"The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. This will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently. This is likely to take some time."

Earlier this week, Westpac Consumer Confidence data showed employment expectations amongst respondents improved to their best level since the mid-1990s, reflecting a high level of job vacancies.

However, October's Australian Labour Force data today has proved a sombre reminder of the RBA's cautionary note above, as employment fell by -46.1k vs. expectations for a +50k rise. The unemployment rate rose to 5.2% vs. expectations of 4.8%, and the participation rose less than expected to 64.7%.

Nonetheless, given the worse is now behind and based on the solid pick up in leading labour market indicators, the reaction from the currency has been modest. The AUDUSD fell from .7338 pre the data to a low of .7316, while AUDNZD fell from 1.0380 to a low near 1.0356.

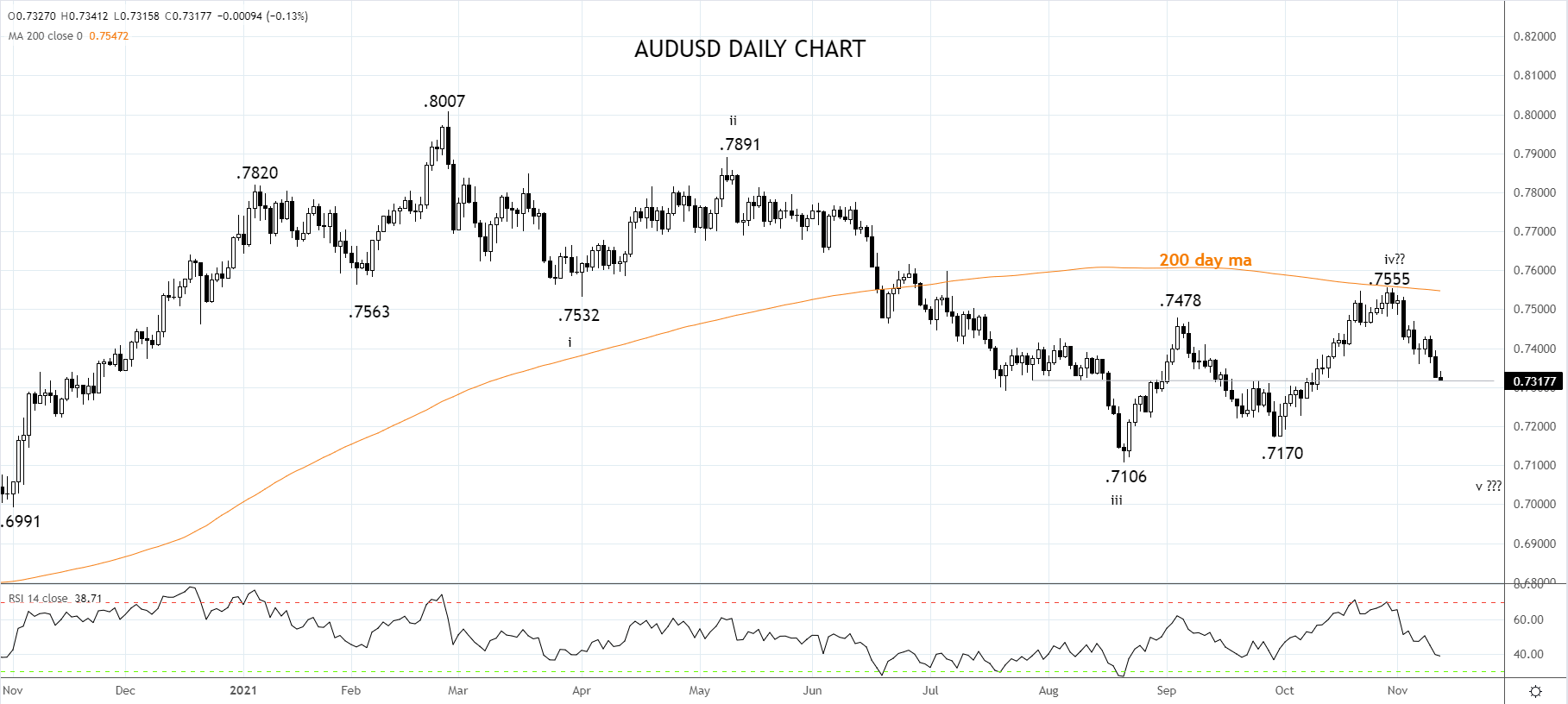

Technically and fundamentally, we remain bearish in the AUDUSD; however, after reaching the initial short-term target of .7320 written about in this article here, we look for better levels to short the AUDUSD before the next leg towards .7100c commences.

Source Tradingview. The figures stated areas of November 11, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

"The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. This will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently. This is likely to take some time."

Earlier this week, Westpac Consumer Confidence data showed employment expectations amongst respondents improved to their best level since the mid-1990s, reflecting a high level of job vacancies.

However, October's Australian Labour Force data today has proved a sombre reminder of the RBA's cautionary note above, as employment fell by -46.1k vs. expectations for a +50k rise. The unemployment rate rose to 5.2% vs. expectations of 4.8%, and the participation rose less than expected to 64.7%.

Nonetheless, given the worse is now behind and based on the solid pick up in leading labour market indicators, the reaction from the currency has been modest. The AUDUSD fell from .7338 pre the data to a low of .7316, while AUDNZD fell from 1.0380 to a low near 1.0356.

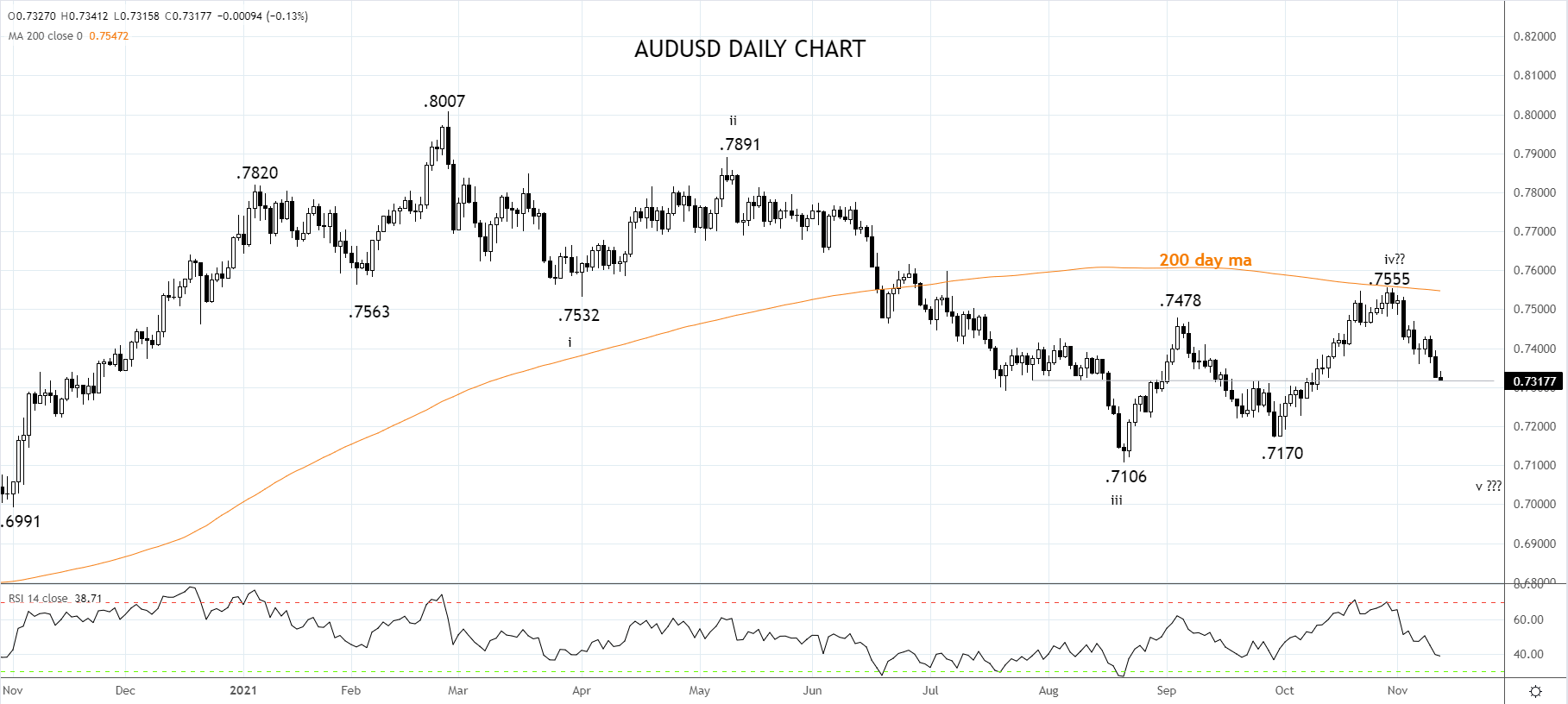

Technically and fundamentally, we remain bearish in the AUDUSD; however, after reaching the initial short-term target of .7320 written about in this article here, we look for better levels to short the AUDUSD before the next leg towards .7100c commences.

Source Tradingview. The figures stated areas of November 11, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with FOREX.com

You can trade with FOREX.com by following these four easy steps:

- Open an account, or log in if you’re already a customer

- Search for the instrument you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade