- AUD/USD snapped a 6-week losing streak, helped by a weaker US dollar and stronger yuan

- While the Australian dollar rose again most currencies, it was more of a reprieve from selling over a risk-on bounce

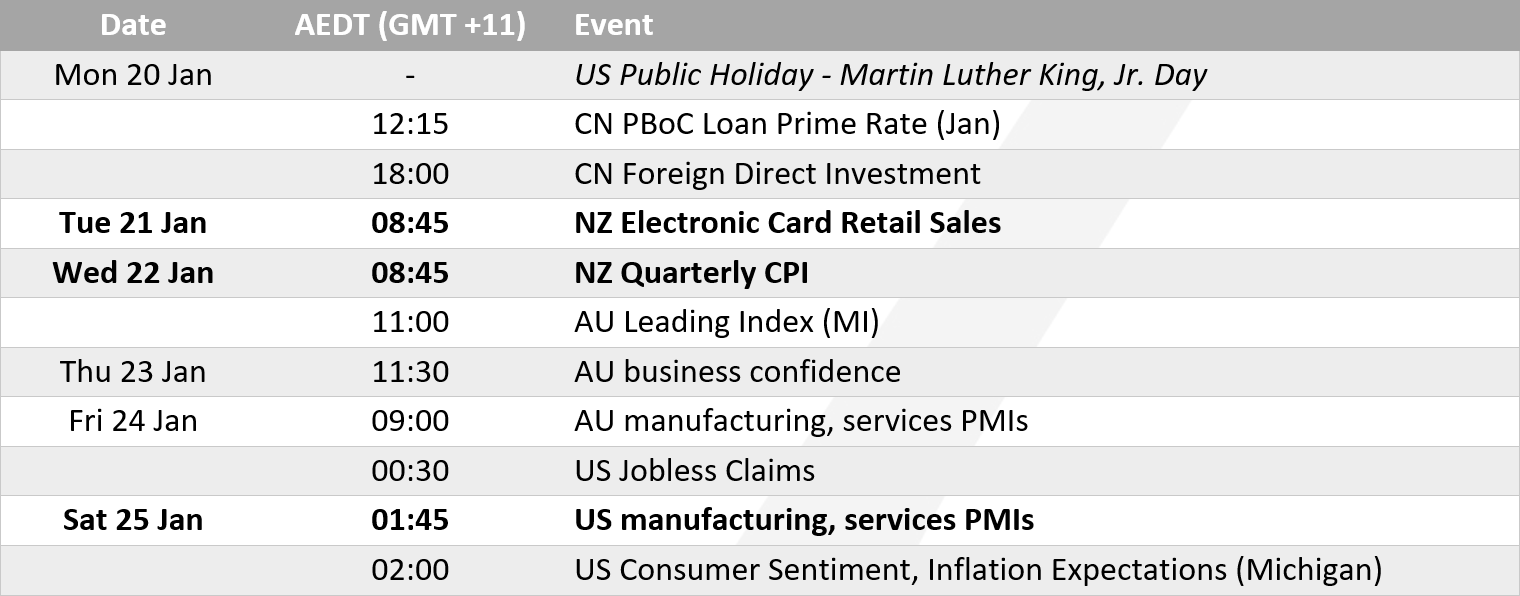

- The 4-day week in the US and lack of top-tier day might suppress volatility for AUD/USD this week

The week kicks off with the US on public holiday, which means volatility could be lower than usual (even by Monday’s standards). Unless we get a surprise LPR cut from the PBOC to give risk a slight pump. There is no top-tier economic data for Australia this week. While the business confidence and PMI reports warrant a look to gauge the strength of the economy, neither tend to prompt much of a market reaction.

There is a chance that the RBNZ will deliver another 50bp cut in February, unless we see an uptick in their quarterly inflation report. And AUD/USD could find itself bid if NZ inflation comes in hotter than expected, as both AU and NZ CPI’s tend to track one another over the longer term.

We’ll need to wait until the back end of the week before US data piles in, with jobless claims, S&P Global PMIs and the Michigan University consumer sentiment report lined up. They don’t quite have that ‘NFP’ or ‘CPI’ status, and given the 4-day week for the US we could find volatility to be on the lower side.

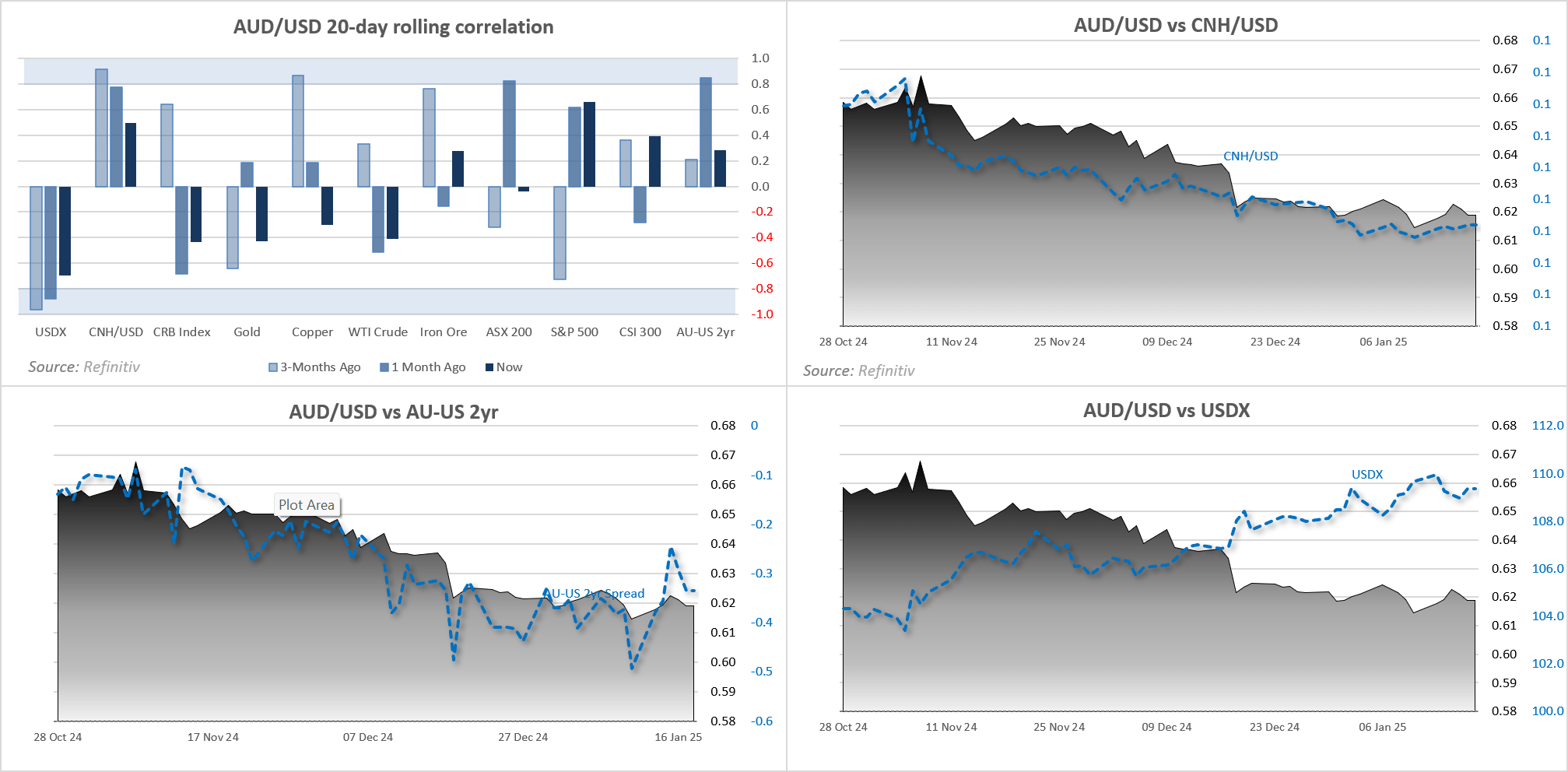

AUD/USD correlations:

- The positive correlation between the yuan and AUD/USD remains in place, although its strength has dwindled

- The same can be said for the inverse correlation between the US dollar and AUD/USD

- Looking through the correlations with AUD/USD, none of the 11 markets we track are strong (defined at 0.8 or higher, or -0.8 or less)

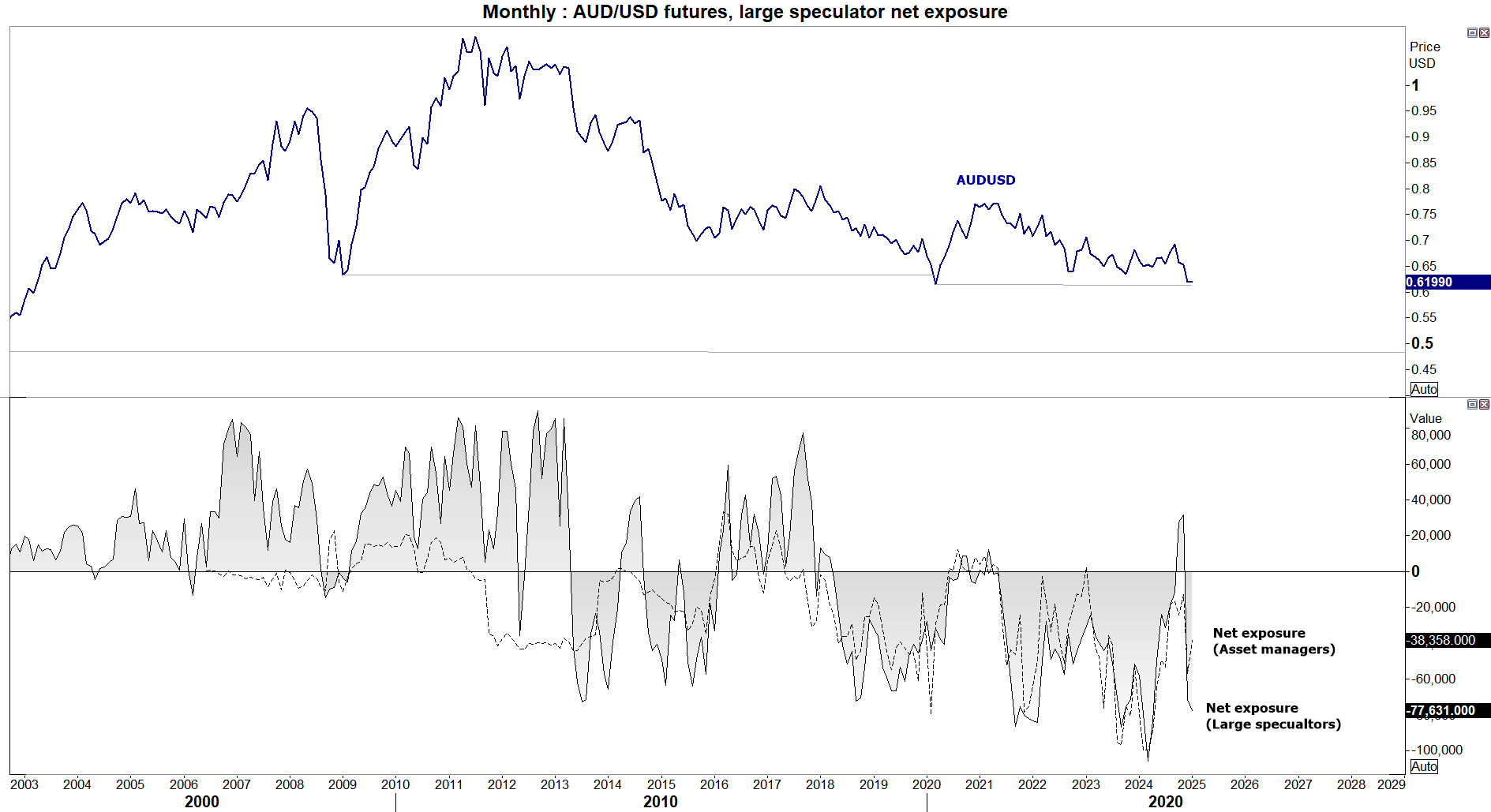

AUD/USD futures – market positioning from the COT report:

- Only minor adjustments were made to AUD/USD positioning last week, with large speculators increasing net-short exposure by ~4k contracts and asset managers reducing their by the equivalent

- This effectively cancels out the change between both sets of traders, who remain net short but not at a sentiment extreme

- That said, we’ve seen an extended move to the downside and I remain convinced we’re due a bounce

- Also note that the weekly close chart is holding above a major support level and now trying to move higher

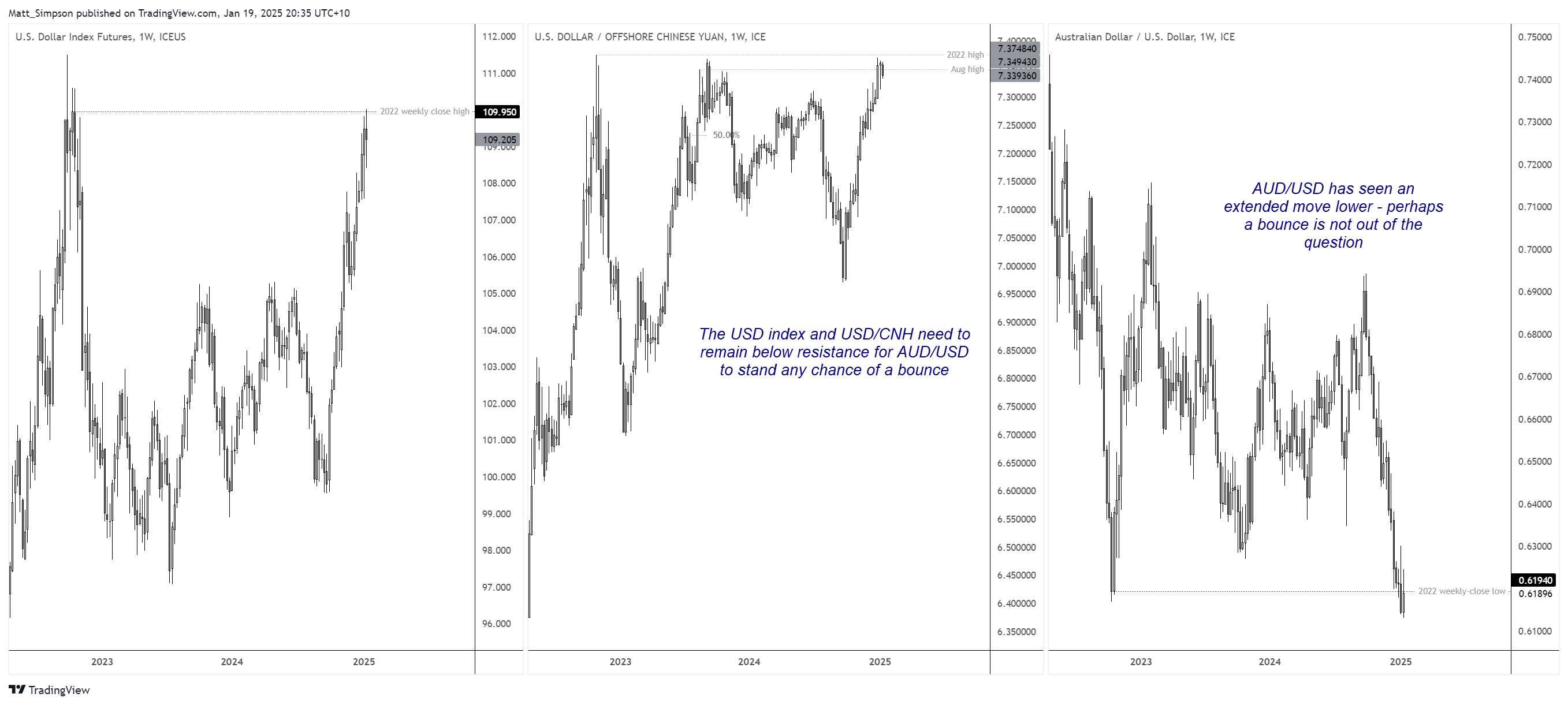

AUD/USD technical analysis

The chart below demonstrates the importance of the US dollar and yuan to AUD/USD. The USD index and USD/CNH have performed a strong bullish move while AUD/USD has rolled over in what is effectively a straight line. It is also interesting to note that both of the former markets have stalled around resistance, which has allowed AUD/USD to break a 6-week losing streak and close back above the 2022 weekly-close low. It also means that the depth of any retracement for AUD/USD sits in the hands of how the USD index and USD/CNH perform around current levels.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge