- Data released on Monday increased the risk that Australian economic growth may have fallen in the December quarter

- Information on larger components of the economy will be released on Tuesday

- It’s hard to be bullish AUD based on the recent domestic economic performance

Risks are growing that Australia’s economy went backwards in the December quarter, keeping alive the prospect of the Reserve Bank of Australia bringing forward rate cuts following a string of weak domestic economic data last week. AUD/USD therefore remains a sell-on-rallies prospect.

Australia Q4 GDP may have gone backwards

Data released by Australia’s Bureau of Statistics on Monday revealed a sharp 1.6% decline in private non-farm inventories in the final quarter of 2023, translating to a full percentage point subtraction from GDP. Given forecasts before the release were already pointing towards the likelihood of a weak number, the figure amplified the risk that economic activity went backwards during the quarter.

Data on wages growth also showed signs of softening in the business indicators release, lessening the risk that persistent strength in incomes could spark an acceleration in household demand. In separate data, building approvals for January disappointed, especially private sector house approvals which tumbled close to 10%.

Tuesday will bring more GDP inputs

While the early signs suggest Australia’s economy may have gone backwards, that assessment comes with the caveat that markets are yet to receive all the GDP building blocks for the December quarter. Tuesday will bring government consumption and investment data, along with net exports. These may change the narrative on what to expect when the national accounts are released on Wednesday.

Data on the largest part of the entire Australian economy – household consumption – won’t be known until the GDP report is released. If consumption trends in the far larger services component mirror those seen in goods, it will show per capita household spending declined again in Q4. That’s important given household consumption accounts for around 55 to 60% of the entire economy, potentially helping to bring demand more in line with demand, diminishing the inflationary threat.

AUD/USD struggling for upside traction

While it didn’t generate much of a reaction in AUD/USD, Monday’s data deluge did nothing to bolster the bullish case for AUD, be it against the USD or other major currencies. It remains soggy on the charts, struggling along with most other Asian currencies.

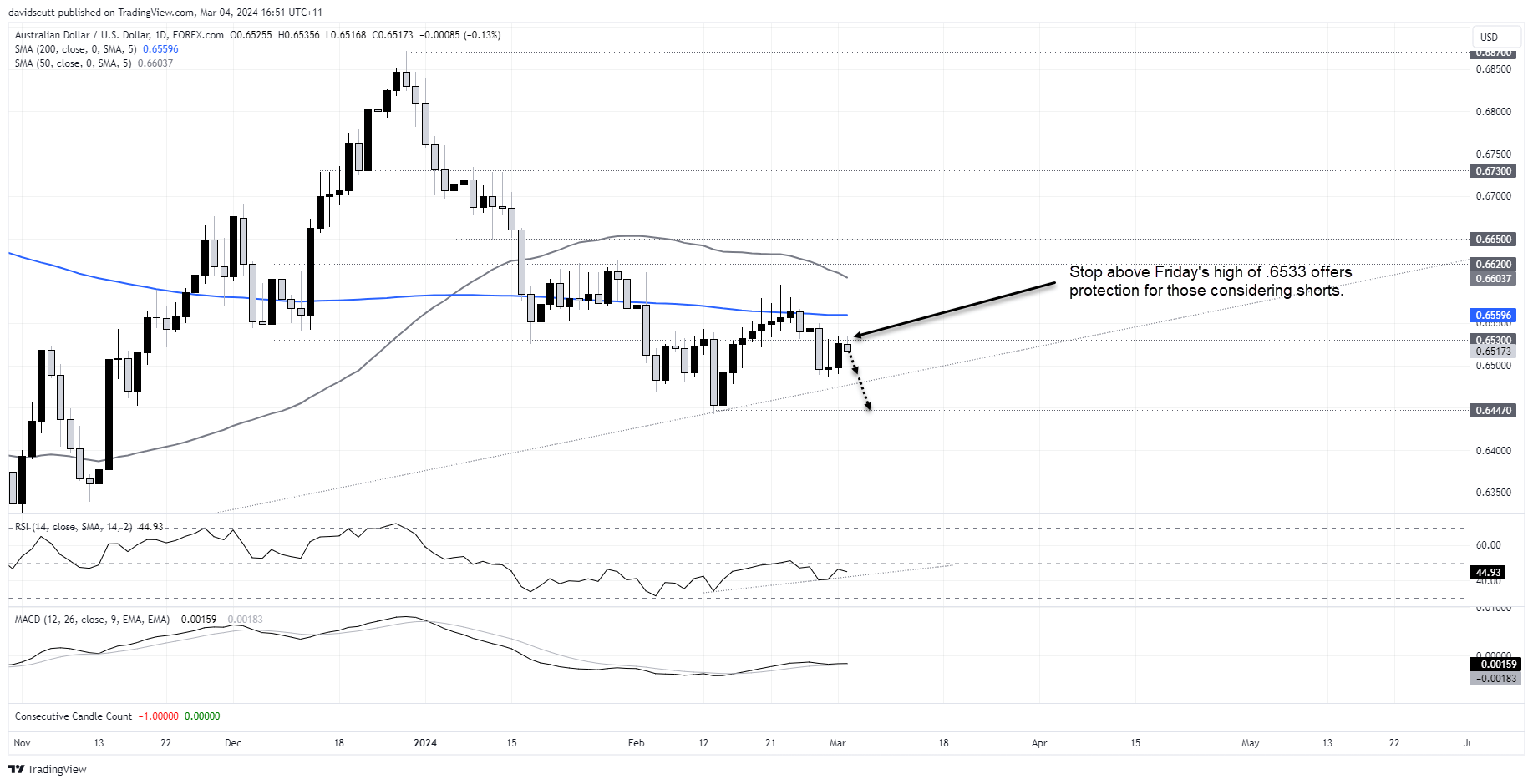

Having popped higher on Friday on the back of softness in the US dollar on declining US Treasury yields, AUD/USD was rejected again above .6530 on during the Asian session, continuing the pattern seen on Thursday and Friday. It’s inability to find traction suggests its near-term path may be lower.

Those considering shorts could sell the pair here, with a stop above .6530, targeting a push towards .6490 where AUD/USD attracted bids last week on three occasions. Below, potential uptrend support around .6480 and the double-bottom at .6447 are the next levels to watch.

There’s not a lot on the events calendar later in Monday’s session, pointing to the potential for markets to potentially retrace some of Friday’s moves ahead of bigger risk events ahead.

-- Written by David Scutt

Follow David on Twitter @scutty