- Australia’s quarterly consumer and producer prices were above expectations

- And that firmly keeps the cash rate at 4.35%, and for the RBA to retain their hawkish bias this week

- The Australian dollar was lower across the board last week and AUD/USD was lower for a fifth week, although I suspect a tough is near

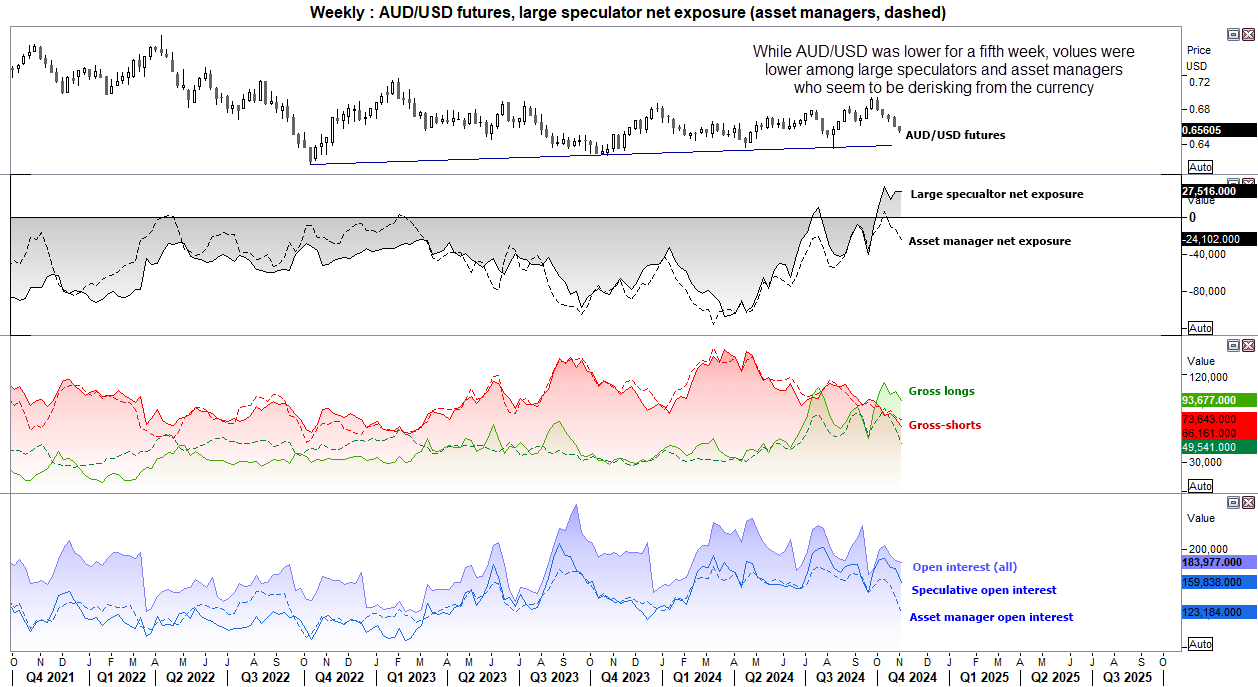

You may have heard that the US Presidential election is next week. It would be more amazing if you hadn’t. While betting markets have been favouring trump of late, I very much doubt it’s the slam dunk for Trump some markets were pricing last week. This could be a close race indeed, and that leaves the potential for volatility on Wednesday as the votes are officially counted.

There are some concerns that the results could take days (or longer) to count, given the record amount of paper ballots reportedly being sent for this election. That could certainly dampen volatility, if so. There are also concerns of riots and general disorder should Democrats be in front, and they are on guard for claims of false counts and even another ‘Jan 6 insurrection’ style event. It is difficult to assess if or even when such events could unfold, but it could prompt a bout of risk off and therefore weigh on AUD/USD if it materialises.

We also have an FOMC meeting to contend with, but with Fed fund futures implying a 98.9% chance of a 25bp cut there seems to be little room for surprise. They also suggest an 82.7% chance of a 25bp cut in December, but with US economic data generally outperforming expectations, if there is to be a surprise at all it seems more likely they will push back on expectations of a final 25bp cut this year. In either case, I suspect the election will be the bigger driver of sentiment and global markets this week.

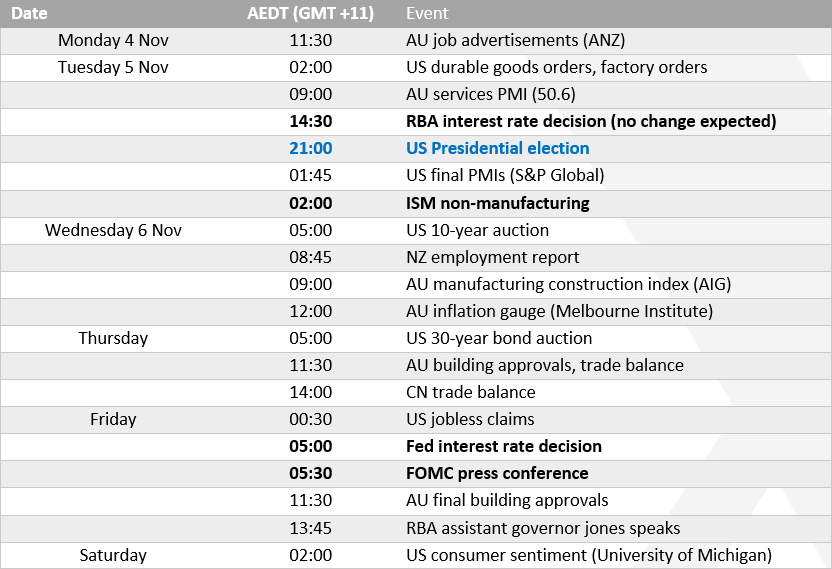

For what it is worth, this chart shows how AUD/USD has performed the three days either side of a US election. Data goes back to 1992, spanning eight elections.

Takeaways:

- Daily volatility tends to peak at T+1 (Wednesday) with an average daily range of 1.75% and median of 1.6% (this makes sense as votes are usually called during Asia’s Wednesday trade

- Daily ranges tend to diminish on the preceding Friday and Monday and pickup on election day (Tuesday)

- Election day (Tuesday) has generated the strongest returns of 0.8% average, 0.47% median

- The skew is also positive with AUD/USD rising 7 or the past 8 elections (and the one down day was a mere -0.17%)

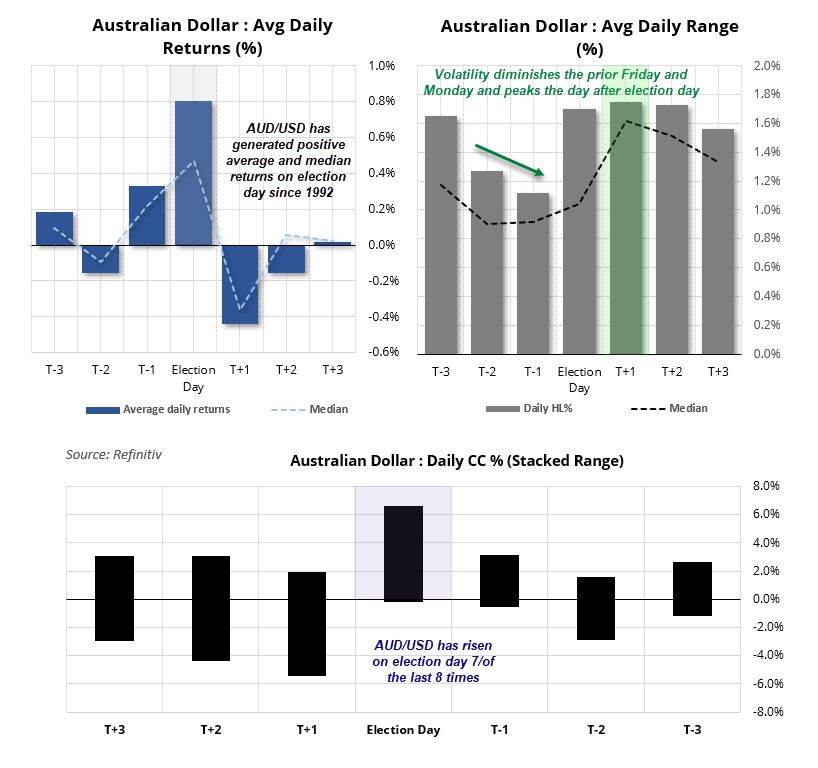

AUD/USD 20-day rolling correlation

- AUD/USD has detached itself from usually strong correlations over the near term, with the 3-day moving to negative -1 against the USD index, commodities, the S&P 500 and the 2-year AU-US spread

- It seems to be taking its cue from the Chinese Yuan, which has a strong positive correlation of 1.0 over 3-day and 0.82 over 3-months

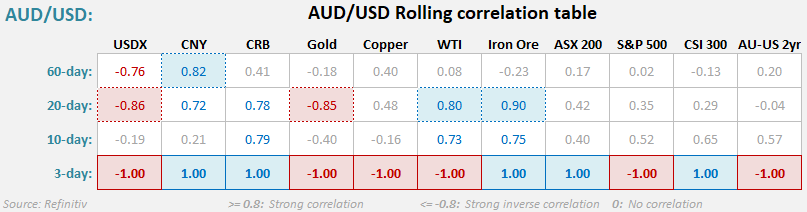

AUD/USD futures – market positioning from the COT report:

- Asset managers were their most bearish on AUD/USD futures in six weeks while net-long exposure among large speculators was effectively unchanged

- Regardless, there seems to be a general de-risking taking place on AUD/USD futures, with total open interest lower alongside volumes for asset managers and large speculators

- Both set of traders trimmed longs and shorts last week

AUD/USD technical analysis

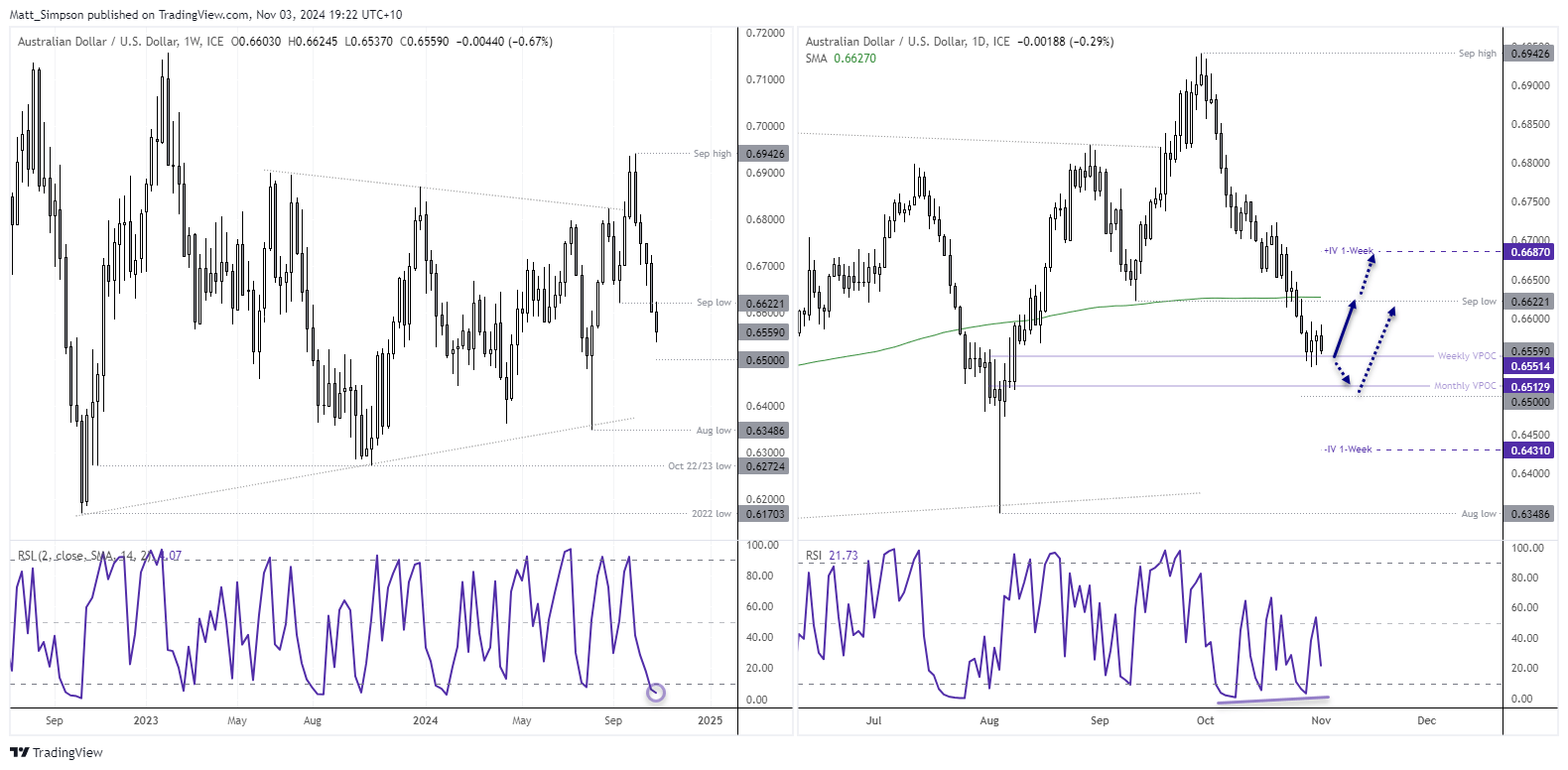

The selloff for AUD/USD has been quite relentless over the past five weeks, but my spidey senses suspect a trough is very close.

We’ve already had five consecutive weeks lower, the weekly RSI (2) is in the oversold level for a second week and at its lowest level since January. Prices are trying to form a base around a weekly VPOC (volume point of control), but perhaps more importantly, the USD rally looks overextended and there is a good argument for China’s markets to rally. Given the strong correlation between AUD and the yuan, this could be bullish for AUD/USD if it all comes together.

Obviously, the US election is the elephant in the room. But I have a sneaking suspicion that Harris can win, and that may be beneficial for risk and therefore AUD/USD. If I am completely wrong and AUD/USD continues lower, 0.6500 is the next level of support for bulls to defend and bears target.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge