- AUD/USD was lower for a second week as the USD extended its gains as markets lowered bets of 50bp Fed cuts

- Still, it was the strongest of the big three commodity currencies, rising against CAD and NZD (with a dovish 50bp RBNZ cut playing a part)

- It lost the most ground against the Chinese yuan after Beijing announced high levels of stimulus ahead of the golden week holiday

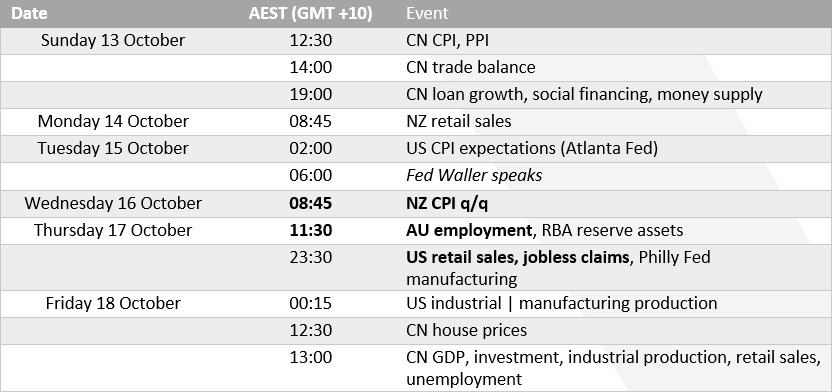

There is a tonne of China data to chew through this coming week. It’s just a shame not of it will account for much, given none of it doesn’t capture output from the recently announced stimulus. Besides, we’ve already seen outlandish moves from China’s stock markets (40% rally on China A50 in nine days, as one example) so the plethora of backwards-looking data is not likely to make much of an impact on sentiment, or AUD/USD for that matter. Still, the data such as GDP warrants a look for a basic grasp of global growth, and CPI for global inflationary pressures.

New Zealand’s quarterly inflation report is released on Wednesday, and traders will want to see it move closer to 2% to keep hopes of another 50bp cut alive. The 50bp cut delivered at their last meeting was accompanied with a dovish statement which tipped its hat to market pricing, and that means any upside surprise could shake out some Kiwi shorts and AUD/USD could also get a lift along with it.

The ECB are expected to cut their interest rate by 25bp on Thursday. The question is whether this will be coupled with a dovish tone to indicate further cuts. The ECB has a long history of division within the ranks, which leaves the potential for a ‘sell the rumour, buy the fact’ response from euro pairs. If so, EUR/AUD could be in for a bounce. Still, if the ECB deliver a dovish cut, then appetite for risk could get a bump (due to the Fed and ECB being in easing cycles) and that could benefit AUD/USD.

Australia’s employment report on Thursday is the main domestic event for AUD/USD traders. And I suspect it will continue to show the “tight” labour market that is preventing the RBA from having a serious discussion about cuts while inflation remains “too high”. Job growth has averaged 31.9k over the past year and remained above its 1-year average for the past five months. The participation rate also matched its record high while the unemployment rate remained at the non-recessionary level of 4.2%. So, unless these same figures throw a curveball next week, the labour report could be a non-event.

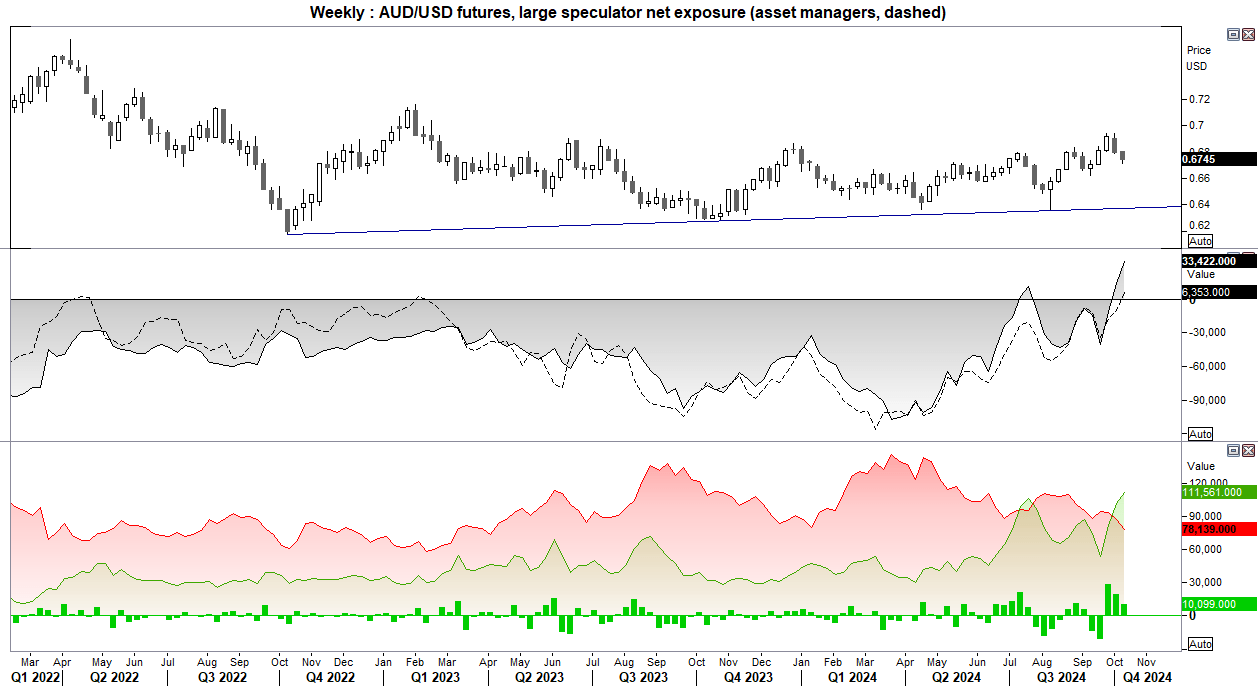

AUD/USD futures – market positioning from the COT report:

- Large speculators were net-long AUD/USD for a second week and at their most bullish level since December 2017

- Asset managers also flipped to net-long exposure for the first time since February 2023, although at a modest 6.2k contracts

- While AUD/USD was lower for a second week, I continue to suspect it will trade higher as we get further into Q4 with seasonality on its side – we just need to wait for the USD rebound to lose steam

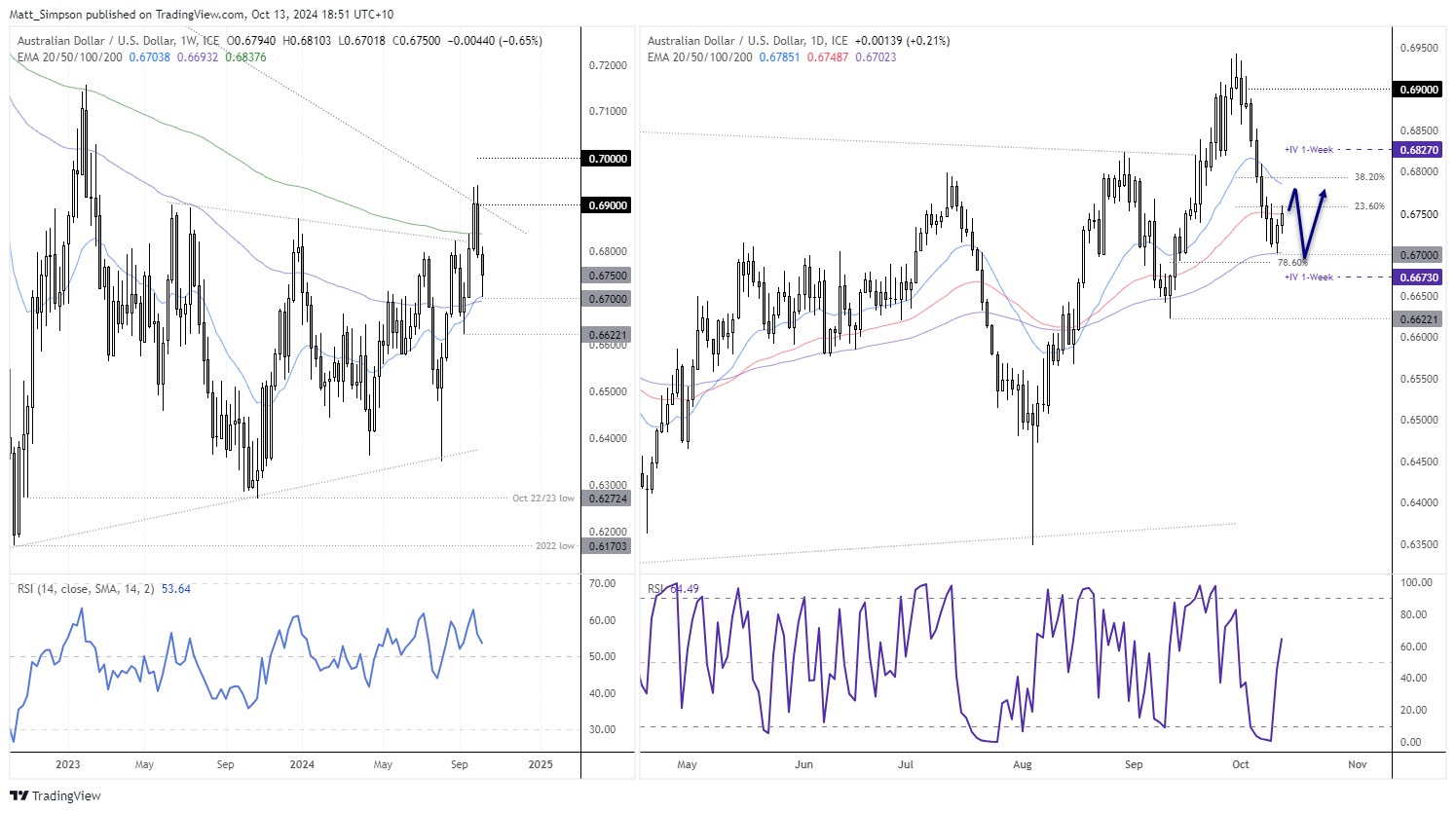

AUD/USD technical analysis

I think we could be in for some choppy trade this week for AUD/USD, as it is not a big week for US or AU data and we’ve already seen a decent move lower on the Aussie.

Support was found around the 20 and 100-week (and 100-day) EMAs, 67c handle and monthly S1 pivot. The lower wick of last week shows bears are losing steam. However, the 2-day ‘rebound’ is hardly a compelling bullish signal. I suspect rallies

will be sold this week, as the USD index looks like it wants another crack at breaking above 103.

However, downside potential for AUD/USD could also be limited given we’ve already seen a decent move lower.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge