AUD/USD Outlook

AUD/USD extends the advance following the Reserve Bank of Australia (RBA) rate hike to register a fresh monthly high (0.6774), and the exchange rate may attempt to test the May high (0.6818) as it carves a series of higher highs and lows.

AUD/USD Forecast: Post-RBA Rally Eyes May High

AUD/USD extends the advance from the yearly low (0.6459) as the RBA warns that ‘some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe,’ and data prints coming out of the US may keep the exchange rate afloat as the Consumer Price Index (CPI) is anticipated to show slowing inflation.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

The core CPI is now expected to narrow to 5.3% in May from 5.5% per annum the month prior, and signs of easing price growth may push the Federal Open Market Committee (FOMC) to the sidelines as ‘the economic forecast prepared by the staff for the May FOMC meeting continued to assume that the effects of the expected further tightening in bank credit conditions, amid already tight financial conditions, would lead to a mild recession starting later this year.’

As a result, the Federal Reserve may vote for a hawkish-hold as ‘real GDP was projected to decelerate over the next two quarters before declining modestly in both the fourth quarter of this year and the first quarter of next year,’ and a pause in the Fed’s hiking-cycle may produce headwinds for the US Dollar as it fuels speculation for a looming change in regime.

In turn, AUD/USD may continue to trade to fresh monthly highs as the RBA keeps the door open to pursue a more restrictive policy, but an unexpected Fed rate-hike may generate a bullish reaction in the Greenback as the central bank takes further steps to combat inflation.

With that said, developments coming out of the US may sway the near-term outlook for AUD/USD especially as Chairman Jerome Powell and Co. are slated to update the Summary of Economic Projections (SEP), but recent price action raises the scope for a test of the May high (0.6818) as it extends the series of higher highs and lows from last week.

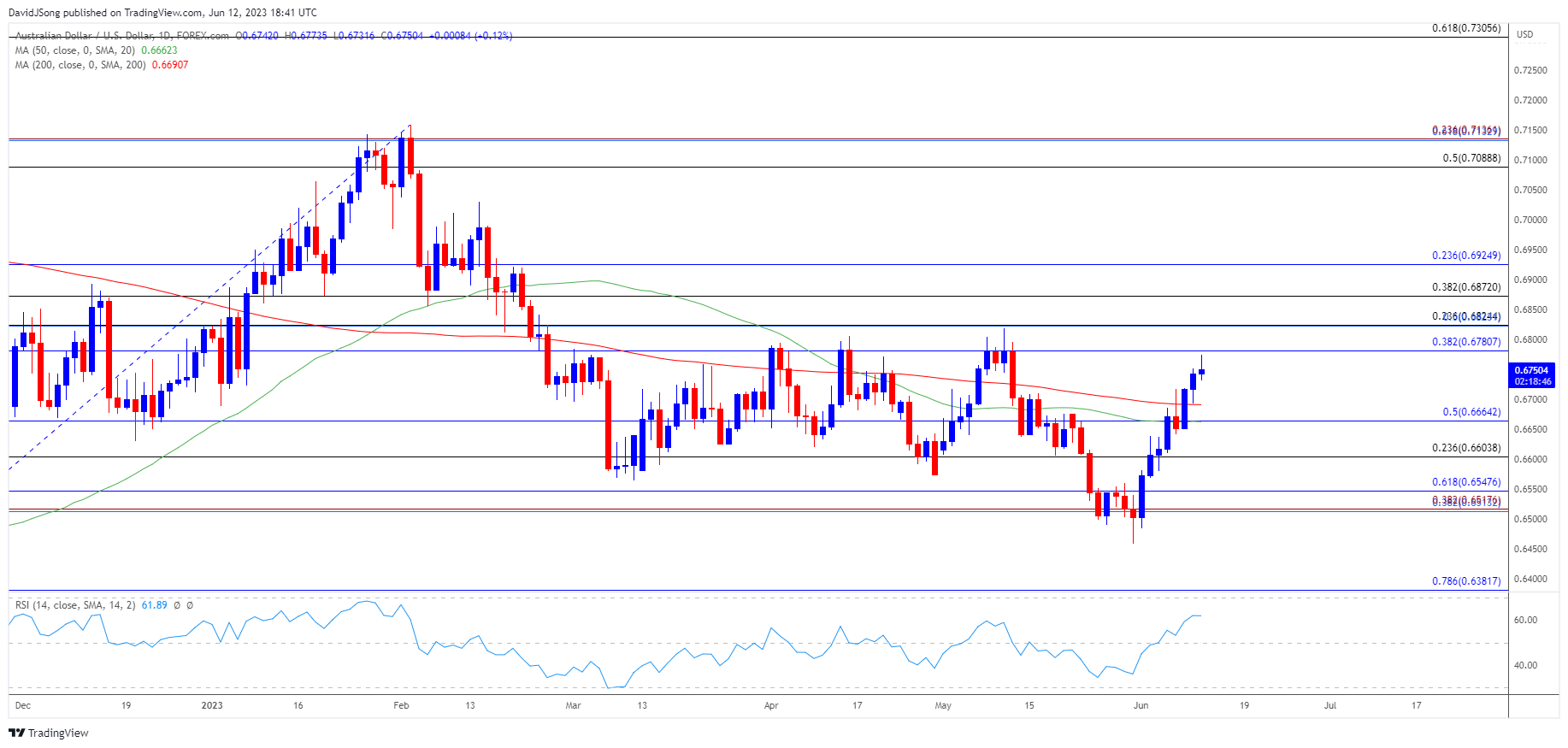

Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD registers a fresh monthly high (0.6774) as it extends the series of higher highs and lows from last week, and the exchange rate may attempt to test the May high (0.6818) as it trades back above the 50-Day (0.6662) and 200-Day (0.6691) SMA.

- Keep in mind, both moving averages continue to reflect a negative slope following the ‘death-cross’ in April, but a break/close above the 0.6780 (38.2% Fibonacci retracement) to 0.6820 (23.6% Fibonacci retracement) region opens up 0.6870 (38.2% Fibonacci retracement), with the next area of interest coming in around 0.6930 (23.6% Fibonacci retracement).

- At the same time, failure to break/close above the 0.6780 (38.2% Fibonacci retracement) to 0.6820 (23.6% Fibonacci retracement) region may curb the bullish price series, with a move below 0.6660 (50% Fibonacci retracement) bringing the 0.6600 (23.6% Fibonacci retracement) handle back on the radar.

Additional Market Outlooks

Gold Price Outlook Hinges on Fed Rate Decision

USD/JPY Ranges in Ascending Channel After Failing to Test May High

--- Written by David Song, Strategist

Follow me on Twitter at @DavidJSong