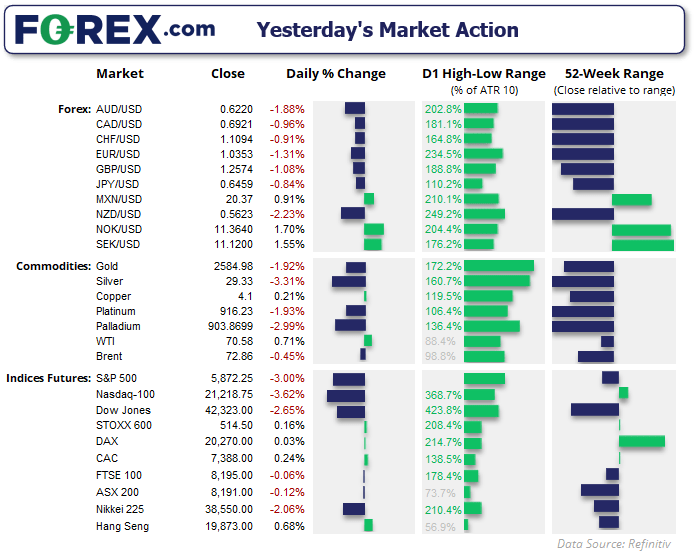

The Fed delivered their widely expected 25bp cut and, in line with my own expectation, slowed their pace of easing to two cuts in 2025. Yet market reactions suggest this development was not priced in. Nasdaq futures suffered their worst day in five months while S&P 500 and Dow Jones had their worst in four. All closed just off their lows for the day with highly negative delta volumes (considerably more sellers than buyers) to show bearish initiation behind the move.

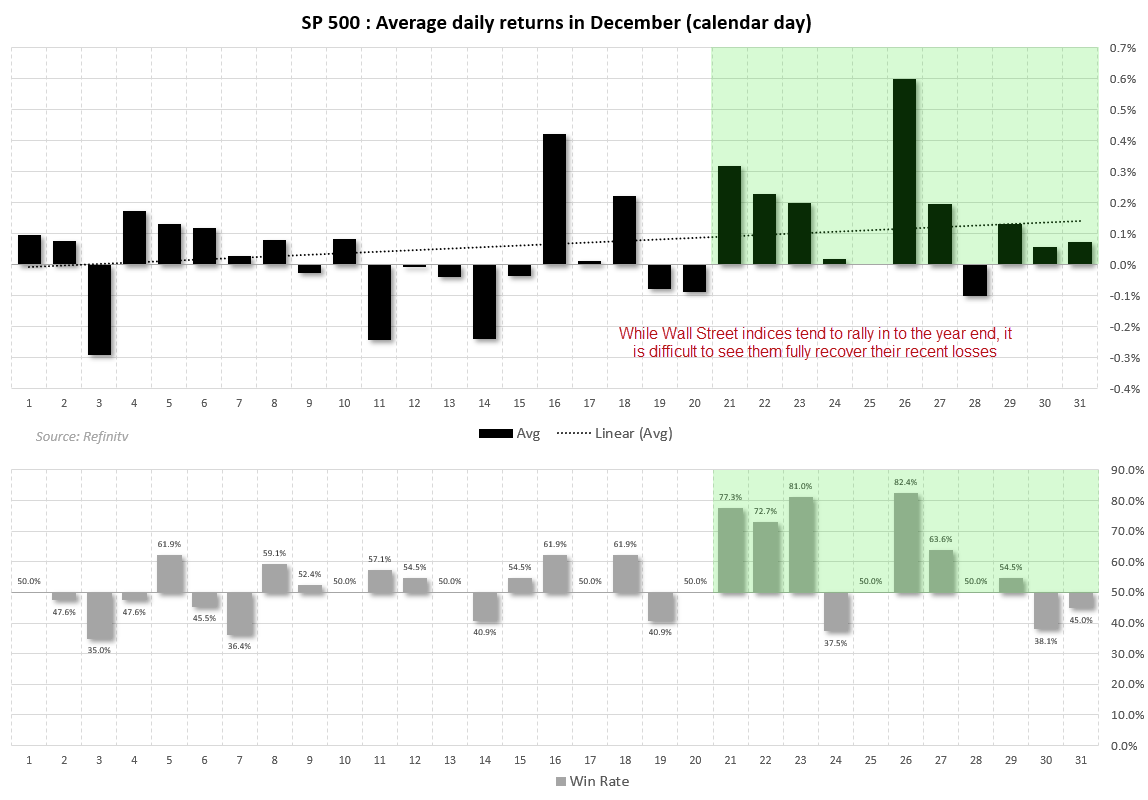

If Santa’s rally is to kick in at all this year, it could be to pick up some of the crumbs left during yesterday’s volatile selloff. As a reminder, we tend to see Wall Street indices rise into the year end, and other global indices follow. The chart below shows the rally tends to kick in around December 21st for the S&P 500, with a series of positive average returns and favourable win rate. But I am not convinced the general returns over this period can outweigh the recent losses sustained, so Santa’s rally may fizzle out to more of a mediocre sympathy bounce.

