Australian Dollar Outlook: AUD/USD

AUD/USD rebounds from a fresh monthly low (0.6131) to pull the Relative Strength Index (RSI) back from oversold territory, but the rebound in the exchange rate may turn out to be temporary as it continues to carve a series of lower highs and lows.

Australian Dollar Forecast: AUD/USD Halts Four-Day Selloff

AUD/USD halts a four-day selloff after failing to defend the 2022 low (0.6170), and the RSI may show the bearish momentum abating as it attempts to climb back above 30.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

However, the US Dollar may continue to outperform against its Australian counterpart as the 256K rise in US Non-Farm Payrolls (NFP) boost the Federal Reserve’s scope to pause its rate-cutting cycle, and the weakness following the US election may persist should AUD/USD continue to track the negative slope in the 50-Day SMA (0.6393).

Australia Economic Calendar

Nevertheless, the update to Australia’s Employment report may influence AUD/USD as the economy is projected to add 15.0K jobs in December, and evidence of a strong labor market may encourage the Reserve Bank of Australia (RBA) to keep the cash rate on hold as ‘returning inflation to target remains the Board’s highest priority.’

In turn, a positive development may generate a bullish reaction in the Australian Dollar as the RBA appears to be in no rush to switch gears, but a weaker-than-expected employment report may produce headwinds for the Australian Dollar as it puts pressure on Governor Michele Bullock and Co. to implement lower interest rates.

With that said, AUD/USD continue to track the negative slope in the 50-Day SMA (0.6393) as it holds below the moving average, but the exchange rate may stage a larger rebound should it snap the bearish price series carried over from last week.

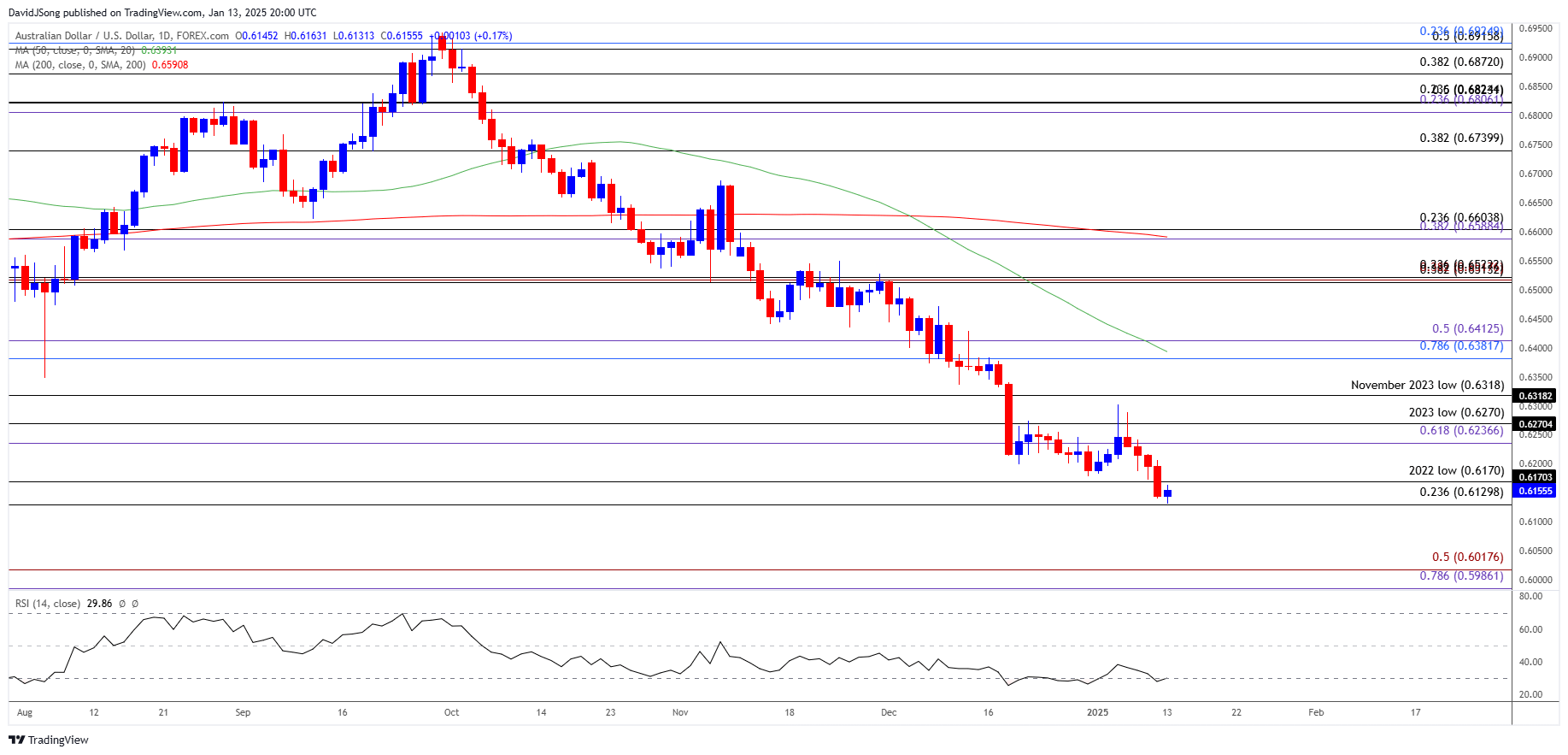

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- The recent series of lower highs and lows pushed AUD/USD below the 2022 low (0.6170), with a close below the 0.6130 (23.6% Fibonacci retracement) to 0.6170 (2022 low) zone bringing the 0.5990 (78.6% Fibonacci extension) to 0.6020 (50% Fibonacci extension) region on the radar.

- Next area of interest comes in around April 2020 low (0.5980), but AUD/USD may snap the bearish price series should it struggle to close below the 0.6130 (23.6% Fibonacci retracement) to 0.6170 (2022 low) zone.

- A move above the 0.6240 (61.8% Fibonacci extension) to 0.6270 (2023 low) region may push AUD/USD back towards the November 2023 low (0.6318), with the next area of interest coming in around 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension).

Additional Market Outlooks

USD/JPY Pulls Back to Keep RSI Below Overbought Zone

US Dollar Forecast: USD/CHF Climbs Towards 2024 High

GBP/USD Approaches November 2023 Low

Gold Price Recovery Eyes December High

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong