Trade tensions and a potential RBA cut has seen AUD/JPY hit new lows on the eve of RBA’s cash rate meeting.

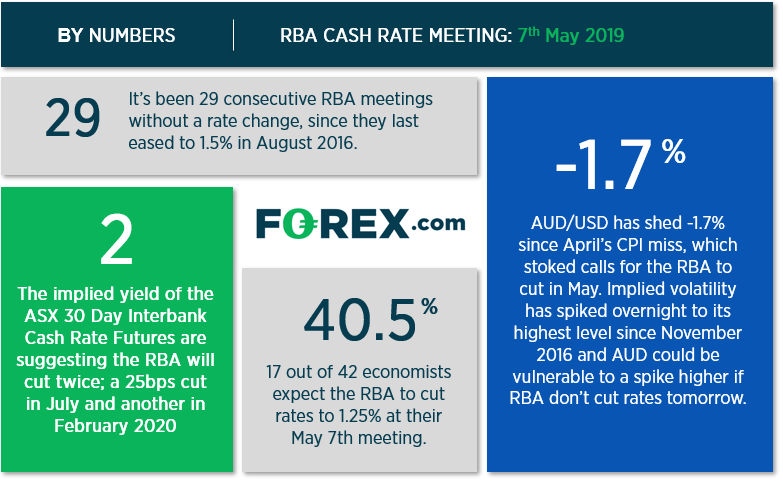

After 29 uneventful meetings, eyes are on the RBA’s meeting tomorrow to see if they cut interest rates to a record new low. Although whilst we expect a cut, the jury is still out on this one. The 30-day interbank cash rates futures are implying two single 25 bps cuts will be delivered over their July and February 2020 meetings, whilst 40.5% of economists polled by Reuters see a cut happening tomorrow.

We noted on Friday that implied volatility for AUD and NZD spiked ahead of this week’s RBA and RBNZ meetings, and it’s interest to note that overnight implied volatility has spiked to its highest level since 2016. As there is not an overwhelming consensus as to what the RBA do tomorrow, we expect it’ll be a volatile session regardless of their decision. AUD/USD, for example, could easily blow its way back above 70c if RBA hold rates and resist having an easing bias in their statement, although we don’t consider this a likely scenario. However, renewed trade tensions, we also have AUD/JPY under focus.

Since failing to hold above 79.84, momentum on AUD/JPY has been predominantly bearish with today’s gap lower taking the pair to its lowest level since early January. A prominent swing high at 78.93 provides a lower low and the gap suggests this could be part of an impulsive move lower. The lows around 77.50 are currently capping as resistance, but the upper gap at 77.83 is also an area bears could consider fading into. Interestingly, AUD/JPY has found support at the November 9th low, which was formed just after Trump was elected as president.

The two key drivers for AUD/JPY this week is tomorrow’s RBA meeting and developments surrounding US-China trade talks in Washington. With Trump threatening to increase tariffs this coming Friday, demand for JPY has spiked whilst commodity currencies have remained under pressure.

The most bullish case for AUD/JPY is if RBA hold, decide not to include and easing bias and then US-China to agree to a trade deal. We think this scenario is unlikely at this stage so expect AUD/JPY to remain under pressure. Conversely, the most bearish scenario is for RBA to cut, include an easing bias (for a further cut) and for US-China not to reach a trade deal.