- US data continues to drive sentiment for markets in general, AUD/USD is taking its directional cues from the USD and yuan

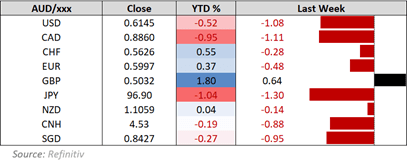

- The Australian dollar was lower against all but GBP last week, with AUD/USD hitting a 4-year low

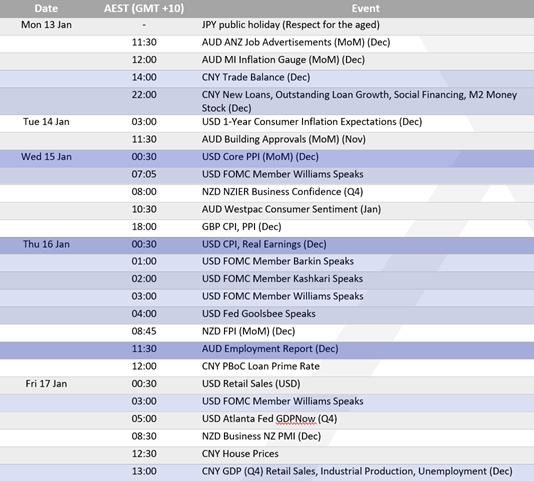

- US CPI is the main economic event, while the Australian jobs report is the biggest domestic event

- RBA cash rate futures imply a 78% chance of a February cut from the RBA following softer timed-mean inflation

Another strong NFP report on Friday dealt another blow to dwindling hopes of Fed cuts and sent AUD/USD to a 4-year low. Markets were barely pricing in two Fed cuts this year ahead of the NFP report. And with evidence of inflationary pressures rising before Trump’s returns to the Whitehouse, no cuts in 2025 is also plausible. And that means incoming US data remains the key driver for sentiment in general.

Most of the key data points this week are for December, the biggest of which will be US CPI released at 00:30 Thursday (Sydney time). Core inflation is expected to soften to 0.2% m/m, which means a print of 0.3% or higher could spell further trouble for the Aussie has traders will likely continue to bid a strong USD and offload bonds to send yields higher.

Several FOMC and Fed members hit the wires this week, but it is difficult to see how they could provide a convincingly dovish tone given the strength of the US economy and uncertainty surrounding Trump’s policies. But in simple terms, strong US data is likely to keep AUD/USD under selling pressure.

Australia’s employment report on Thursday is the biggest domestic event on the calendar. And given the excitement of a softer trimmed-mean figure last week (which is now 0.2% points above the RBA’s 2-3% band), even small signs of weakness have the potential to be amplified by Aussie bears. But unless Australian businesses culled staff for Christmas, I suspect another robust set of figures to arrive. Still, RBA cash rate futures now imply a 78% chance of a February cut, but we really need to see a softer quarterly CPI report in a couple of weeks before we can be sure a Feb cut is a given.

China’s Q4 GDP report lands on Friday alongside the usual retail sales, industrial production, unemployment and investment figures. They are of course worthy of a look, but traders are likely to pay greater attention to incoming leading indicators to see if or when freshly-announced stimulus is making an impact.

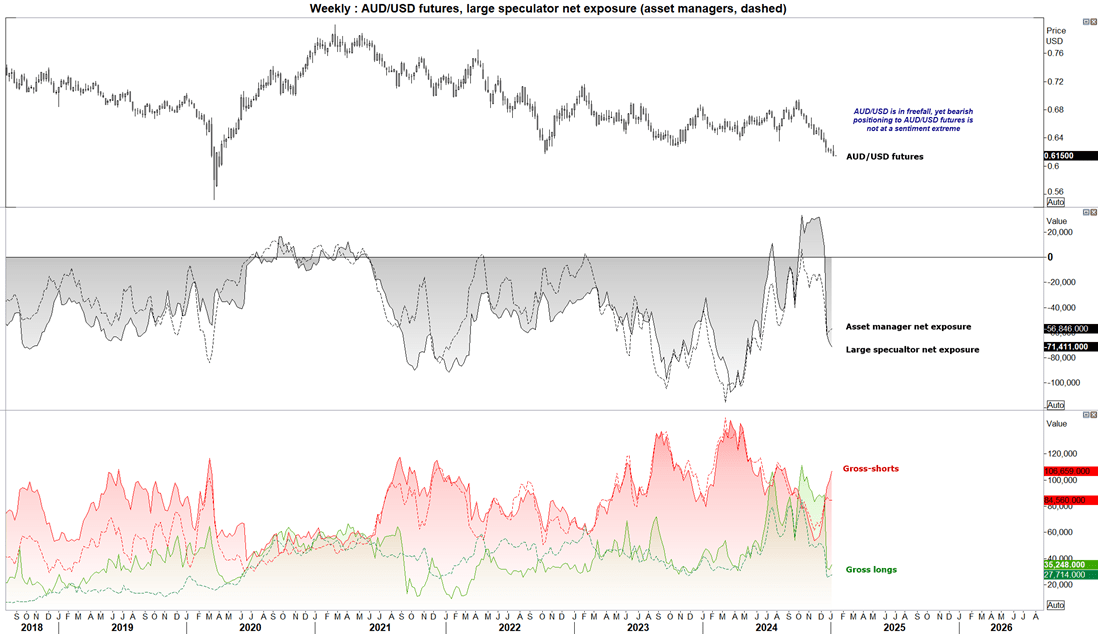

AUD/USD futures – market positioning from the COT report:

The data delays due to public holidays over the festive season means that we’re actually looking at how traders were positioned in the final week of 2024. The latest batch of data will be released overnight, but for now this makes a decent recap.

- Large speculators increased their net-short exposure to AUD/USD futures to a 33-week high

- While asset managers trimmed their net-short exposure slightly by -1.4k contracts, they were net-short for an 11th week and around their most bearish level in just over 6 months

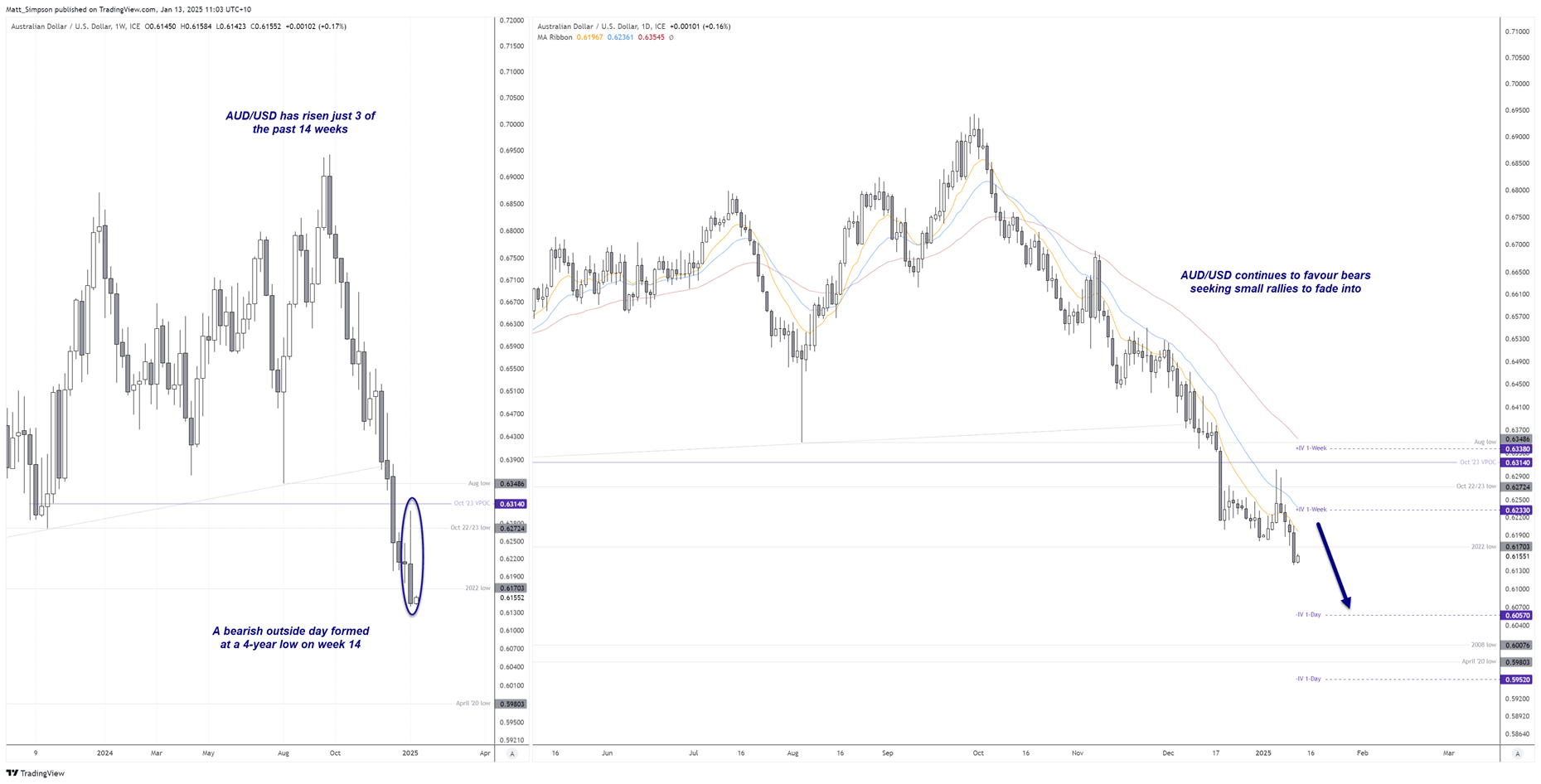

AUD/USD technical analysis

Over the past 14 weeks, AUD/USD has fallen 11 and risen just three. Traditional metrics could suggest the market is oversold, but macro moves like the one we’re witnessing cares little for such measures. And that fact that we saw a bearish outside candle form at a 4-year low on week 14 is a testament to that.

If the implied volatility levels are correct, AUD/USD could be in the upper 50s in four weeks. What would make this unique is that we’re yet to see the Aussie fall below 60c without a shock to the system such as Covid, the GFC or the Nasdaq bubble bursting.

The daily trend is firmly bearish and one that likely favours bears fading into minor rallies, while prices remain beneath 63c. A test of 61c this week is not out of the question, a break beneath which brings the 2008 (GFC) and April 2020 low into focus for bears.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge