- AUD/USD and NZD/USD closed at 2024 highs on Monday

- Both are benefitting from hopes for a soft economic landing and further stimulus measures from China

- Bias remains higher as long as both pairs remain in uptrend

- RBA likely to retain neutral policy bias with hawkish tinges at September monetary policy meeting

Overview

Both the Australian and New Zealand dollars closed at 2024 highs on Monday against the US dollar, benefiting from continued gains in riskier asset classes and speculation policymakers in China may move aggressively to head off a worrying slowdown in the world’s second largest economy. With the Reserve Bank of Australia (RBA) interest rate decision for September out later Tuesday, it promises to be a volatile session for the antipodean currencies in Asia.

RBA brief

None of the 43 economists polled by Reuters expect the RBA cash rate will change from 4.35% today. And only three see a rate reduction by year-end. While OIS and cash rate futures don;t expect a move today, traders still favour a 25 basis point rate cut this year, implying around a two-in-three chance of a move by December.

For the RBA to shift towards a stance signalling looming rate cuts, it needs confidence that inflation will return to the midpoint of its 2-3% target range in a timely manner. As yet, it’s not received anywhere near enough evidence, thwarted constantly and forced to push out the expected timeframe for inflation to return to target.

To get the confidence it needs, you suspect it will require two full quarterly consumer price inflation reports showing a moderation in price pressures, putting a potential rate cut on the table in February 2025 at the earliest.

The only factors that could make it move earlier would likely be a disorderly increase in Australian unemployment or some form of global crisis. None come across as likely in the near-term, hence the RBA is likely to retain the neutral to hawkish views conveyed when the board last met in August.

Expect the statement to suggest the board remains “vigilant to upside risks to inflation” and will continue to not rule anything "in or out".

Watch the last line of the statement particularly closely given it seems be used to deliver an implicit message to markets.

In August, it said “the Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome.” The last part of the sentence has often appeared when the board has been particularly concerned about the inflation outlook. I expect it will be retained today.

China needs more than lower rates

Just before the opening of Chinese markets on Tuesday, policymakers from the People’s Bank of China (PBOC), National Financial Regulatory Administration and China Securities Regulatory Commission will hold joint news conference to discuss financial support for the economy. The announcement came on Monday after the PBOC surprised markets by cutting its 14-day reverse repo rate by 10 basis points.

While the prospect of stimulus can often get markets excited, traders need to remember a lot of further easing measures are already priced in, meaning simple moves to lower interest rates may be met with “selling the fact” behaviour.

Even though you can argue real rates in China are very restrictive given where inflation sits, hence they should be cut aggressively, the main issue facing Chinese economic growth is demand. It has far too much supply to not enough demand, hence why inflation remains so weak. With a declining population, only concrete structural measures to boost demand are likely to get traders truly excited about a meaningful rebound in the Chinese economy.

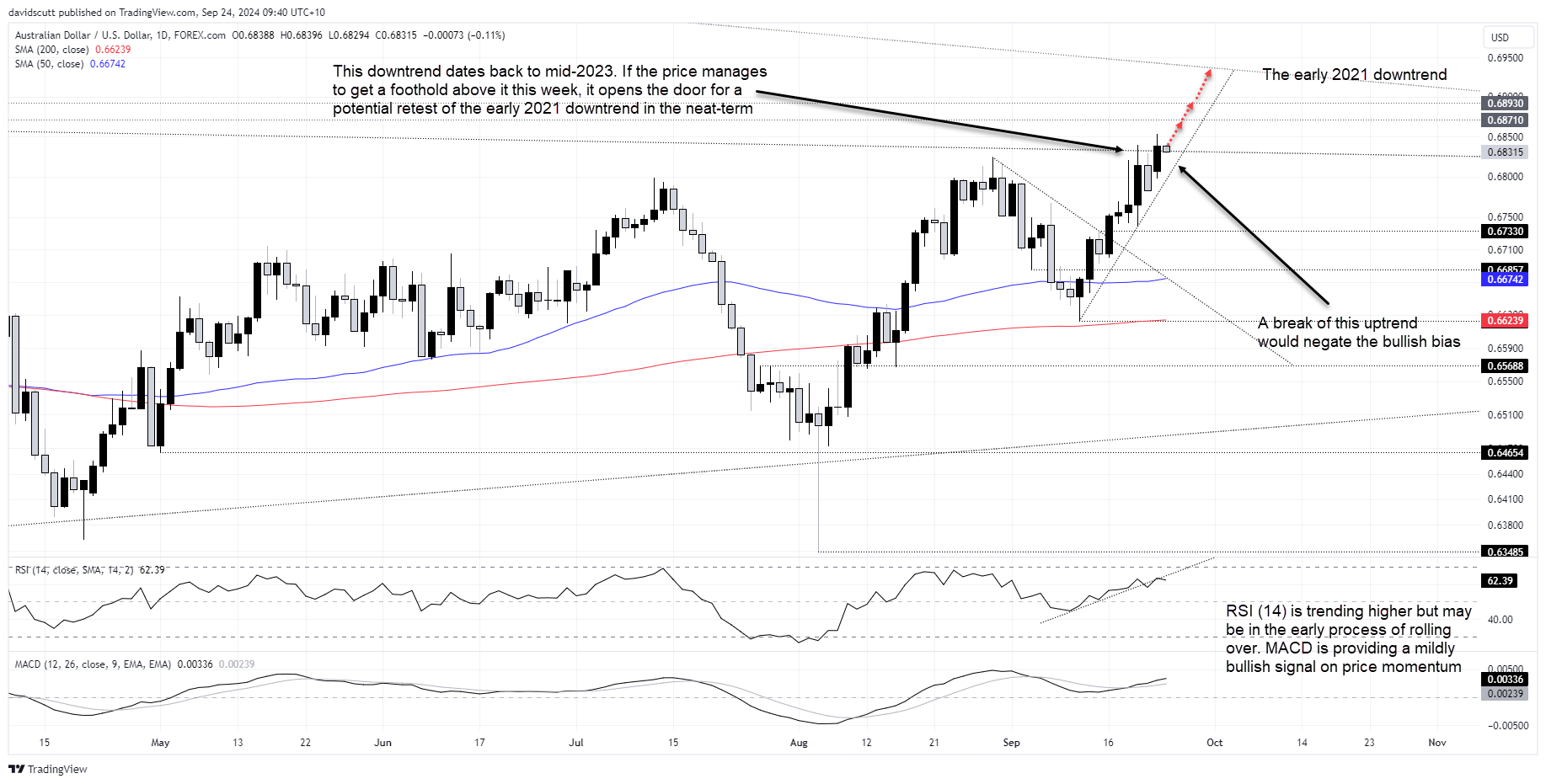

AUD/USD eyeing break of pandemic downtrend

AUD/USD hit 2024 highs on Monday, breaking and closing above downtrend resistance that has repelled bullish advances on multiple occasions this year and last. While the initial bullish break looked promising, the early signs on Tuesday don’t look great with the price reversing back below the level. The uptrend in RSI (14) has also been broken, although price has yet to follow suit and MACD has not confirmed the momentum signal.

AUD/USD hit 2024 highs on Monday, breaking and closing above downtrend resistance that has repelled bullish advances on multiple occasions this year and last. While the initial bullish break looked promising, the early signs on Tuesday don’t look great with the price reversing back below the level. The uptrend in RSI (14) has also been broken, although price has yet to follow suit and MACD has not confirmed the momentum signal.

Given the mixed picture, I’m not prepared to do away with the bullish stance until we see a clean break of the uptrend AUD/USD has been in since September 11. As such, I’m still inclined to buy dips looking for a push towards prior market peaks at .6871 and .6893, especially as a break of that zone may facilitate a test of long-running downtrend resistance dating back to early 2021.

Traders keen to buy dips could use the uptrend or a stop below .6830 for protection. If the uptrend were to be broken, the bullish stance would be invalidated, pointing to potential range trade or selling rallies.

NZD/USD bulls gaining upper hand

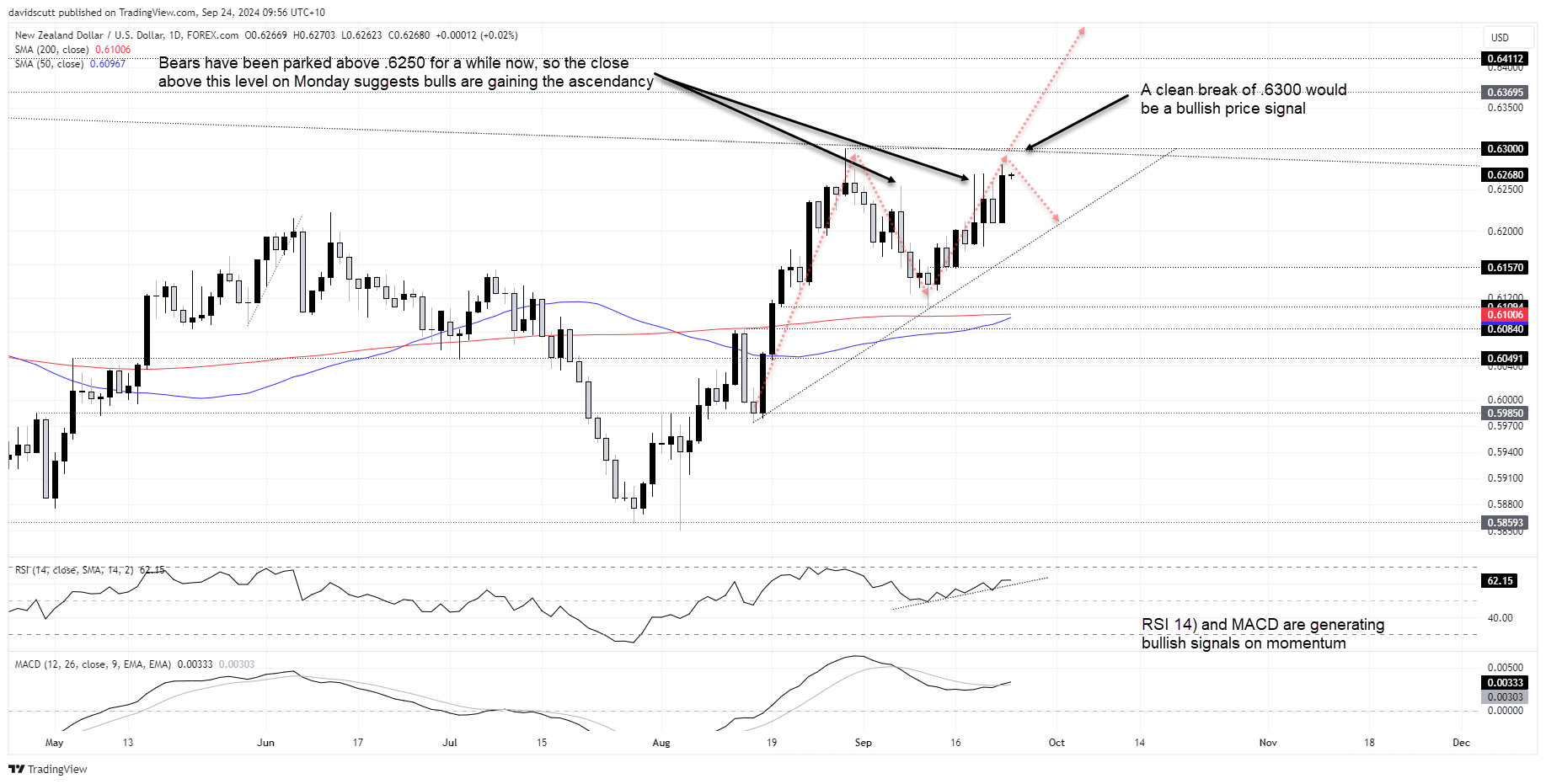

NZD/USD is in a similar position to AUD/USD, sitting in an uptrend dating back to mid-August. The only difference is it’s yet to retest downtrend resistance dating back to mid-2023.

One look at the price action above .6250 shows there’s plenty of willing sellers at this level, as demonstrated by the long topside wicks. However, with the price managing to close above this level, it suggests bulls may be gaining the upper hand, especially with Monday’s candle printing as a key reversal. With momentum indicators providing bullish signals, upside is preferred over downside in the near-term.

I’m prepared to wait for a setup to come to me given where NZD/USD sits on the charts, waiting for a potential pullback towards the uptrend, allowing for a stop to be placed below it for protection, or waiting for a potential bullish break above .6300, the intersection of downtrend and horizontal resistance. If such a move were to stick, you could place a stop below it for protection. Potential upside targets include .6370 and .6411.

If uptrend support were to give way, the bullish bias would be negated, allowing for alternate trading strategies.

-- Written by David Scutt

Follow David on Twitter @scutty