Powell said during his press conference that stronger economic growth and lower unemployment has driven the slower pace of easing, and further progress on inflation needs to be achieved to justify further cuts. But they can afford to be more cautious as they are very close to neutral. Perhaps wisely, he declined to comment on Trump’s policies.

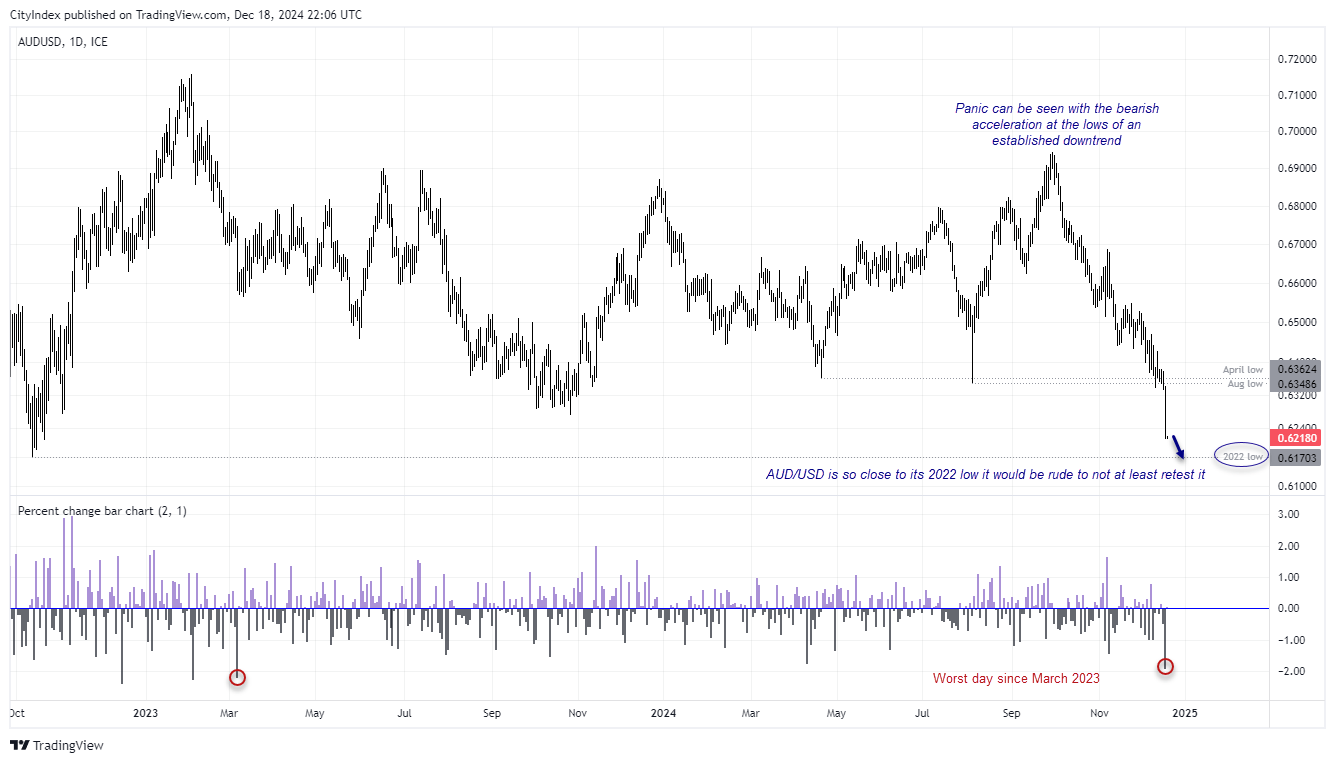

AUD/USD technical analysis:

The combination of a surging US dollar and fallout on Wall Street saw AUD/USD plunge to a 2-year low during its worst day since March 2023. The Aussie now trades just over 50-pips from its 2022 low, which is close enough to be rude not to at least tap it.

Still, the 2022 is a big level indeed. And one that could at least trigger a volatile shakeout, as bears are tempted to book profits. But to see such a bearish acceleration at cycle lows underscores the panic, and with the yuan weakening alongside China’s bond yields, this is not a bearish stampeded I intend to stand in front of. But AUD/USD traders need to monitor how China’s markets react to get a feel for just how low AUD/USD can go and if it can break or rebound from the 2022 low.

Economic events in focus (AEDT)

11:00 – NZ business confidence

11:30 – AU reserve assets

14:00 – BOJ interest rate decision (no change expected)

17:30 – BOJ press conference

23:00 – BOE interest rate decision (no change expected)

00:30 – US GDP (Q3)

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge