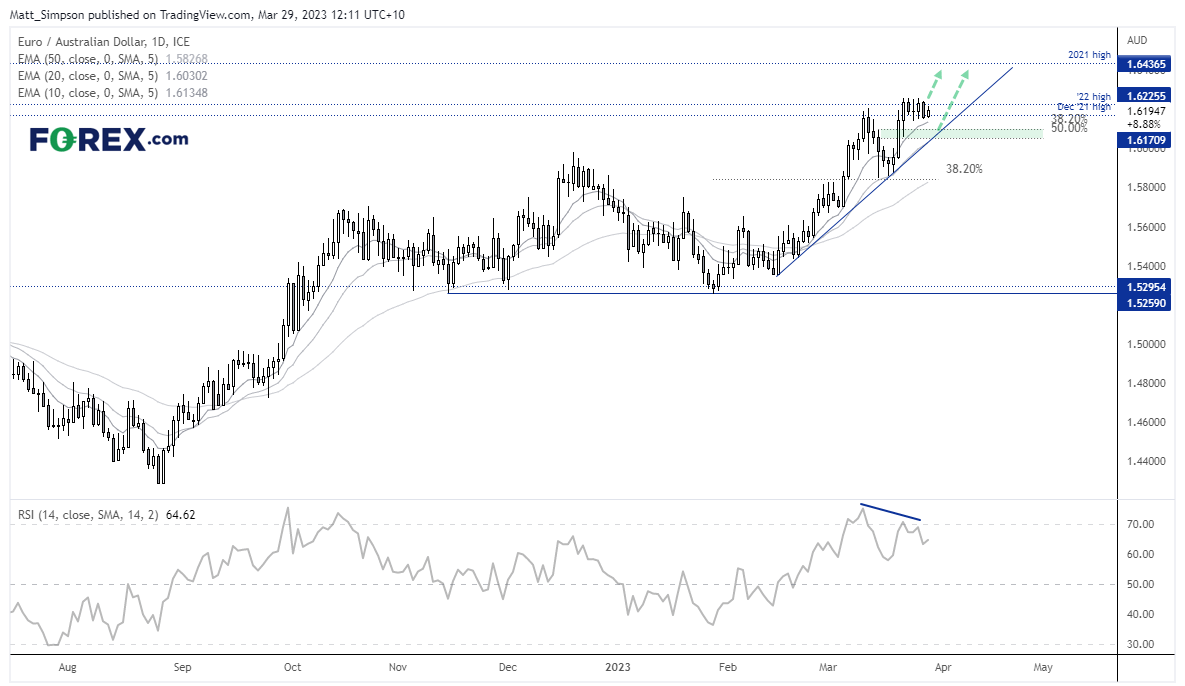

EUR/AUD consolidates near 19-month highs

A strong bullish trend has developed on the daily chart of EUR/AUD, and the market reached its highest level since August 2021 last week. Prices are having a tough time breaking higher, and are essentially consolidating around the December 2021 and 2022 highs. A bearish divergence has formed on the RSI (14), and perhaps that is a prelude for a break of the bullish trendline and trend reversal.

But with European data continuing to outperform, inflation remaining high, the ECB remaining hawkish, the pair has the potential to move higher as long as no more European banks implode and the RBA remain on track for a dovish pause next week. IN which case, we’d seek bullish setups along trend support or the Fibonacci zone, or wait for a break of last week’s highs to assume bullish continuation.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge