- AUD/USD nears a retest of its recent range highs after strong jobs data

- December employment surged, but gains were driven by part-time hiring

- Unemployment edged up as participation hit a record high

- RBA rate cut bets ease, but global factors still drive directional risks

Summary

AUD/USD remains on track to retest the top of its recent range, with a strong December jobs report adding to doubts about whether the Reserve Bank of Australia (RBA) will begin lowering interest rates in February. However, more broadly, global factors continue to drive dictational risks in the Aussie.

Australia jobs report details

Source: ABS

Employment growth surged by 56,300—nearly four times the expected figure—though the gain was entirely driven by part-time hiring, with the full-time workforce declining by 23,700. Despite this split, total hours worked across the labour market grew by 0.5%.

The unemployment rate ticked up to 4.0%, driven by a record-high labour force participation rate of 67.1%. Without the increase in the workforce, the unemployment rate would have remained steady. At 4.0%, the average unemployment rate in the December quarter was 0.3 percentage points below the RBA’s forecast of 4.3%, signalling a much stronger labour market than anticipated.

The employment-to-population ratio hit a record high, while underemployment—the share of employed workers wanting more hours—eased to 6%. Broader underutilisation, which combines unemployed and underemployed workers, held steady at 10%. Youth unemployment and underemployment held at levels not seen since before the GFC in 2008, underscoring the strength of economically sensitive segments of the workforce.

These broader labour market measures are critical, as the RBA has previously flagged them as lead indicators of underlying workforce trends.

RBA implications

While the rise in unemployment and decline in full-time hiring take some shine off the report, it’s worth noting that Australia’s jobs data tends to be volatile month-to-month, particularly in hiring splits. Stepping back, the labour market is far stronger than the RBA anticipated just a couple of months ago when its last forecasts were finalised.

This strength reduces the urgency for the RBA to cut rates, especially as it remains unclear whether Australia’s non-accelerating inflation rate of unemployment (NAIRU) is substantially lower, as some suggest. While official wage data is softening, anecdotal evidence from ongoing industrial disputes suggests wage pressures persist.

The labour market was softening when the latest wage data was compiled, but conditions have since improved. It will take time for official wage figures to reflect whether unemployment is well above levels that add to inflation.

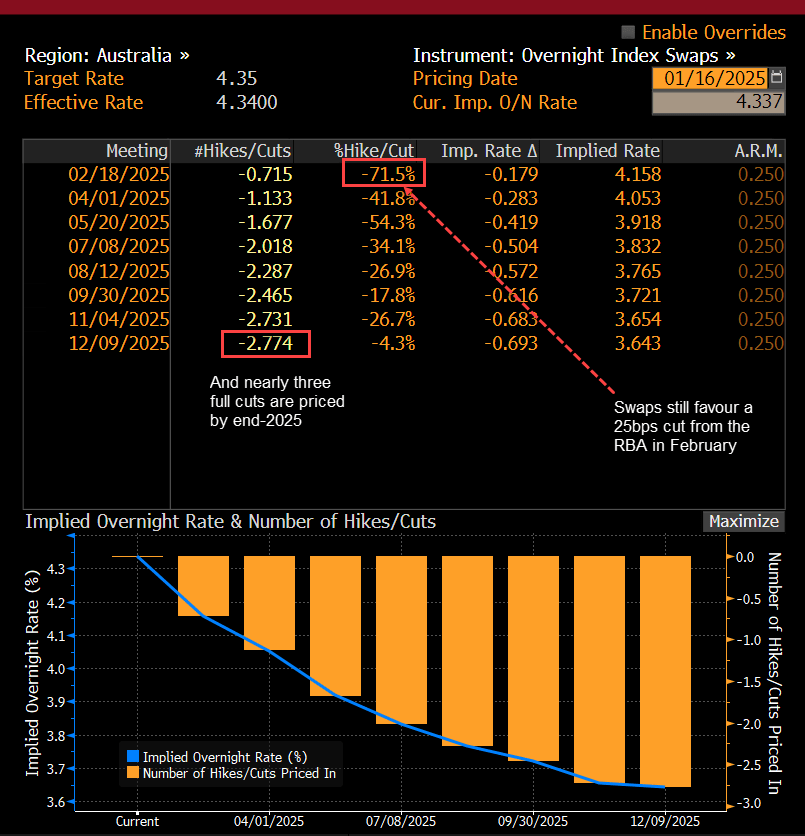

Source: Bloomberg

For the RBA, February’s decision will hinge on what it prioritises to deliver on its mandates: a labour market far stronger than expected or a sharp deceleration in underlying inflation in Q4, partly driven by government subsidies and rebates.

Swaps markets assign a 71% probability of a 25bps cash rate cut on February 18, down slightly from pre-jobs report levels.

AUD/USD directional risks skew higher

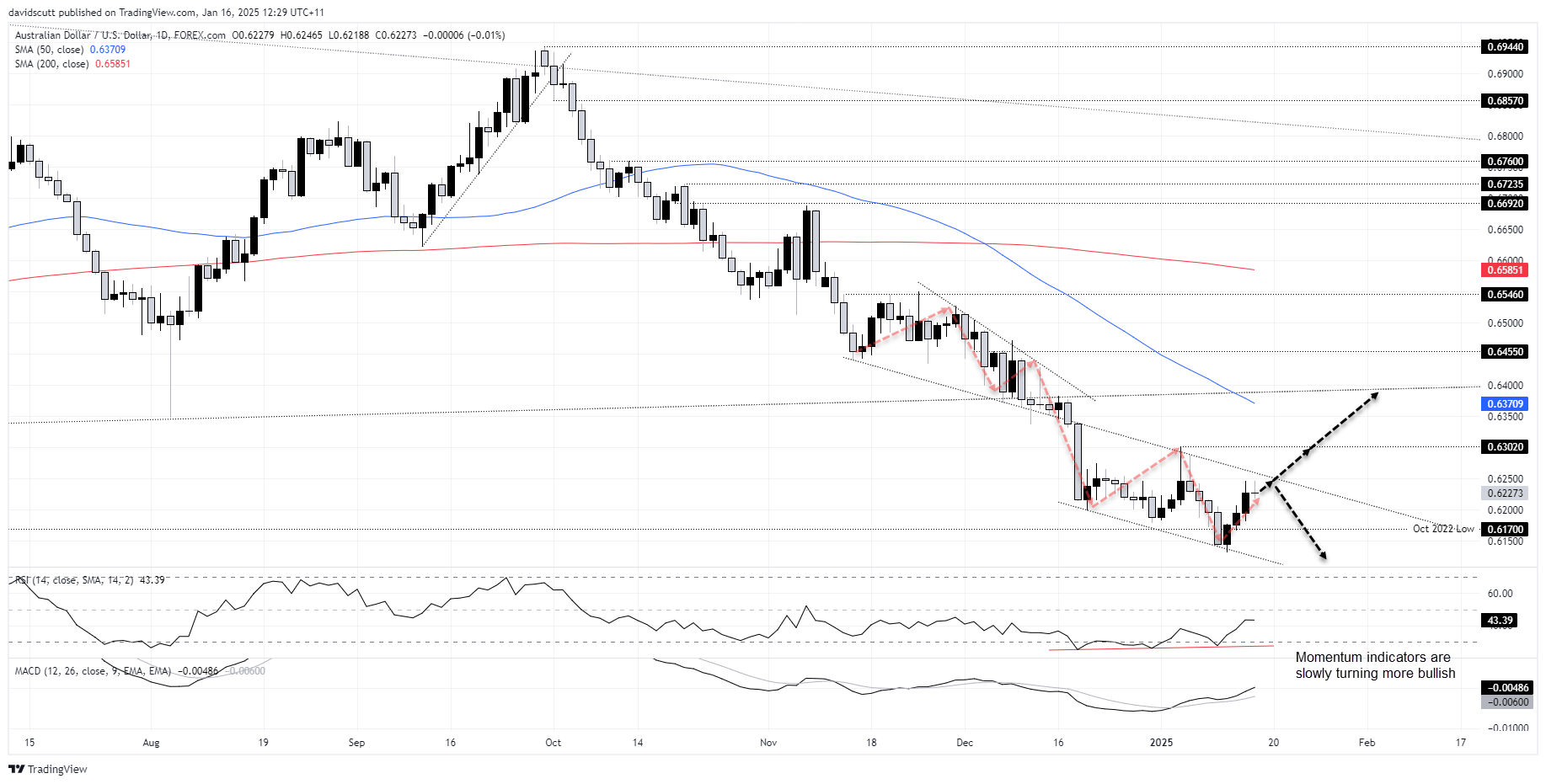

Source: TradingView

For AUD/USD, the December jobs report should be seen as neutral. However, it’s important to note that domestic rate expectations are less significant for the Aussie’s direction than the US rates outlook, global risk sentiment, and trade risks tied to the incoming Trump administration.

AUD/USD remains in a descending channel established about a month ago, bouncing from support earlier this week after briefly hitting fresh multi-year lows. While the initial rally post the jobs report has faded, RSI (14) and MACD are trending higher, increasing the likelihood of a retest of channel resistance.

A break above this level would be significant, given its prior role as support, particularly if the price closes above it. Beyond .6302, there’s limited visual resistance until former long-running uptrend support near .6400. Conversely, failure at channel resistance would pave the way for potential bearish setups targeting a retest of the range lows.

-- Written by David Scutt

Follow David on Twitter @scutty